The Collapse of the Petrodollar Could be Coming Sooner Than You Think

News

|

Posted 19/01/2023

|

10048

At Davos yesterday, Saudi Officials confirmed reports that they are having discussions to trade in currencies other than the US dollar, as well as focusing on strengthening their relationships with key international players, most notably China.

We discussed the De-Dollarization of the USD and the hunt for the new trade system on Monday, and today we will take a greater look at the Petrodollar and how Saudi Arabia have expressed an openness to new options regarding oil trade, and the strong possibility of Saudi Arabia and China partnering to essentially end US dollar dominance.

“There are no issues with discussing how we settle our trade arrangements, whether it is in the US dollar, whether it is the Euro, whether it is the Saudi riyal,” Saudi Arabia’s finance minister Mohammed Al Jadeen told Bloomberg TV in an interview in Davos on Tuesday.

“I don’t think we are waving away or ruling out any discussion that will help improve the trade around the world.”

Of course, the concept of the petrodollar has been imperative to the stabilization of the US dollar since its origination in 1973, almost 50 years ago. Effectively, it meant that any nation that purchased oil from Saudi Arabia had to do so in US dollars, creating an artificial demand for the USD and significantly improving its liquidity. As a consequence, the US Dollar became the strongest currency around the world.

However, a certain geopolitical partnership could mean the tide is finally starting to turn…

“We enjoy a very strategic relationship with China,” Al Jadeen went on to say.

Rumors of a Petroyuan have been circulating, mainly due to China’s extraordinary rate of gold buying throughout 2022. A gold backed Petro-yuan would be nearly impossible for the US dollar to compete with.

Though notoriously secretive with specific economic figures at times, the rate at which China has been buying gold is borderline unprecedented. They added 32 tons in November 2022, as well as 30 tons only a month later.

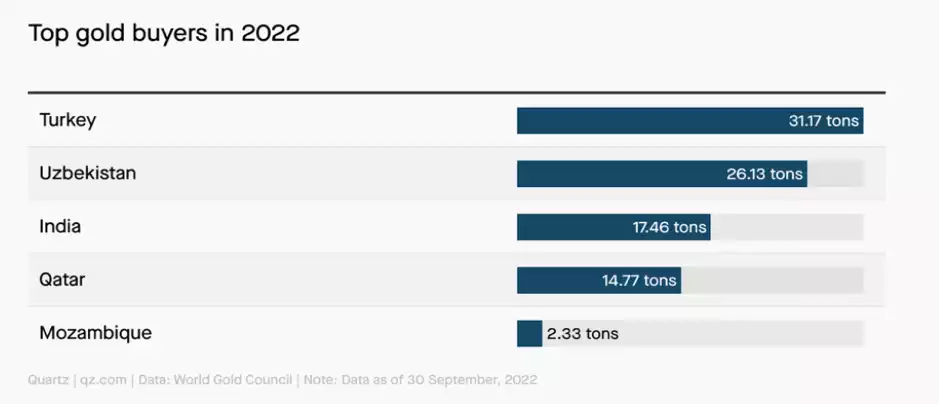

To help put these numbers into perspective, the top gold buyer between January 2022 through to September 2022 was Turkey, which only bought 31.17 tons throughout that time.

The creation of Petroyuan would obviously be detrimental to the USD, as it would not only cause a decrease in USD liquidity and net exports but also strengthen their biggest rival. The relationship between the gold price (top), USD and Yuan are all evident in the chart below.

The words of Zoltan Pozsar, top US economist and Credit Suisse analyst, best summarize the current macroeconomic state as it pertains to the Saudi-US relationship and its budding Chinese infiltration.

“Dusk for the petrodollar…and dawn for the Petroyuan.”

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************