Fools Gold

News

|

Posted 01/04/2020

|

20843

We have written extensively on the questionable gold investment vehicle of ETF’s and last week wrote of the pressures in the futures markets with deliverability of physical gold and the ensuing disconnect between the paper spot price and the price to buy real gold.

So how does one fix a problem around the physical supply of gold on futures paper promises? You create another paper derivative! (This is not an April Fools joke, read on). The clever folk at CME Group have created a new COMEX future gold contract called Enhanced Delivery which whilst still being the standard COMEX 100oz unit size will allow “expanded delivery options that include 100-troy ounce, 400-troy ounce and 1-kilo gold bars”. Now depending on your mathematical abilities you may have spotted that a 400oz bar doesn’t fit into a 100oz contract when it comes to delivering physical gold. To fix this physical delivery problem they have created the Accumulated Certificates of Exchange (“ACE”). From CME themselves:

“The ACE mechanism facilitates the conversion of 400 oz bars in fractional units which can be used for delivery. Once a 400 oz bar is warranted, it can be assigned to the Clearing House, and in return the Clearing House will issue four ACEs.

Each ACE will represent an equal share of ownership of the larger bar. That means that each 400 oz bar will result in the issuance of 4 ACEs. ACEs can only be issued against the 400 oz bars, not the smaller 100 oz or kilo bars.”

And just like most gold derivatives there is the escape hatch of not actually delivering real gold on demand:

“Once issued, ACEs can be held as long as necessary. A client can use ACEs to comply with short delivery requirements (1 ACEs reflecting one futures contract of 100 oz) or it can be swapped back against a 400 oz bar by exchanging 4 ACEs. A customer can comply with delivery requirements with ACEs or regular bars, or a combination of both.”

Fans of the movie Top Gun will recall the main characters and best buds were ACE and Goose. Now we’re not saying only a Goose would buy this ACE story but…well… read on…

To make this even more farcical the latest metal depository statistics from CME Group (who run COMEX) show that not a single 400oz bar is on deposit ready for delivery. So to be clear, there are zero 400oz bars sitting behind that ACE promise as at 30 March, a full week after its release.

There is a reason physical gold supply is so tight and premiums for it higher, and that is people are seeing this house of debt and free money for what it is and are scrambling for real money, real hard assets.

The financial system is a ticking time bomb and when things completely unravel such derivatives will show who is swimming naked.

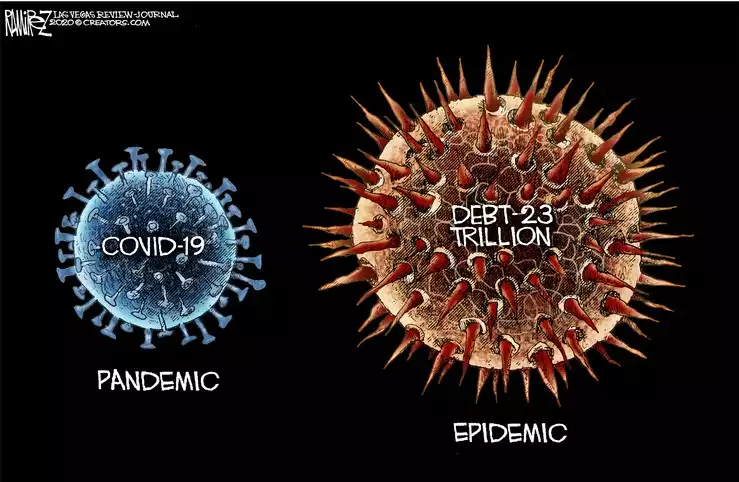

The following meme, whilst funny if it weren’t so sad, also misses the point. Yes the $23 trillion US government debt balance is a mine bomb awaiting a nudge, but it is not an epidemic per se. It is but one of similar debt bombs all around the world. These debts are in the process right now of being expanded at an unprecedented pace as governments scramble to inject debt funded stimulus into their economies to keep things going at best or at least ‘hibernate’ as is the new catch phrase. Last night G20 Treasurers met to reinforce exactly that trajectory. This unprecedented debt is most certainly a pandemic not an epidemic. There is no chance the impacts of just one major economy imploding under debt will not spread around the world faster than any virus could.