Smart Money is Taking Cover

News

|

Posted 18/11/2020

|

8219

Equities markets are often driven more by emotion than fact or fundamentals. 2 nights ago we saw Wall St surge on another positive vaccine announcement and then last night fall back. Nothing much changed so did the market just momentarily pause and look more pragmatically at fundamentals not hope?

There are a host of metrics screaming warning signs that a vaccine will likely come too late, we shared some more recently here. The Dow Jones Industrial Average hit all time highs yesterday seemingly on hope of a V shaped recovery, not the reality:

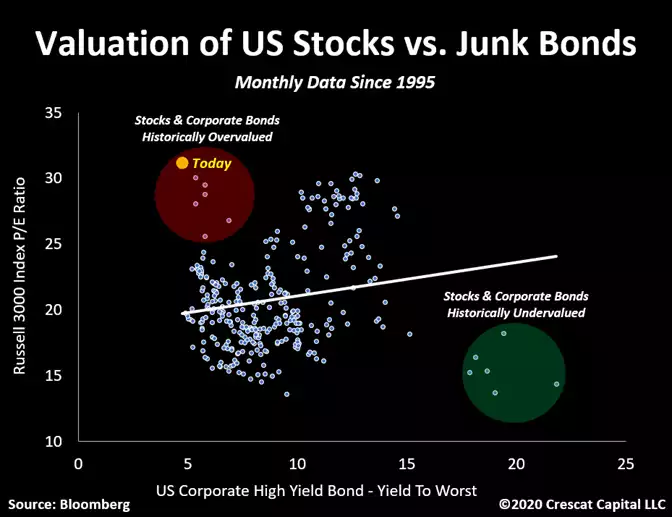

Maybe one of the most striking charts we have seen for some time is that below plotting the Price/Earnings ratio for the ‘real economy’ index of the US’s top 3000 growth shares, the Russell 3000 against the yield on US corporate high yield or ‘junk bonds’ for every month since 1995. As you can see neither have EVER been more over extended.

In the words of the author:

“The Federal Reserve and fiscal powers may appear for now to have come to the rescue during the Covid-19 recession, but they have only upped the ante on the imbalances and risks they have allowed to build in the first place. In this context, low interest rates equate to anything but low risk. From a valuation standpoint, in our analysis, the risks presented by US financial asset bubbles today are the highest they have ever been.

For long-oriented investors, the good news is that it is perhaps one of the greatest setups ever for precious metals, the forgotten asset class of the last decade. Gold is the one cheap asset that truly benefits from artificially manufactured low interest rates. We expect gold will increasingly become the new high demand asset for discerning allocators given its low correlation, undervaluation, and high absolute return potential compared to overvalued and overcrowded stocks and bonds at large. “Buy gold and sell stocks” is Crescat’s macro mantra today.”

