The Big Paper v Physical Disconnect

News

|

Posted 05/09/2018

|

10089

One of the key tools of a contrarian investor is to look dispassionately at market metrics and apply logic, albeit sometimes hidden from obvious sight, over emotion or the ‘crowd’ view.

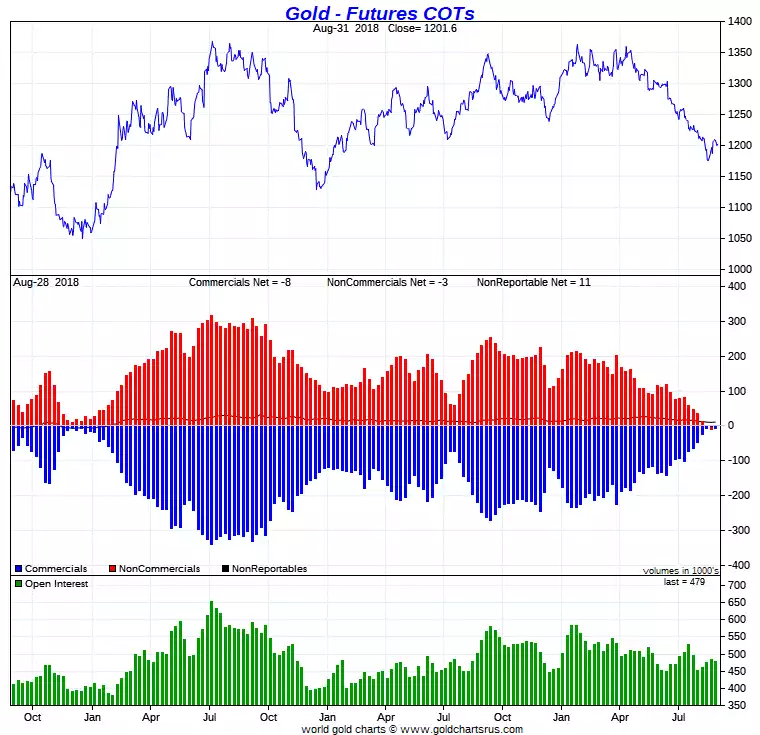

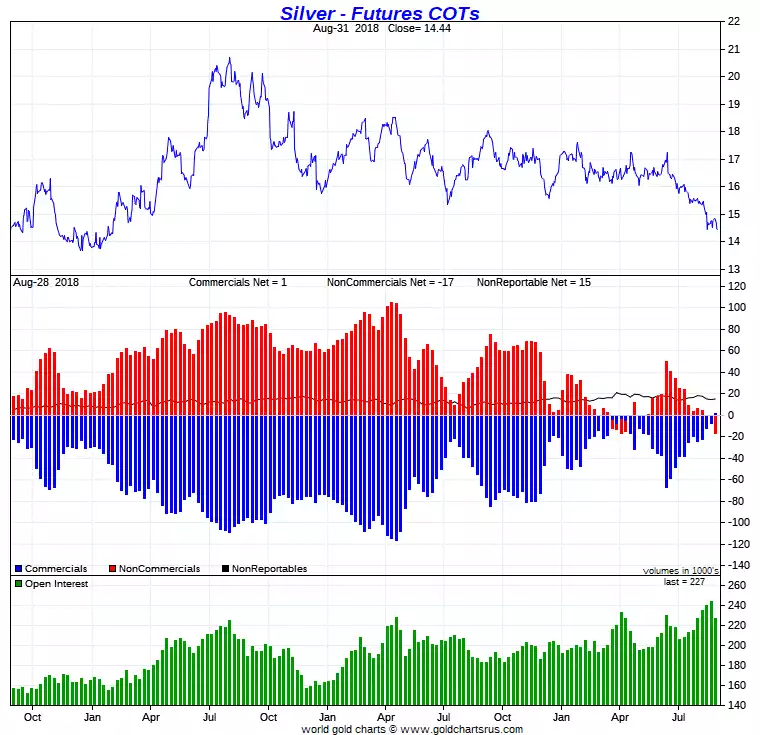

First let us give you an update on the latest COMEX Futures’ Commitment of Traders report from that we last shared here 3 weeks ago. If we were excited by it last time you will see below, it is now even more so.

