No Longer “Safe as a Bank” – When The Safety Net Is Removed

News

|

Posted 15/07/2020

|

21767

Love them or loath them, you wouldn’t want to be a bank right now. Stuck between a rock and a hard place they have balance sheets asymmetrically exposed to Aussie property prices at a time when the majority of property analysts are forecasting sizeable price declines, unemployment is over 13% and the country’s central bank, the RBA just described the current situation as "the biggest contraction since the 1930s". If they force sales they risk the effect of a self reinforcing spiral of plummeting house prices and blowing what comparatively little capital they have. And so they ‘provision’ expected losses and extend mortgage repayment holidays and employ the hope strategy by kicking the can down the road. Over 800,000 mortgage holders and small businesses have asked for these holidays on over $260 billion of debt.

The banks have extended the holiday by 4 months and likewise the government has extended JobKeeper to help on the other hand. However these ‘holidays’ do not stop the interest accruing and the debt expanding. At some point, once the government support is removed reality returns. From the ABC in the weekend:

“The banks are the next domino in danger.

Australian banks' capital buffers against bad debts have improved a lot since the global financial crisis.

But Rachel Slade, the group executive for personal banking at the NAB, acknowledges there is a limit to how long deferring mortgage repayments can work.

That's because deferred mortgages are still accruing interest and household debts are getting bigger.

"There's nothing worse than leaving a customer hanging out there, if we and the customer can see that they're not going to come out the other side of this," Ms Slade said.”

Aussie banks have already slashed dividends to make these bad debt provisions and earlier this week fund manager Janus Henderson told the Australian Financial Review that banks will be forced to shore up their capital buffers by cutting capital management programs and dividends further.

“We think that banks will continue to need to shore up capital……They will go through a multi-year reporting period and cycle of reporting a higher level of provisioning.”

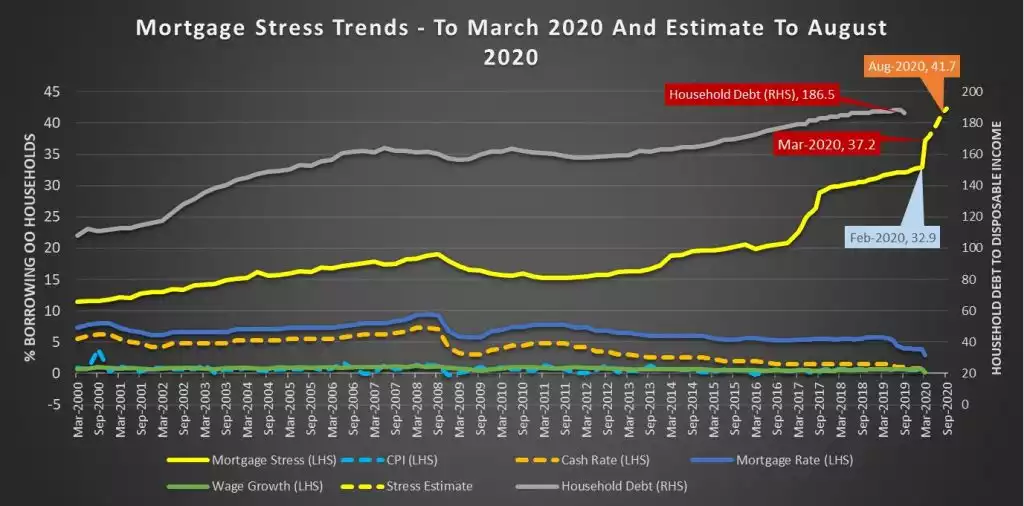

Certainly mortgage stress, which was already rising since 2017 has spiked and with immigration effectively at nil and the second wave once feared now a reality, it promises to rise further particularly when the holiday ends:

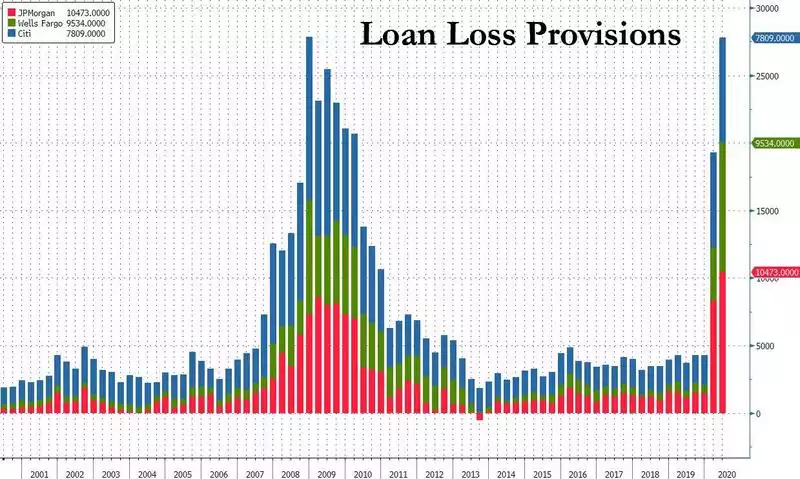

Last night we saw 3 of the US’s top banks release their Q2 earnings reports and topically their loan provisions jumped nearly $10 billion from Q1 which itself saw that unprecedented $15 billion jump from the previous quarter. Now at GFC levels, with hopes of the V shape recovery taking a battering from the second wave sweeping the US, higher provisions seem a certainty.

JPMorgan, Citigroup and Wells Fargo alone provisioned almost $28 billion for bad loans inQ2 with more major banks to report later this week. The bad news was somewhat overshadowed by huge gains in earnings from, you guessed it, playing this surging market. With the removal of the Glass Steagall Act in 1999, banks holding depositors funds were allowed to go play in the markets with all the risk that entails. We saw first hand in the GFC how that can play out but despite enormous pressure the Act remains repealed. Imagine what a major crash in the sharemarket would do. Whilst the banks are outwardly provisioning for loan losses (not market losses) many believe the amounts are nowhere near enough despite the CEO of the biggest bank, JP Morgan’s Jamie Dimon, last night acknowledging:

"This is not a normal recession. The recessionary part of this you’re going to see down the road….You will see the effect of this recession. You’re just not going to see it right away because of all the stimulus."

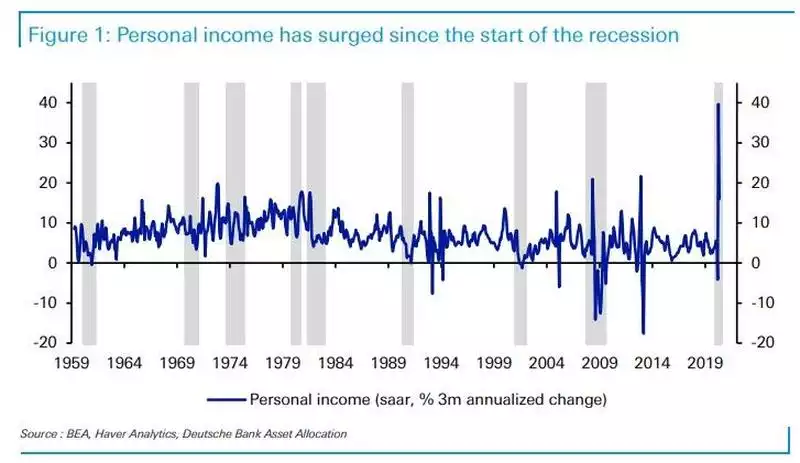

What Dimon refers to in terms of stimulus is in large part the government handouts that have actually seen a lot of Americans better off now than before the crisis. Sound familiar? We all know someone who is now actually getting paid more from ScoMo than they were from their part time jobs. In the US, where over 18m people have become jobless, that has seen the following phenomenon of spiking income:

Speaking to this, JP Morgan’s CFO observes “It’s fair to say right now, given where we are in the crisis, that the relationship between the business cycle and the health of the business sector and the health of the household sector is broken,”

The same can be said for Australia. Until the government stimulus ends or winds back, we are living in a false reality. Currently businesses, landlords, and tenants are all on life support through ‘holidays’ or handouts. Even Treasurer Frydenberg admitted on Monday their official 7.1% unemployment is really 13.3% as we discussed here a month ago.

Until recently it looked hopeful that Australia would get back to normal sooner than most but the second wave starting in Victoria and seemingly now working its way north means that may have been a false hope. Indeed there is more and more talk from epidemiology experts that this could be our new normal until or if a vaccine materialises. Finding a safe haven for your hard earned in such an environment is going to test long held Aussie dogmas of “safe as a bank” and “bricks and mortar”.