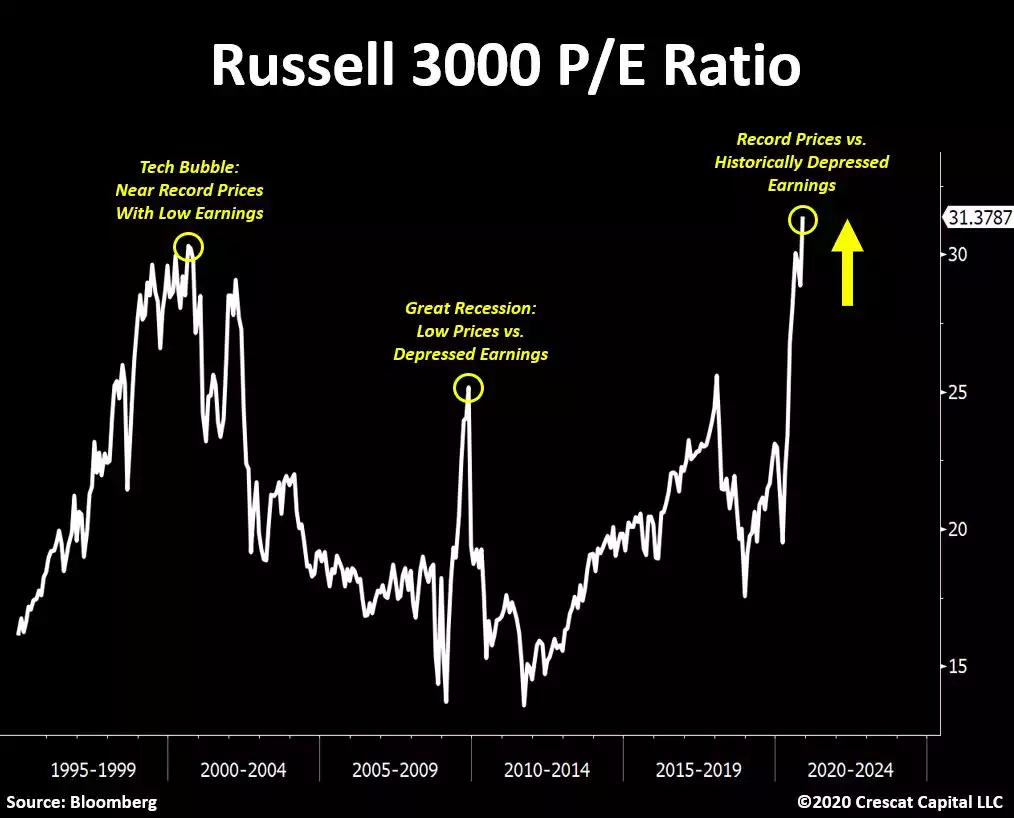

To put the Russell 3000 P/E ratio alone into perspective:

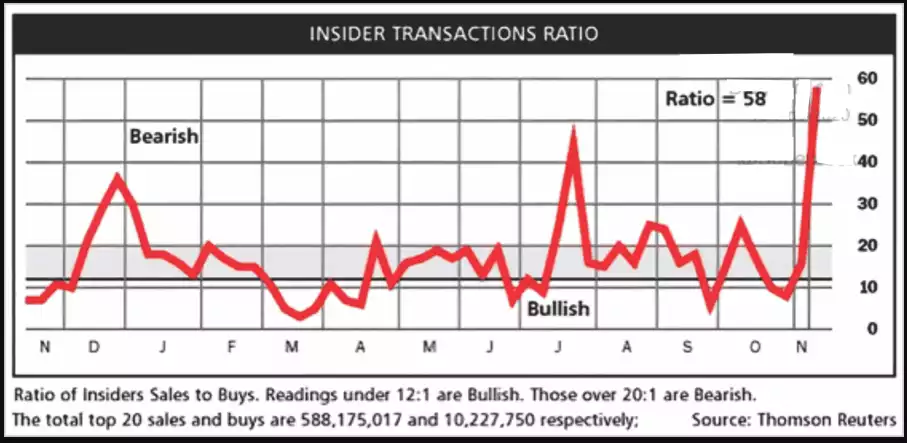

It may also be instructive to look at what the ‘inside money’ is doing right now. i.e. the executives of these companies that have the insight of the real business position compared to traders piling in on expectations of future business… Answer? They are selling hand over fist…

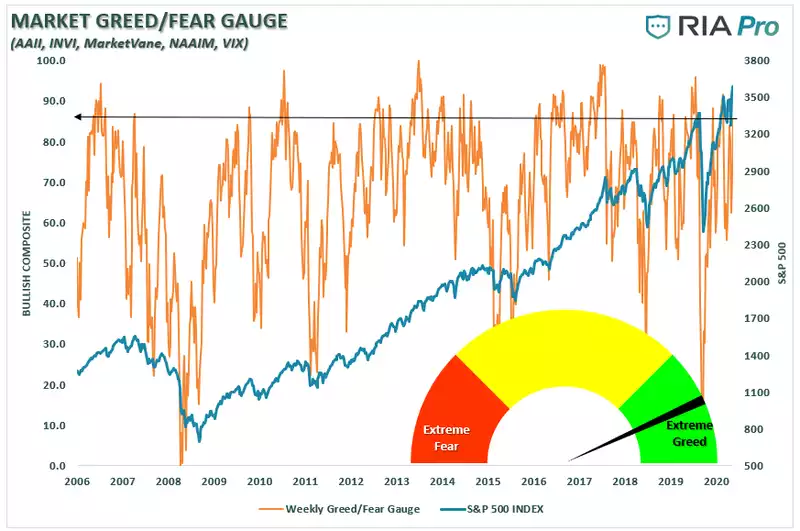

And so, whilst insiders are selling, the bullish masses and passive funds are piling in with eyes-rolled-back abandon. Real Investment Advice’s market greed / fear gauge is going full Gordon Gecko “greed is good”…. As is the case before every crash.

