Bye bye “transitory” hello “End Game”

News

|

Posted 01/12/2021

|

10075

Yesterday afternoon saw market turmoil that simultaneously saw S&P500 futures with a big red candle and gold with a big green one. Fear is back. Fed chair Jerome Powell, before the Senate Banking Committee, essentially conceded on his policy error and earlier Moderna CEO and other senior execs warned that current vaccines would “struggle” with the Omicron variant and warning it would be months before new vaccines would be available to do so.

Curiously the two headlines are kind of opposed in effect with Powell stating it could be the new variant that stops them tightening, the very news that saw markets tank. Essentially one is a taper tantrum and one is a fear trade.

The big(ger) news was of course the Powell pivot that caused the taper tantrum last night. From the horse’s mouth:

“It is appropriate, I think, for us to discuss at our next meeting, which is in a couple of weeks, whether it will be appropriate to wrap up our purchases a few months earlier…..In those two weeks we are going to get more data and learn more about the new variant.”

So he is giving himself some room to move should the Moderna concerns materialise. But the big admission was around THAT word….”transitory”:

“it’s a good time to retire that word and try to explain more clearly what we mean.”

Explanation? From Bloomberg:

“Powell said the word “transitory” was supposed to signal a blip in prices that “won’t leave a permanent mark in the form of higher inflation.” That view was largely based on the idea that inflation resulted from supply disruptions on everything from goods to labor. But scarcities of both are taking longer to resolve, Powell said in both his opening remarks and in response to questions.

“Most forecasters, including at the Fed, continue to expect that inflation will move down significantly over the next year as supply and demand imbalances abate,” he said. “It is difficult to predict the persistence and effects of supply constraints, but it now appears that factors pushing inflation upward will linger well into next year.””

And so we have the prospect of non-transitory inflation and an expedited tightening that could shock the easy money addicted markets or a new variant combines slower growth with already strong inflation and hence stagflation.

Macro Insiders’ Julian Brigden released his latest Deep Dive earlier this week and it has proved quite prophetic in terms of what Powell is now conceding. Brigden was screaming policy error with the slow taper and slower rate rises. The following is particularly interesting given the now seemingly inevitable shorter taper period:

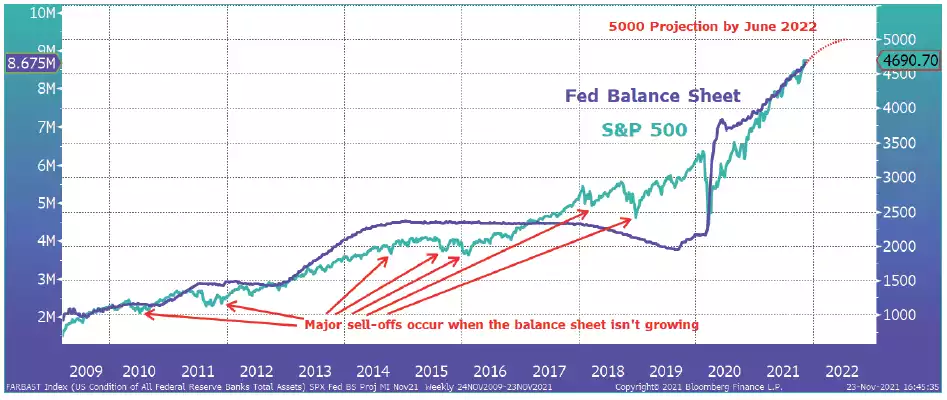

“Liquidity is far more than rates for stocks. Slow tapering suggests the S&P could keep rising towards 5000 by next June. But when the balance sheet stops expanding, it’s time to be very careful. P.S. Note how the S&P has just bounced to the level suggested by the balance sheet.”

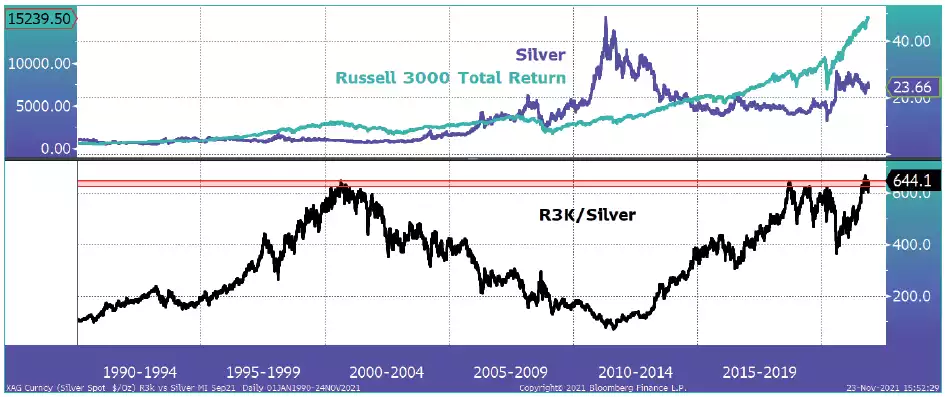

“Hence our preference is to own hard assets. The ratio of the Total Return Russell/Silver is back to interesting levels, i.e. September 2000 and September 2018. We like silver and if it’s 2018, now is the time to buy.”

