What is Worrying Wall Street?

News

|

Posted 16/12/2020

|

8994

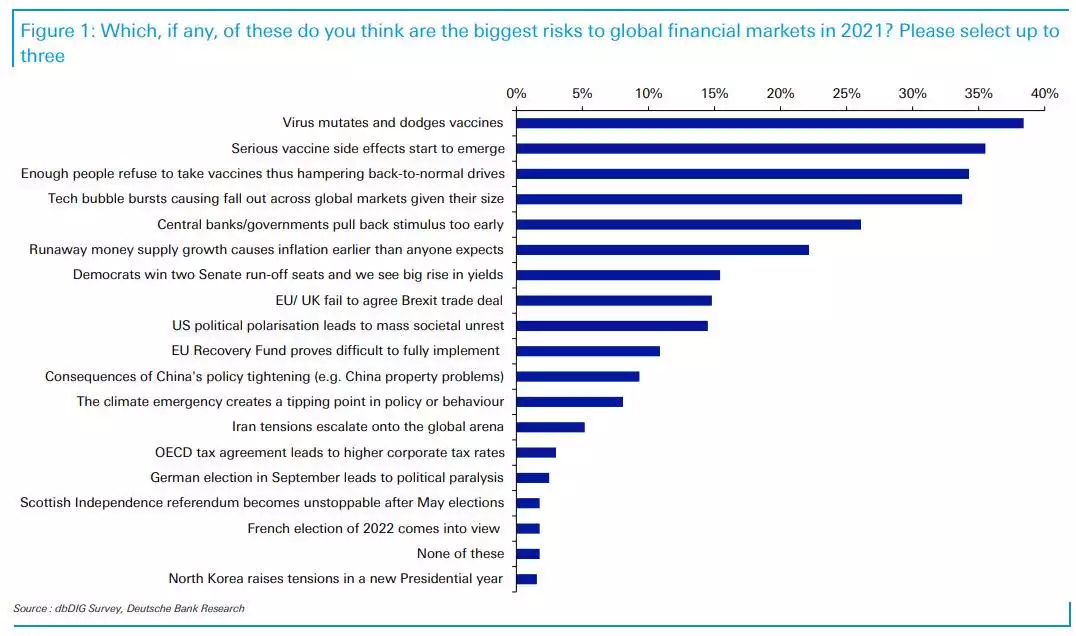

Deutsche Bank released their latest survey of fund managers with what was their biggest response yet, some 984 respondents. Despite the ‘everything’s awesome’ euphoria in markets today (another strong night on Wall St last night), COVID-19 stands as the biggest risk to fund managers, the theme taking out the top 3 positions of the survey.

Interestingly, the biggest risk identified is one not getting much press, and that is the risk that the virus simply mutates and dodges the vaccine. News late yesterday of one such mutation taking hold in the UK adds weight to these fears. From Reuters:

“The new variant, which UK scientists have named “VUI – 202012/01” includes a mutation in the viral genome region encoding the spike protein, which - in theory - could result in COVID-19 spreading more easily between people.

The British government on Monday cited a rise in new infections, which it said may be partly linked to the new variant, as it moved its capital city and many other areas into the highest tier of COVID-19 restrictions.”

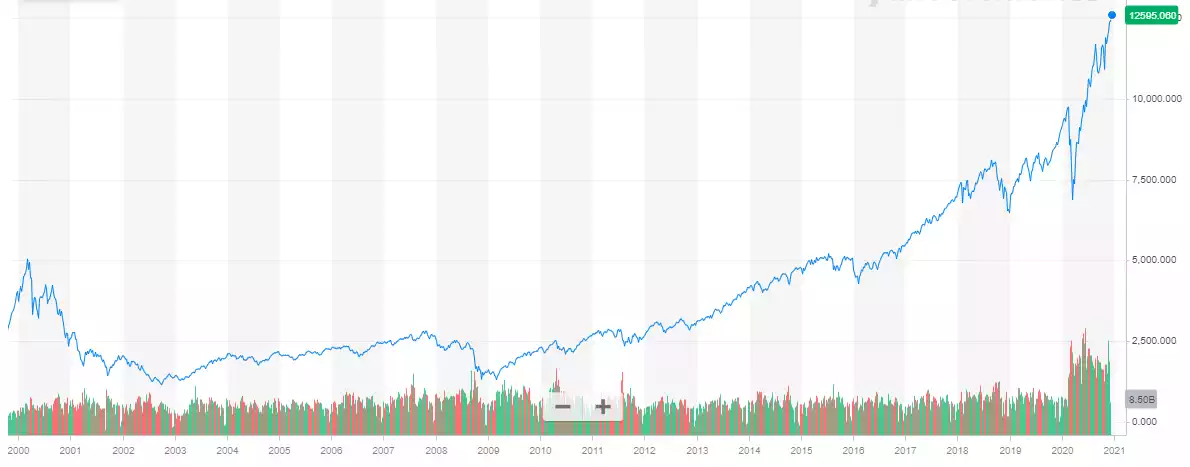

Moving past COVID, it’s not until we get to the 4th most feared that we approach the elephant in the room, a tech bubble bursting. The NASDAQ was up another 1.25% last night to yet another all time high. To put current levels compared to the dot.com bust into perspective, check out the chart below and as discussed recently we are at valuations now only matched by those dot.com 2000 levels in all history.

