Why Bitcoin Jumped 45% & What Next?

News

|

Posted 30/10/2019

|

20210

Over the weekend we saw crypto jump off a key support level, reaching as high as $15,100. The 40%+ pump in bitcoin also dragged the altcoins up with it - finding from 7-30% gains among to top alts.

So what caused the increase?

“After an extended period of low volumes and dismal sentiment, in a sudden instant, last Friday the crypto asset class has snapped back to life,” eToro’s Mati Greenspan wrote in a note to clients Monday.

This sentiment slump meant investors bet against the bitcoin price, predicting it would move lower.

When the bitcoin price recovered a couple of hundred dollars per bitcoin in just a few minutes, some $150 million worth of short positions on the Seychelles-based BitMEX crypto exchange were liquidated, according to bitcoin and cryptocurrency analytics provider Skew.

This triggered what's known as a "short squeeze," where an asset rapidly increases in value due to short-sellers trying to cover their positions, resulting in buying volume that drives the price up.

Additionally, the announcement from Chinese President Xi Jinping that China should ‘seize the opportunity’ to adopt blockchain has had a sweeping impact and is believed to be the driving force behind bitcoin’s price jump. Xi’s comments came just a day after Facebook chairman and CEO Mark Zuckerberg warned that if the U.S. didn’t lead the way in digital currencies—such as the one his company has proposed, Libra—China would seize the advantage.

Most importantly is that bitcoin broke its key resistance level of USD 10,000. This indicator gives reason to believe bullish times are ahead. However, bitcoin is currently in the middle of a very broad trading range and may fluctuate significantly day-to-day.