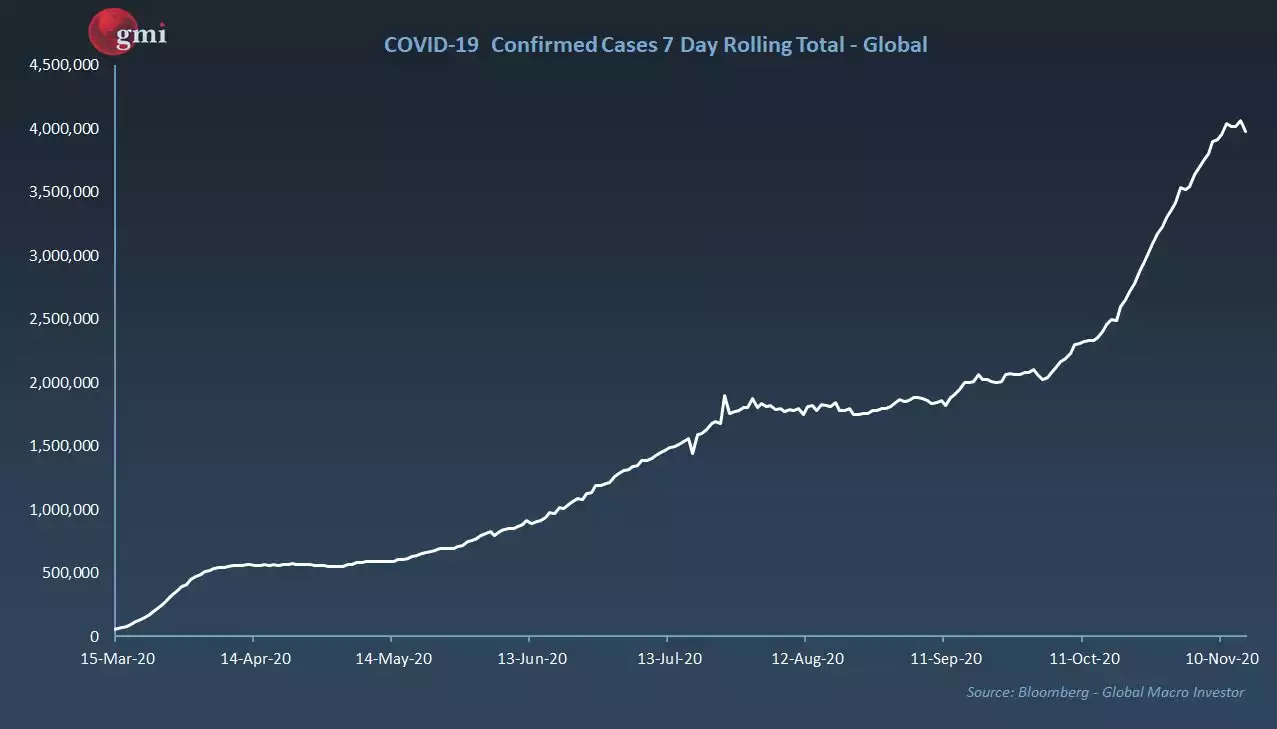

What will be the catalyst is anyone’s guess. What is not seemingly being taken fully into account is the ferocity of this second wave sweeping the US, Europe and the sub continent. We entered the recession on the little rise at the beginning of the chart below. That puts the surge since mid October into perspective. 4m cases were added just in the last 7 days.

And deaths are higher than ever before:

This is not so much about the numbers themselves but the reaction of governments. Biden is going to be much more inclined toward shutdowns and other extreme measures than Trump ever was. That people are starting to talk about ‘cancelling’ Thanksgiving and Christmas cannot be ignored. As we started this article, sharemarkets are often emotionally driven and such moves could be just the little prick this bubble is waiting for. Sovereign bonds on the other hand are not emotionally driven and they are telling a very different story… It’s the same picture with inflows to gold ETF’s and Bitcoin just hit its highest price since 2017. The smart money is taking cover.