Liquidity REPOcussions – Was that the warning sign?

News

|

Posted 18/09/2019

|

10842

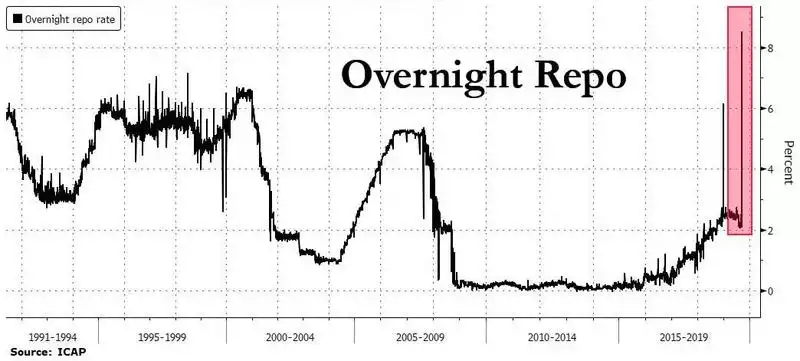

You will no doubt have seen a few headlines around the REPO market spike over the last couple of nights and why it is raising real concerns. Repo is short for a repurchase agreement which in simple terms is when one party (usually a bank or other money market fund) lends cash to another party (usually a hedge fund or Wall St broker-dealer) who provides security usually in the form of US Treasuries. It is usually just over night and in theory has little risk for either party given UST’s back it all up and the short term nature of it. The repo rate therefore is normally pretty much in line with the Fed Funds Rate which currently sits at 2-2.25%. But this happened:

Speculation is therefore rife over what caused this spike which is clearly a symptom of a cash liquidity squeeze. The simple answer is that quarterly tax payments for companies was due combined with the latest $78b of US Treasuries auctions due for settlement. However both of these were ‘known knowns’ and therefore shouldn’t have surprised the market. From the Wall Street Journal:

“Whenever repo rates come under sharp and unexpected pressure, investors are going to question whether the cause was something short-term and mechanical, or whether there is a more serious source of stress in the market. That could be a surge in perceptions of risk or a major drain on cash, such as big trading losses.

“Whether this is a one-off day explained by a convergence of distinctive factors, or evidence that more troubling developments are afoot, will be a crucial question for short rates in coming days,” BMO Capital Markets analysts said in a note.”

And therein lies the elephant in the room. Liquidity when things ‘turn’. The ‘known unknown’.

Last night the US Fed intervened and injected $53b into the market to get things under control. The Fed, unlike the other ‘parties’ does this by just creating more money. It’s effectively another kind of QE at a time when apparently QE is not on the table…

Let’s leave you with some timely commentary from Lance Roberts:

“The rush by the Central Banks globally to ease liquidity, the ECB restarting the QE, and the Federal Reserve cutting rates in the U.S. suggest there is a liquidity problem somewhere in the system.

Given the disproportionate role of quant-driven strategies, leveraged traders, and the compounded risk of “passive strategies,” there is profound market risk when rates rise too quickly. If the correlations that underpin the multitude of algo-driven, levered, risk-parity portfolios begin to fail, there is more than a significant risk of a disorderly reversion in asset prices.

The Central Banks are highly aware of the risks their policies have grown in the financial markets. Years of zero interest rates, massive liquidity injections, and easy financial standards have created the third asset bubble this century. The problem for Central Bankers is the bubble exists in a multitude of asset classes from stocks to bonds, and particularly in the sub-prime corporate debt market.”

Last night was probably just a warning, but it’s a warning that anyone in financial markets needs to take note of. The sheer scale, ‘auto-pilot’ and ‘all-in’ nature of our new norm of passive funds and ETF’s means this could all unwind incredibly quickly, beyond the liquidity capabilities of the system, and without warning.