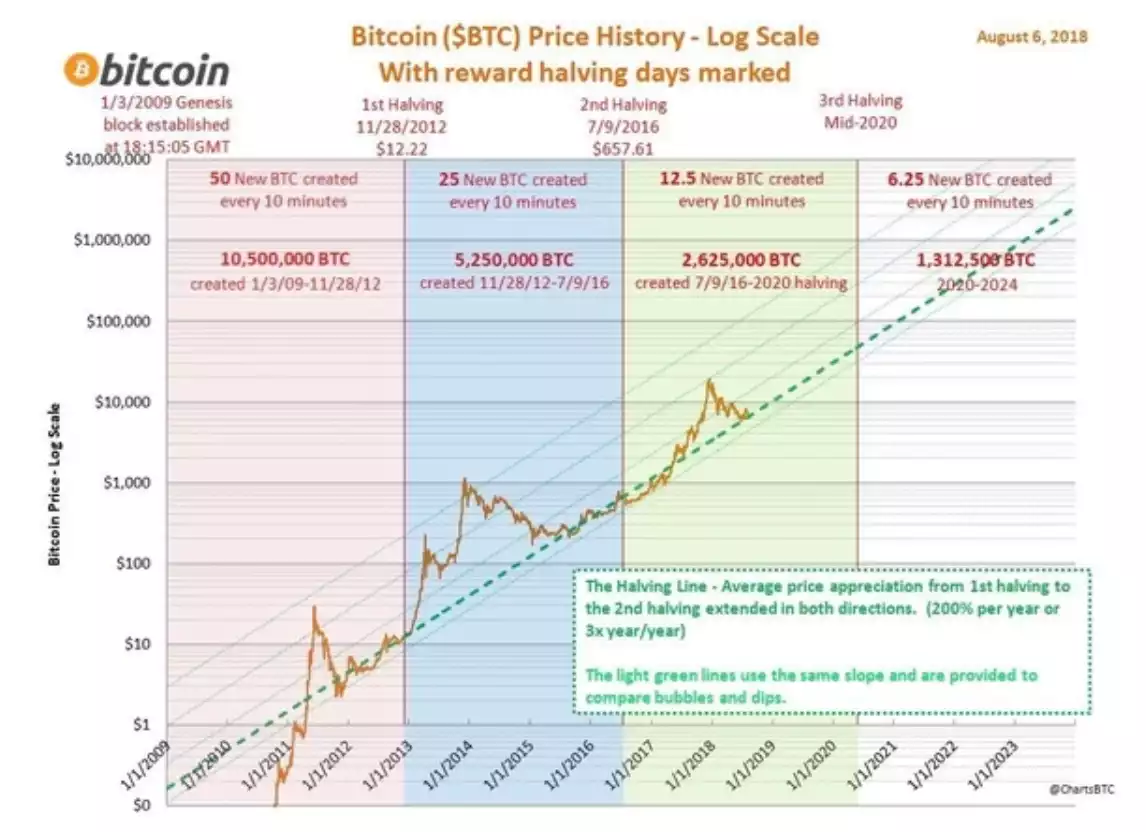

The bitcoin halving is also a few months away and a halving rally is around the corner as the bitcoin supply will experience a supply shock from 12.5BTC mined a day to only 6.25BTC making bitcoin scarcer than ever. You can see below the correlation with the price and halving and understand too the scarcity and intrinsic monetary fundamentals this maintains in the asset:

At last week’s Gold and Alternative Investment Conference we spoke about how crypto (high quality, large cap crypto) and precious metals are complimentary not competing. We were joined on stage by some excellent speakers who went through a range of topics around alternative investments with the inevitable focus on bitcoin as the leader in the ‘alternative’ space.

In our presentation we put the 2018 correction of bitcoin again into perspective by comparing the journey of Amazon. Regular readers will know this but if you missed it and believe (again) ‘bitcoin is dead’ after the bubble popped in January 2018 then you must read this.

We were also taken by a couple of charts put up by Haas from Amber (please excuse the photo from audience quality).

