Fed meet Pavlov – Are Markets Unwitting Dogs?

News

|

Posted 04/06/2020

|

19286

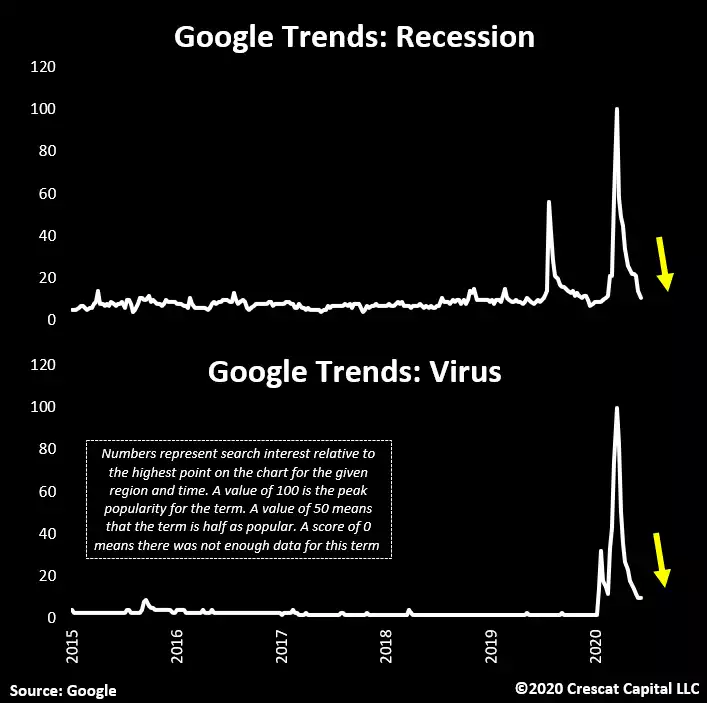

America is burning, in deep recession, sabre rattling with China escalates, 40m unemployed, earnings falling and yet US shares continue to rise. Whilst the answer from many is ‘don’t fight the Fed’, play the casino, it fundamentally makes no sense. Gordon Gekko is back baby…

Nothing to see here….

Many were expecting a correction in the US shares at the 61.8% retracement level, but it never eventuated. Against all odds it has smashed through it leaving many perplexed as to what the next resistance level actually is and for how long will ‘animal spirits’ keep these new highs?