Brigden goes on to present the dilemma we often talk about:

“This creates a real dilemma for the Fed and indeed all CBs.

If they believed the demand side inflation push, they would be tightening to tackle an overheating economy. They insist that inflation pressures are supply driven and transitory. According to Dudley, the longer they delay the move, the faster they have to go once they start and the greater the risks.

Yet they have committed to support government. The Fed has been cajoled to stand behind the Biden Administration’s employment objective and fiscal spending.

And if they tighten too far they will undermine assets and the economy. The financialisation of the economy means they are trying to thread a needle.

They are snookered. Hence policy will be reactive, setting us up for an accelerative oscillation.”

“As in the 1960s, the Impossible Trinity means there’s only one end game.

The Fed must pick. They can only control two out of three variables:

– Stocks aka the real economy.

– Bonds aka accommodate government.

– FX

Ultimately the choice is clear, but the process won’t be linear. Eventually, pain inflicted by the Fed or bond markets will bring us to the inevitable: they have to support stocks, subsidise bonds and sacrifice the dollar.”

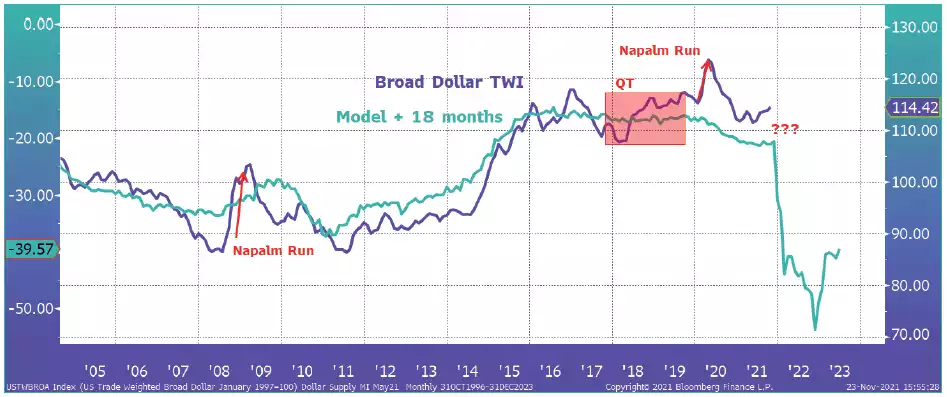

And this is the BIG call. The deliberate tanking of the USD is their only option left but it is a MASSIVE option. Brigden does warn it isn’t the right time to do just yet but the following charts illustrate the enormity of it against their model which has been eerily accurate all century:

“For now, the time isn’t right. Given that most central banks remain behind the curve, FX is a difficult game. But these dynamics could change rapidly if we break any of these key levels!”

“And our models suggest there is plenty of downside.”

There are many layers to this for gold and silver investors. Of course history has shown that generally gold goes up as the USD does down in a secular move. There have been ample more recent short term moves higher of the USD where gold has also rallied but that has been a investor safety play for both. Imagine when the USD is no longer the ‘safe haven’…. However in addition to the USD correlation we have the sheer scale of volatility before us as we enter the ‘end game’ as Brigden calls it. In essence there is no easy way out of this mess and whether devaluing the USD is the tool or not, the road ahead looks volatile and should be a perfect environment for precious metals. We’ll leave you with the outlook for the year ahead and remind you yet again of our trademark ‘Balance your wealth in an unbalanced world’….

“Greenspan (one of the great villains of recent history) oversaw (and arguably took credit for) The Great Moderation. In reality, he was the lucky beneficiary of an illustrious predecessor (Paul Volcker) and the deflationary impulse of the end of the Cold War which ushered in the early phases of three decades of globalisation.

Jay Powell, now newly re-appointed as Fed Chair with Lael Brainard as his Deputy, has inherited a poisoned chalice. He is demonstrably not suited to deal with the challenges before him. In any event, monetary policy is ill-equipped to deal with some of the problems like supply constraints and deglobalisation. But as the presentation demonstrates, demand is rock solid too.

Add in fiscal largesse, public sector indebtedness reaching new heights around the world and a financialized economy, and the task becomes increasingly difficult. Don’t envy anyone having to deal with all the moving parts! It will be nigh on impossible for Jay, Lael and their peers around the world to thread the needle.

With almost every major central bank meeting for the rest of 2021 and all of 2022 now “live,” in the sense that decisions will need to be made every time, the contrast could not be greater than with the multi-year period of inaction we saw in the 2010s under Bernanke and Yellen. Monetary activism (especially procyclical, as it is likely to be) is a recipe for volatility. Expect risk premia to rise across all asset classes.

These will include… higher term risk premia in fixed income and higher implied volatility; higher volatility in stocks and huge dispersion and rotation; dynamic currency outcomes as interest rate differentials begin to diverge. Inflation risk premium has already climbed to 3% in the US and 4% in UK. This latter may fall once policy activism kicks in.

The presentation and feedback give us a valuable snapshot of where things are now. 2022 will challenge the status quo. Expect an altogether different landscape by this time next year. Think carefully about what your goals are for next year (profit, wealth preservation, liability control) and let’s try to navigate the stormy waters ahead together.”