Bank of America Merrill Lynch also just released their latest fund manager survey and again it would come as no surprise that ‘long tech’ has been the most crowded trade for 8 consecutive months, with the latest survey seeing 52% of respondents nominating it as such.

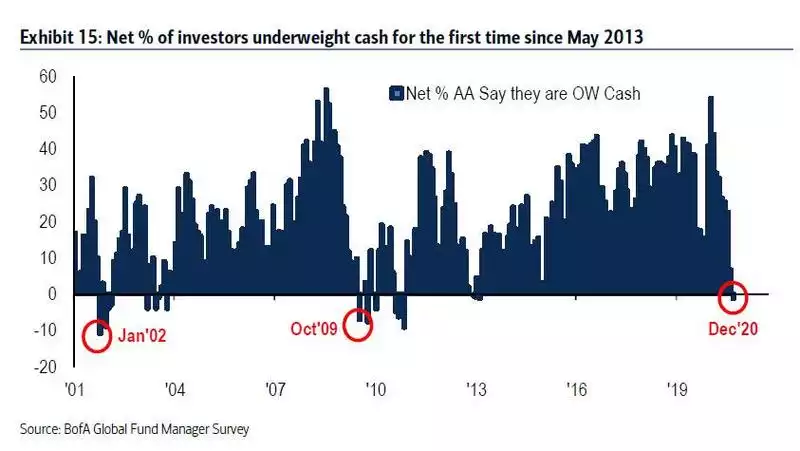

However whilst the chart above talks to what is worrying Wall St, they collectively are not acting worried at all. Indeed so ‘risk on’ is that collective sentiment, that they are now underweight cash (ala ‘all in’) for the first time since 2013.

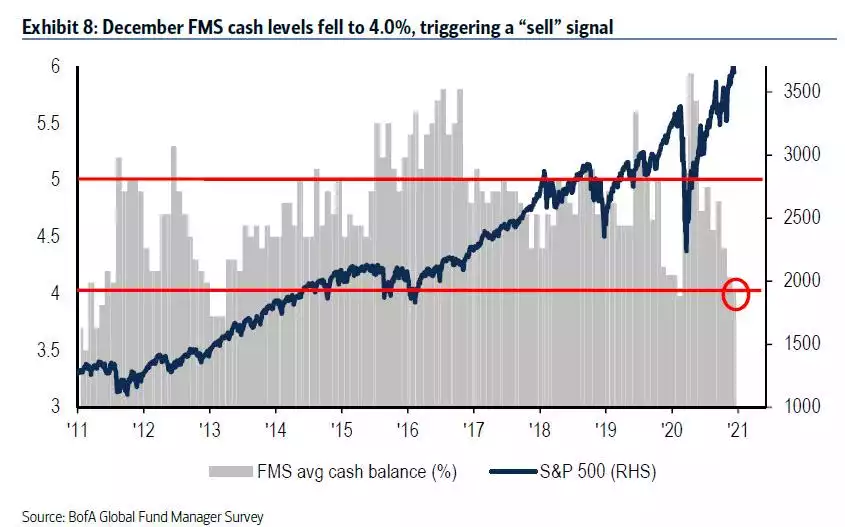

BofAML have a Cash Rule Sell Signal triggered at 4% cash holdings. The last time that happened was just before the S&P500 fell from 3380 to 2224, a 34% drop.

Getting back to that list of top tail risks for markets, the next few risks in order are ones discussed at length here of late.

The next is “Central banks/governments pull back stimulus too early”. In the context of this being a market clearly fuelled and priced on central bank stimulus even those wilfully blind know that should that stimulus be withdrawn there is a vacuum of support under these heady prices. The next point is inextricably linked to the former. “Runaway money supply growth causes inflation earlier than anyone expects”. As we reported recently the signs of impending inflation are starting to mount. Yesterday Otavio Costa of Crescat Tweeted:

Rising inflation and a rebounding commodities market are incredibly bullish fundamentals for gold and silver in particular. Noting the 7th ranked risk of a Democrat Senate and you have nirvana for silver.