S2F Model Predicts BTC at $288k US.

News

|

Posted 28/04/2020

|

22926

"The important thing in science is not so much to obtain new facts as to discover new ways of thinking about it" - William Lawrence Bragg

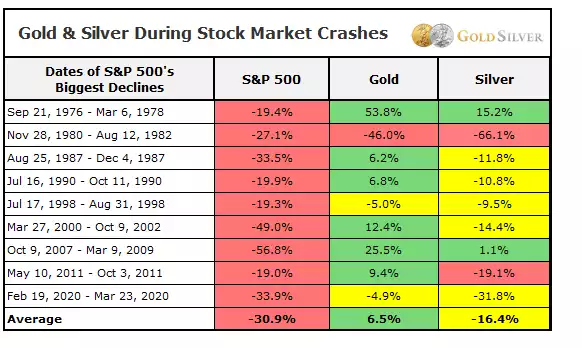

Stock-to-Flow measures the Bitcoin price using two factors: the stock — the number of Bitcoins in circulation — and the flow, which is the number of new Bitcoins entering circulation. Bitcoin's low emission rate relative to its existing supply - like gold - means Stock-to-Flow constitutes useful evidence in the argument that Bitcoin is "digital gold."

This model treats Bitcoin as being comparable to commodities such as gold, silver or platinum. These are known as 'store of value' commodities because they retain value over long time frames due to their relative scarcity. It is difficult to significantly increase their supply i.e. the process of searching for gold and then mining it is expensive and takes time. Bitcoin is similar because it is also scarce. It is the first-ever scarce digital object to exist. There are a limited number of coins in existence and it will take a lot of electricity and computing effort to mine the 3 million outstanding coins still to be mined, therefore the supply rate is consistently low.

Stock-to-flow ratios are used to evaluate the current stock of a commodity (total amount currently available) against the flow of new production (amount mined that specific year).

The original BTC stock-to-flow model created by PlanB is a formula based on monthly stock-to-flow and price data. Since the data points are indexed in time order, it is a time series model. This model has activated quantitative analysts around the world. Many have verified the non-spurious relationship between stock-to-flow and BTC price.

PlanB has recently released a new stock-to-flow model, removing time and adding other assets (silver and gold) to the model. PlanB calls this new model the BTC S2F cross-asset (S2FX) model. S2FX model enables valuation of different assets like silver, gold and BTC with one formula. Here are some of the findings:

Phase Transitions

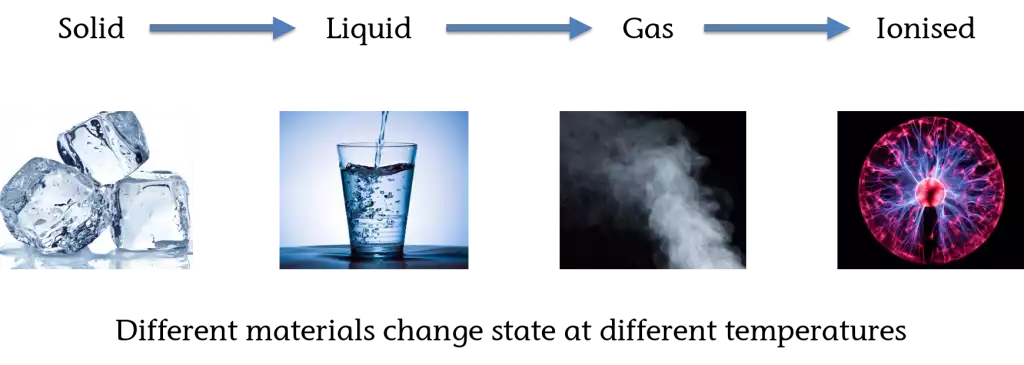

Phase transitions are an important perspective in understanding S2FX model. During phase transitions, things obtain totally different properties. Transitions are often discontinuous. Three examples of phase transitions are:

- Water

- US Dollar

- BTC

Water

The classic example of phase transitions is water. Water exists in four different phases (states): solid, liquid, gas, ionized. It is all water, but water has different properties in each phase.

