IGWT 2 – Real Interest Rates & Gold

News

|

Posted 12/04/2019

|

7155

Yesterday we presented the first of 6 articles off the “Preview Chartbook” for the highly anticipated “In Gold We Trust” report by Incrementum. Today we look at the effect of all the debt the US has amassed, but importantly the rate environment it has done it in and the impact that will likely have on gold.

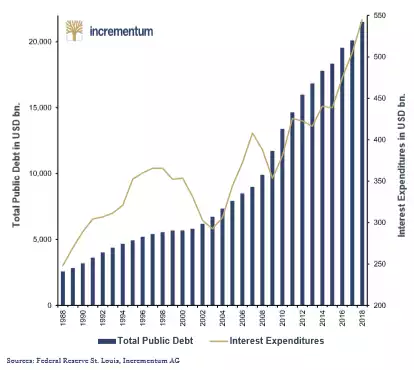

Firstly, and nothing new to regular readers, lets remind ourselves of the staggering accumulation of debt by the US, especially since the GFC.

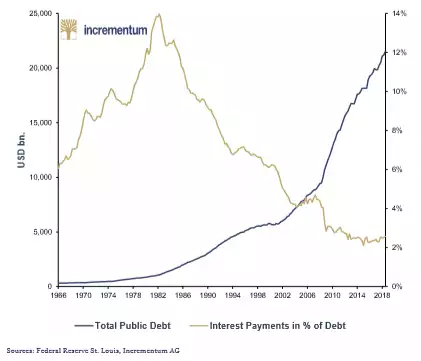

All that debt needs servicing of course, and in 2018 there was a new record high interest service cost of $545b. That is set to climb in coming years. However as a percentage of debt that is actually historically low thanks to the near zero interest rates. The debt explosion since the 1970’s has essentially forced interest rates to remain low. Look no further than the market reaction and subsequent capitulation of the Fed at the beginning of this year.

As Incrementum say:

“One thing is certain in our opinion: In view of existing debt levels we are unlikely to see strongly rising or clearly positive real interest rates in the coming years. Central banks are caught in the interest-rate trap.”

But is there an acknowledgement of this trap and easing off? Nope..

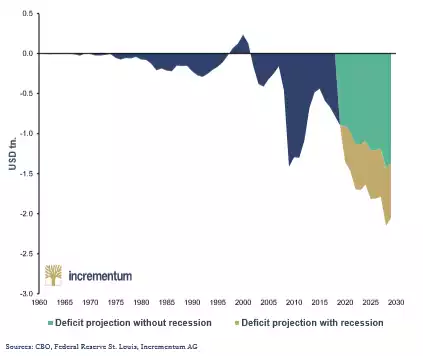

“Government debt has more than doubled to USD 21,000bn in the past decade and is now expected to rise to USD 33,700bn by 2029. An additional budget deficit of USD 900bn is expected for the fiscal years 2018-19 and 2019-20. The CBO expects a deficit of USD 13,324bn for the period 2018 to 2029. However, these numbers are based on the highly unrealistic assumption that there will be no recession before 2029 (!).”

So what does this really mean for gold?

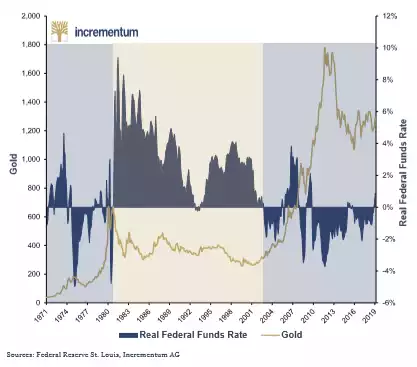

“Due to the Enormous Debt Pile, High Positive Real Rates Seem Implausible. Negative and Falling Interest Rates Boost the Gold Price. Real interest rates – their direction and momentum – are one of the most important drivers for gold! There are two time periods that were shaped by predominantly negative real interest rates (blue shading below): the 1970s and the period since 2001. Both phases clearly represented a positive environment for the gold price. One can also discern that the trend of real interest rates is extremely important for the gold price.”

So when we look at the combination of the need to suppress rates to contain debt servicing; and the reintroduction of QE discussed yesterday, which ordinarily seeks to increase inflation; and remembering Real Interest Rates = Interest Rates less Inflation… well, you can do the math…