The #ShortSilverSqueeze storm

News

|

Posted 01/02/2021

|

11012

Short news today as it’s all hands on deck here. The weekend saw unprecedented (yep the 2020 word de jour is back in 21) silver demand with both Ainslie web orders and Silver Standard (AGS) sales on CoinSpot and Bamboo literally through the roof. As we reported Friday, the WSB started “THE BIGGEST SHORT SQUEEZE IN THE WORLD $SLV Silver $25 to $1000” movement that has now turned into a viral #ShortSilverSqueeze storm with all providers of silver getting smashed over Friday and the weekend with orders.

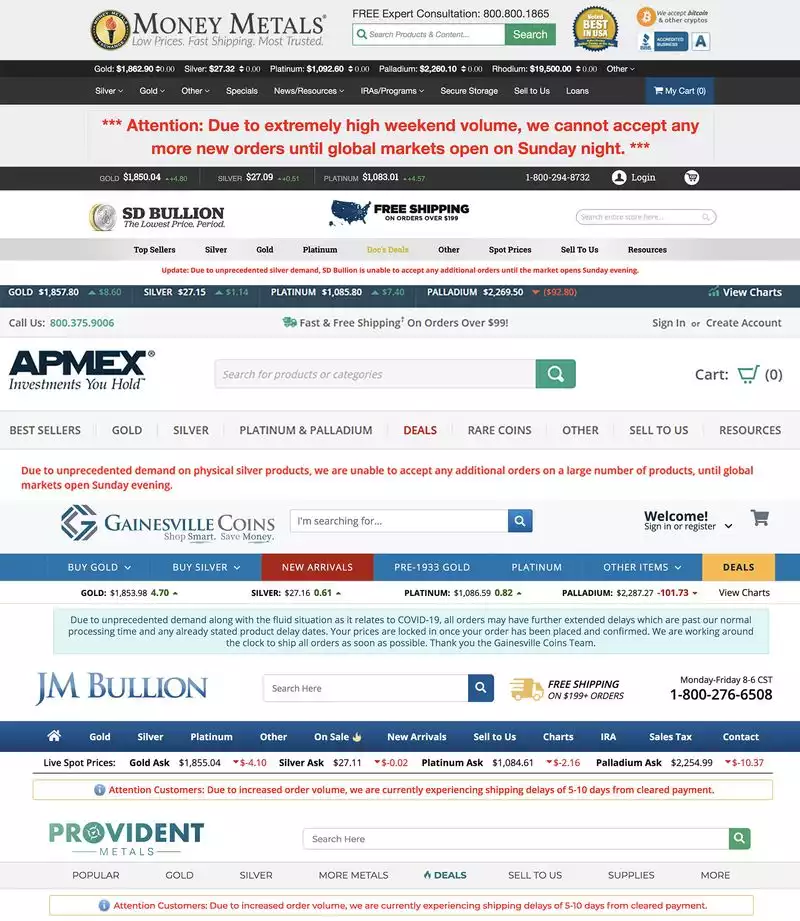

The major bullion dealers in the US had to close their shops as they ran out:

From Bloomberg:

“Retail sites were overwhelmed with demand for silver bars and coins on Sunday, suggesting the Reddit-inspired frenzy that roiled commodities markets last week is spilling over into physical assets.

Sites from Money Metals and SD Bullion to JM Bullion and Apmex, the Walmart of precious metals products in North America, said they were unable to process orders until Asian markets open because of unprecedented demand for silver.”

Volume on SLV on Friday was over $1b, nearly double the all time record.

Whilst gold has rallied too, the GSR has dropped to 68 as we write. That is a very bullish move.

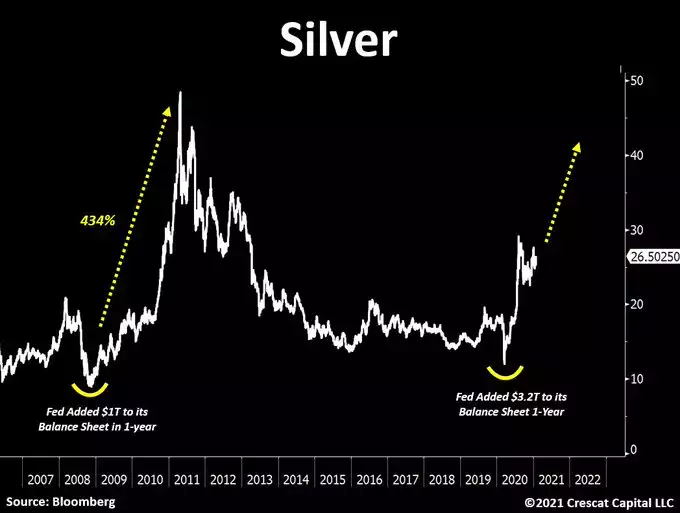

As you can see in the chart below, the last time we had anything like a proper short squeeze in silver the market jumped 434% to $50 but that was without the kind of retail demand this movement unleashes. Where this goes from here is anyone’s guess. The futures market is already pricing USD30.50 as we write which is $40 Aussie. That’s potentially a 15% jump on open. If you already bought silver earlier, enjoy the ride. If you don’t have any yet, you may need to move quickly to get it.