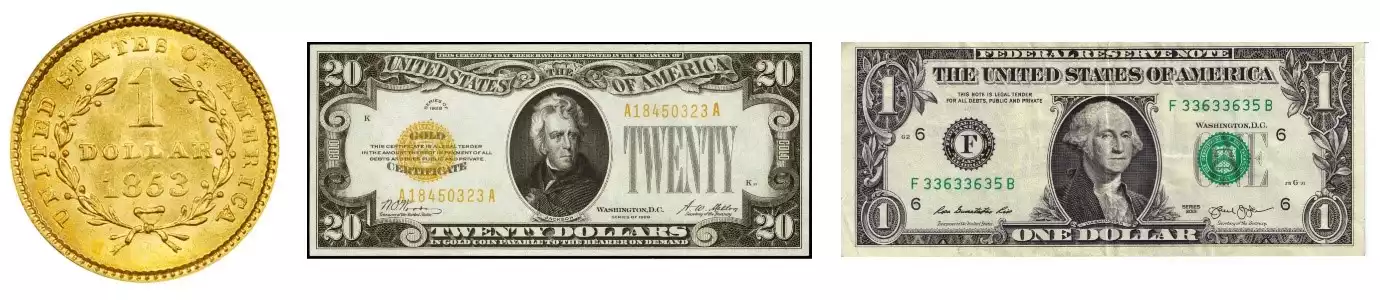

US Dollar

Phase transitions are also present in finance. For example, the US Dollar has transitioned from gold coin (One dollar = 371.25 grains of pure silver = 24 grains of gold) to paper backed by gold ("In gold coin payable to the bearer on demand"), to paper backed by nothing ("This note is legal tender for all debts, public and private"). Although we keep calling Dollar, Dollar has a different meaning in these phases.

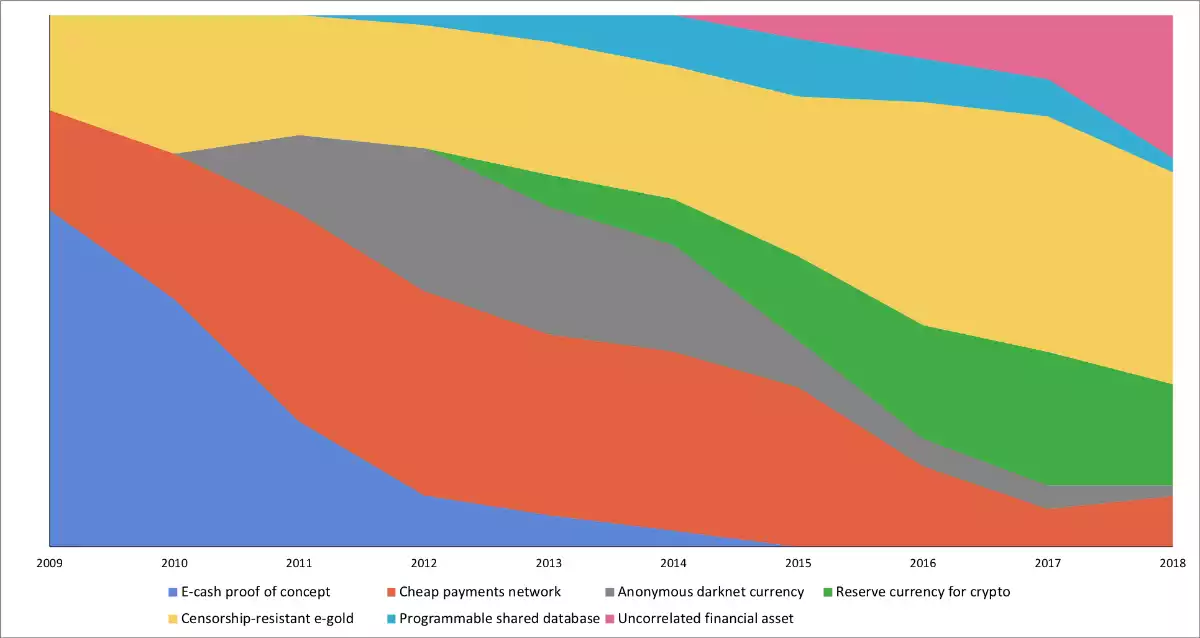

BTC

Same is true for BTC. Nic Carter and Hasu show in their 2018 study how BTC narratives changed over time.