As you can see we have had complete capitulation of the managed money category and the big commercials are collectively neutral.

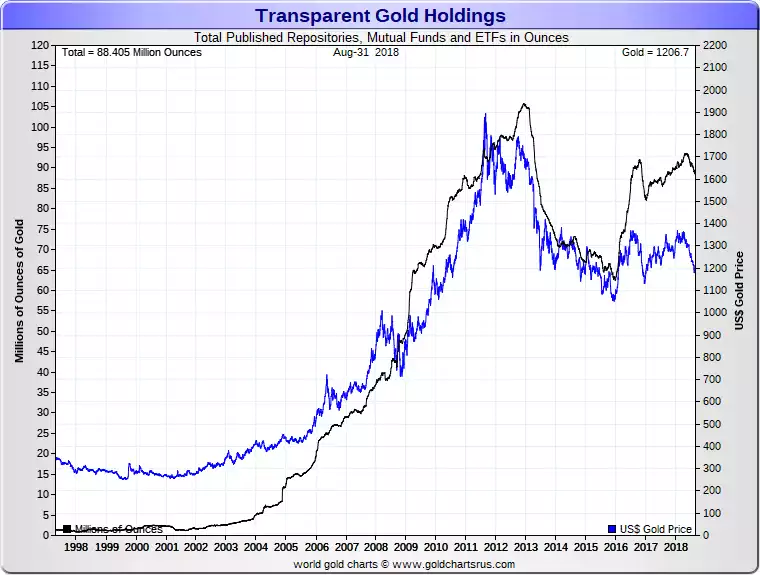

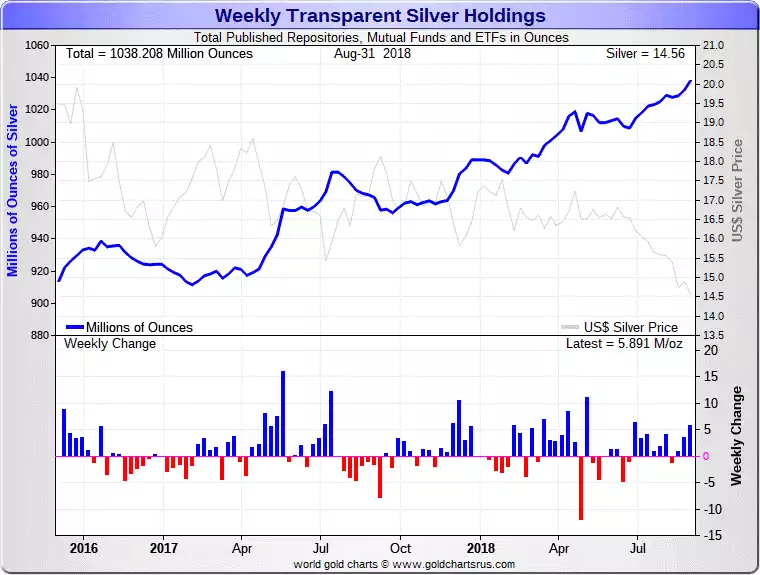

That’s the futures market so how about the other ‘paper’ market of ETF’s and mutual funds? The following charts show the total transparent holdings of both gold and silver, both short term and long term for these funds. ETF’s generally use a ‘custodian’ to hold the metal supposedly backing up the ETF share (we’ve spoken previously about how cleverly the PDS for GLD, the biggest ETF, disconnects the ETF from the metal in a way that could only be highly concerning to a discerning investor). Only ‘authorised participants’ can lodge and redeem physical metal through the custodian. The list is the usual suspects including Credit Suisse, Goldman Sachs, HSBC, J.P. Morgan, Merrill Lynch, Morgan Stanley, RBC, Scotia Capital, UBS, and Virtu Financial.

You will note the historic and intuitively logical correlation with price and holdings of metal until 2016 for gold, but not even close for silver since the GFC. Take a look at the disconnect of silver holdings compared to the price during the GFC and what happened afterwards. Now compare that to the silver holdings versus price since 2011. There are very big players, making very big deposits of physical silver over a period of price declines that they may or may not have had a hand in creating through the futures market. Now compare the charts above with the charts below and decide if a contrarian may see this as a generational opportunity.

Short term

Now zooming out to 20 year look: