US Fed Hikes into Overvalued Market

News

|

Posted 27/09/2018

|

7795

In line with almost unanimous expectations the US Fed hiked rates again last night by 0.25% to 2.25% under a narrative of a strong economy and low jobless rate. However it was the forecast and language that all eyes were on, and what the market saw the market didn’t like with the Dow down nearly 107 points.

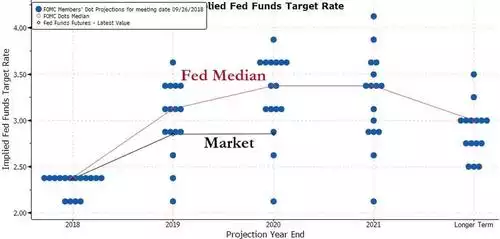

The language in the minutes noticeably removed the word ‘accommodative’ from the financial conditions it orchestrates signalling pseudo officially that they believe the economy is close to a neutral setting. That might ordinarily have people thinking the rate hikes might be at an end but the so called ‘dots’ being the forward estimates of each of the 16 committee members showed 12 of the 16 expect another hike in December. Further, all bar 2 of them expect more hikes next year.

The narrative of a strong economy was tempered by Fed Chair Powell’s statements afterwards and even that removal of ‘accommodative’ from the minutes was in effect reinserted through his live statement where he literally said ‘policy is still accommodative’. He tried to put a spin on the declining US housing market by saying housing is more affordable now than before the GFC.

A key comment for the markets was where he admitted twice that sharemarket valuations were at the “upper reach of historical ranges” and that “it’s no secret we’re on an unsustainable fiscal path”. Whilst obviously not stopping them from hiking, he acknowledged the effects too on emerging markets and that their performance “really matters” to the Fed. You will recall our article yesterday on exactly that. A rising cash rate in the US just adds more pressure to that already unsustainable USD debt pile ‘submerging’ emerging markets.

Interestingly their forward estimates of US economic growth all show a decline from a peak of 3.1% this year as the short term effects of the Trump tax cuts and spending binge (all off more debt of course) wear off and the trade wars hit home.

History shows all Fed hiking policies lead to a crash. That we have a Fed hiking, forecasting many more to come, admitting markets are already over priced off the very stimulus they are now ending and against a backdrop of unsustainable and growing debt just 3 days before the notorious crash month of October may have some looking at their exposure to these markets right now.