These BTC narratives seem very continuous in the chart. However, if we combine the narratives with financial milestones (and later S2F and price data), they look very much like phases with more abrupt transitions:

- “Proof of concept” -> after Bitcoin white paper

- “Payments” -> after USD parity (1BTC = $1)

- “E-Gold” -> after 1st halving, almost gold parity (1BTC = 1 ounce of gold)

- “Financial asset” -> after 2nd halving ($1B transactions per day milestone, legal clarity in Japan and Australia, futures markets at CME and Bakkt)

These three examples of phase transitions in water, US Dollar and BTC offer a new perspective on BTC and S2F. It is important to not only think in term of continuous-time series but also in phases with abrupt transitions. In developing S2FX model, PlanB sees BTC in each phase as a new asset, with totally different properties. A logical next step is identifying and quantifying BTC phase transitions:

BTC S2F Cross Asset (S2FX) Model

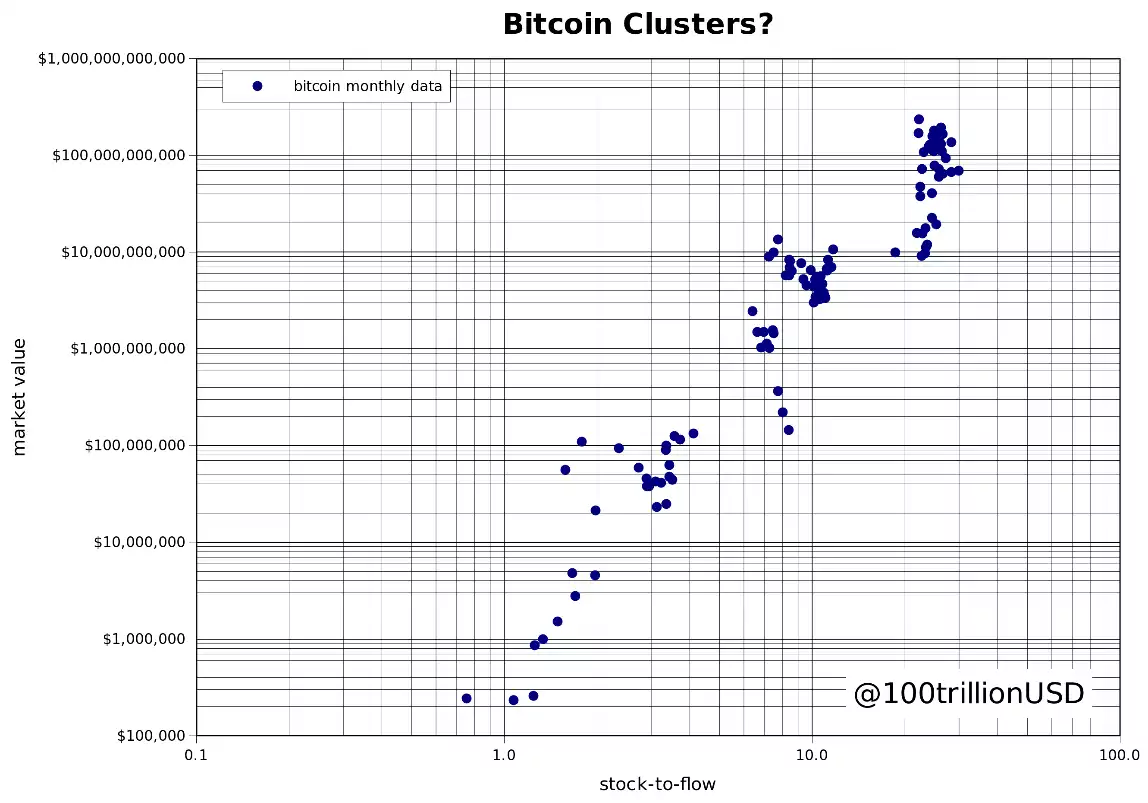

The chart below shows the monthly BTC S2F and price data points used in the original S2F model. One can visually identify four clusters.

These four clusters could indeed indicate phase transitions.

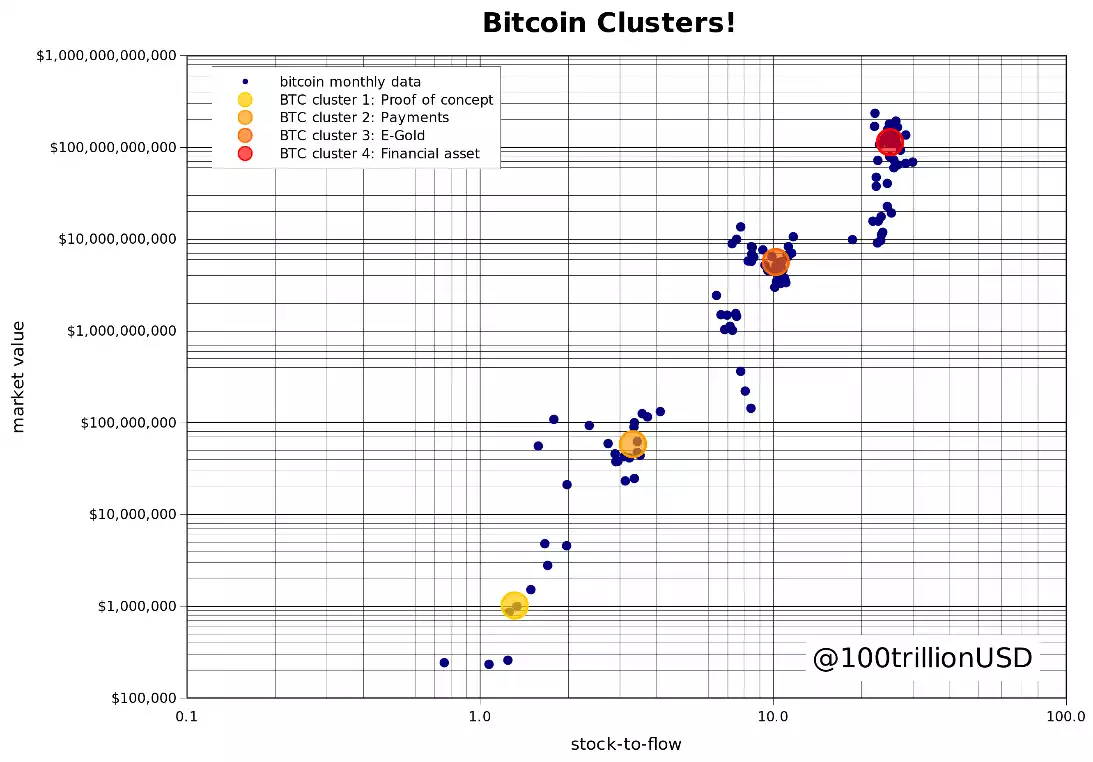

Quantifying these clusters can be done by minimizing the distance between monthly BTC data and clusters using a genetic algorithm (minimizing absolute distance) to quantify four clusters. Future research could focus on different clustering algorithms.

Each of the four identified BTC clusters have a very different S2F-market value combination that seems to be consistent with halvings and changing BTC narratives.

- BTC “Proof of concept” (S2F 1.3 and market value $1M)

- BTC “Payments” (S2F 3.3 and market value $58M)

- BTC “E-Gold” (S2F 10.2 and market value $5.6B)

- BTC “Financial asset” (S2F 25.1 and market value $114B)

Like water and US Dollar these four BTC clusters represent four different assets, each with different narrative and characteristics. BTC "Proof of concept" with S2F 1.3 and only $1M market value is a different asset than BTC "Financial asset" with S2F 25 and $114B market value.

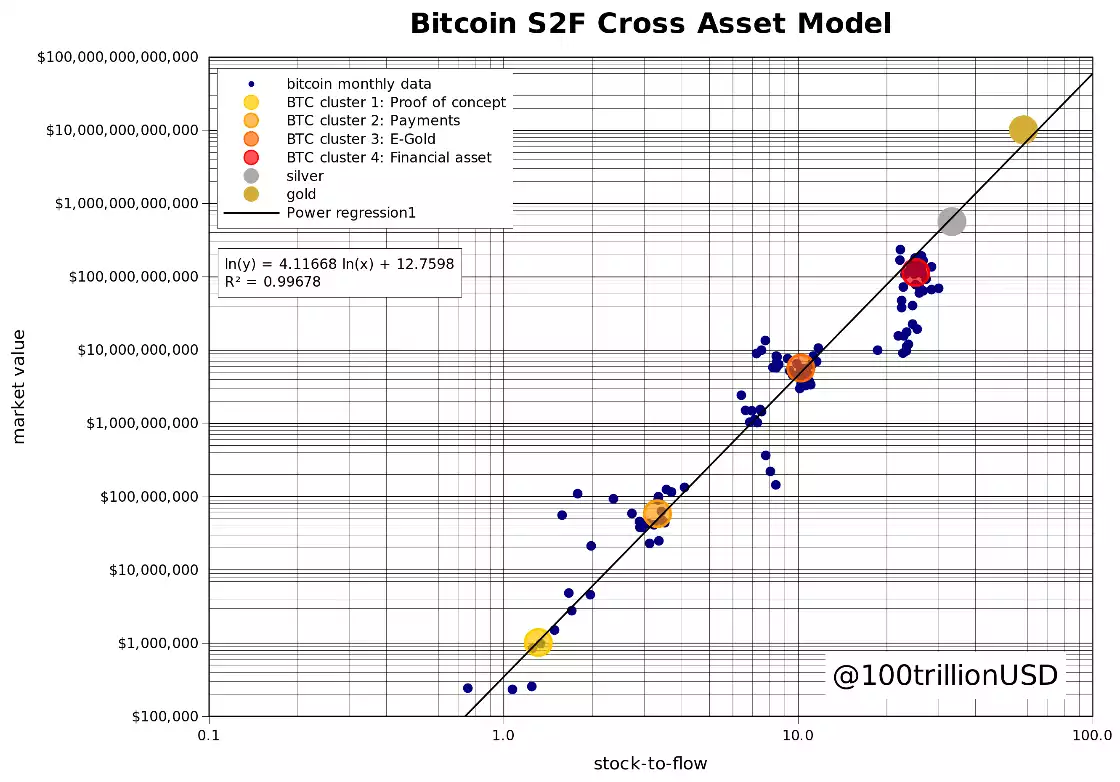

With the phase transition perspective of BTC clusters as different assets, PlanB adds other assets like silver and gold to the model. This makes it a real cross-asset model.

- Silver S2F 33.3 and market value $561B

- Gold S2F 58.3 and market value $10,088B

The chart shows the four quantified BTC clusters (plus the original BTC monthly data for context), silver and gold. They form a perfectly straight line.

The S2FX model formula can be used to estimate the market value of the next BTC phase/cluster (BTC S2F will be 56 in 2020–2024):

Market value = exp(12.7598) * 56 ^ 4.1167 = $5.5T.

This translates into a BTC price (given 19M BTC in 2020–2024) of $288K US.

Solidifying known facts from the original S2F study, the S2FX model offers a new way of thinking about BTC transitioning into the fifth phase and shows that the cryptocurrency market is continuing to mature into a new phase.