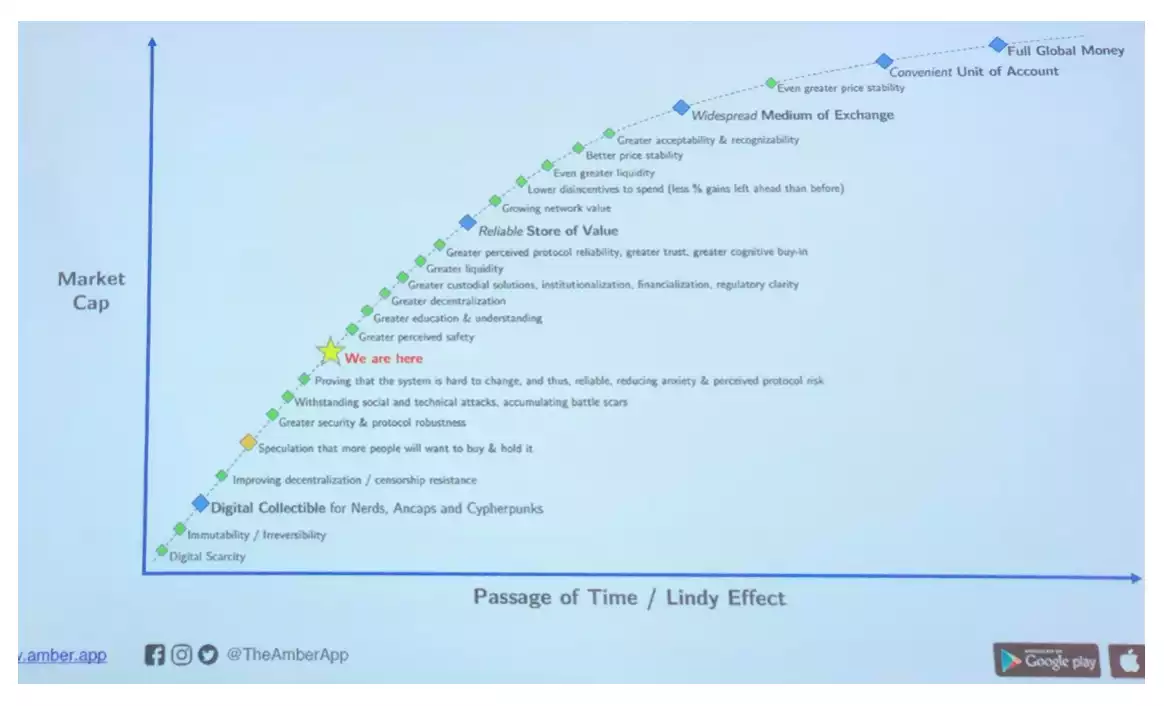

Firstly, where are we in the bitcoin journey?

As you can see above and as we discussed in the above linked ‘Amazon’ comparison, we are still in the very early stages of this new monetary asset’s life.

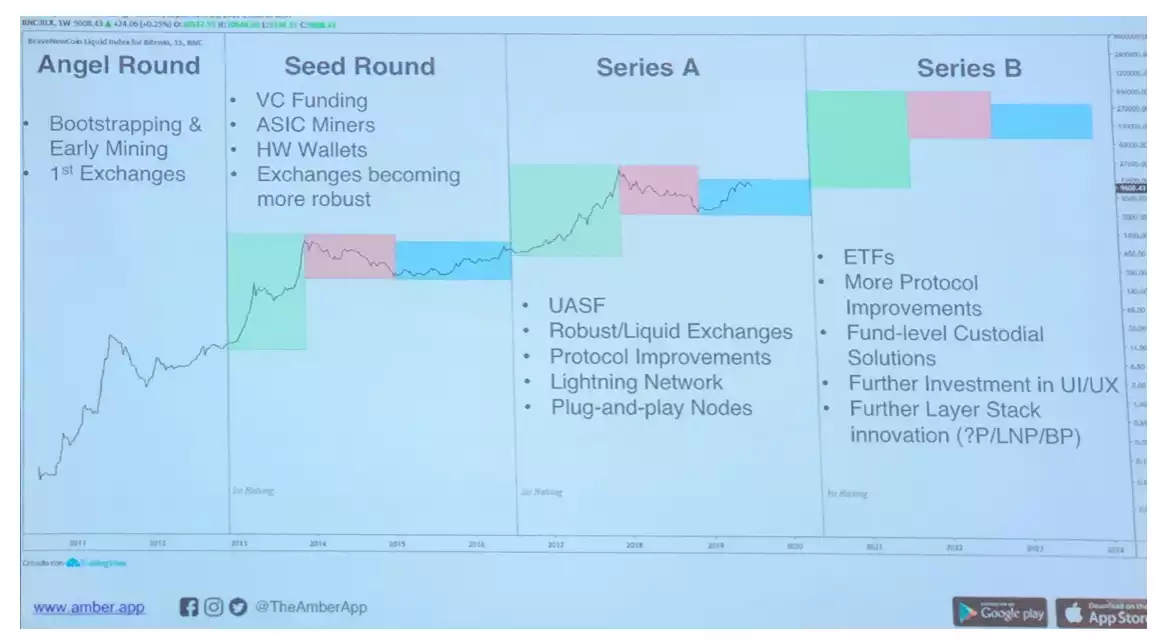

The following chart, in conjunction with the halving one above gives a brilliant summary of the journey and drivers behind each phase:

We are currently in what Haas describes as Series A. UASF (or User Activated Soft Fork) was transformative in terms of proving the decentralised nature of bitcoin and debunking the ‘big miners could control this’ theory. That first UASF that introduced the SegWit improvement also facilitates the next big improvement being the Lightning Network that is already making the transfer of BTC incredibly quick and cheap. Its early days for Lightning but it promises to take BTC to the next level. Keep in mind the chart above is log scale and whilst not meant to be a price prediction tool, you can see we could easily be looking to a return and beyond of those heady late 2017 prices soon. A 45% price rise in 24 hours on Friday night reminds us of the potential before us.