Looking at valuations…

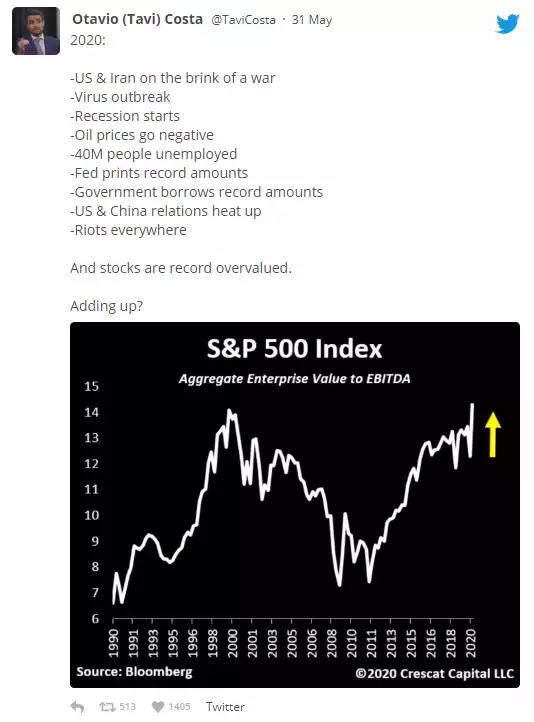

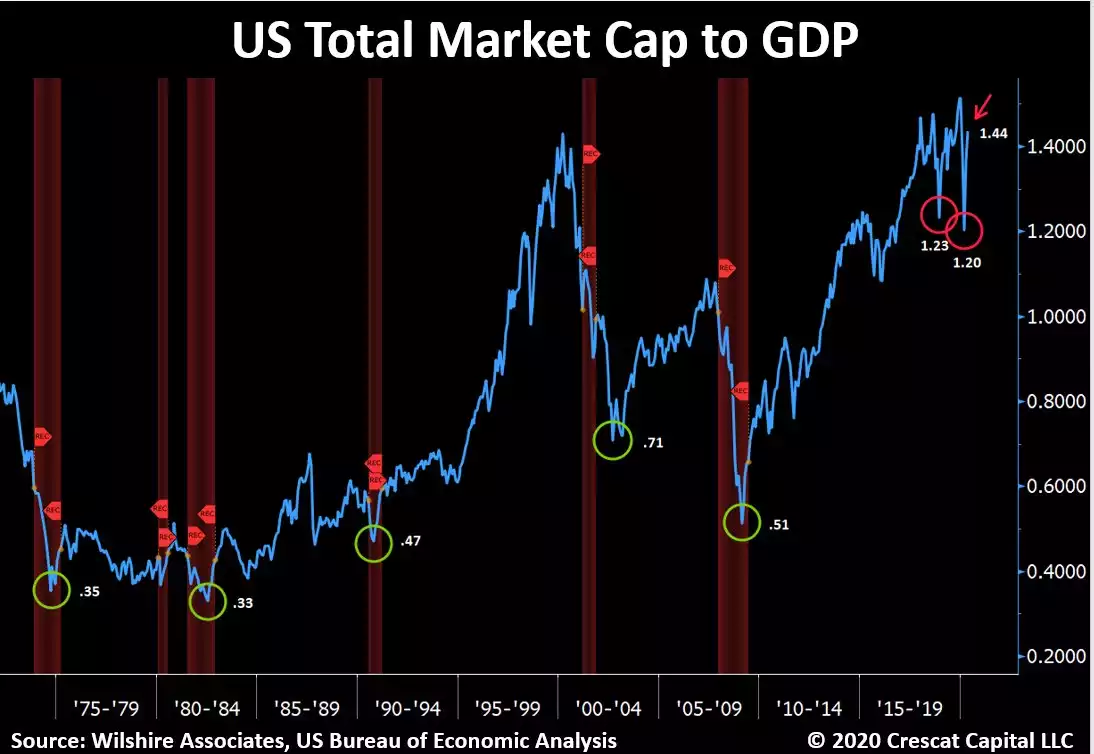

As Crescat’s Kevin Smith notes on the chart below:

“Valuation mania still unbroken.

Average market cap to GDP ratio when bear markets and recessions bottom out: .47

67% lower than today.

Tremendous opportunity on the short side as we take out the fake lows of 2018 and 2020.”

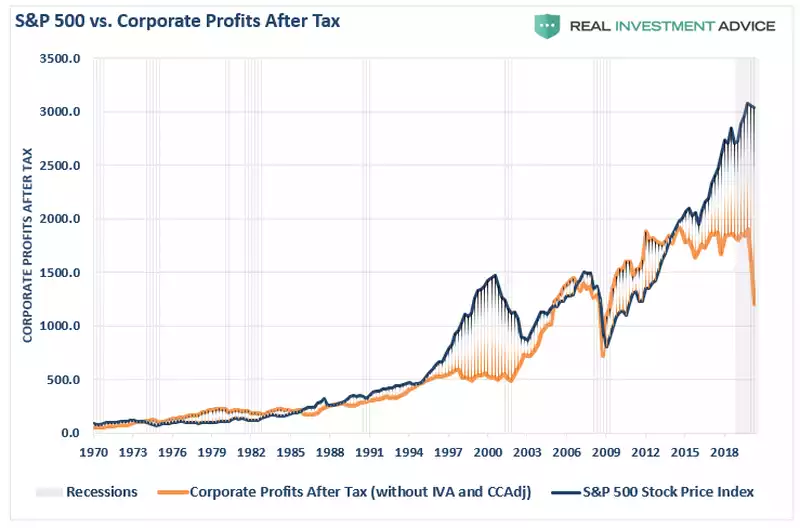

Indeed with falling earnings we have seen market valuations back up to record breaking levels – higher than dot come for S&P500 and even tech shares getting very close to those ridiculous 2001 levels that preceded an 80% fall.

The chart below clearly illustrates the disconnect between earnings and share price. You either don’t care and are just playing the “Fed’s got this” game or you somehow think there will not just be a V shaped recovery but it will somehow come back (soon) bigger and better!?

And the whole Fed stimulus thesis is not as solid as most people think, reinforcing the arguably Pavlovian effect of their actions rather than actual money…

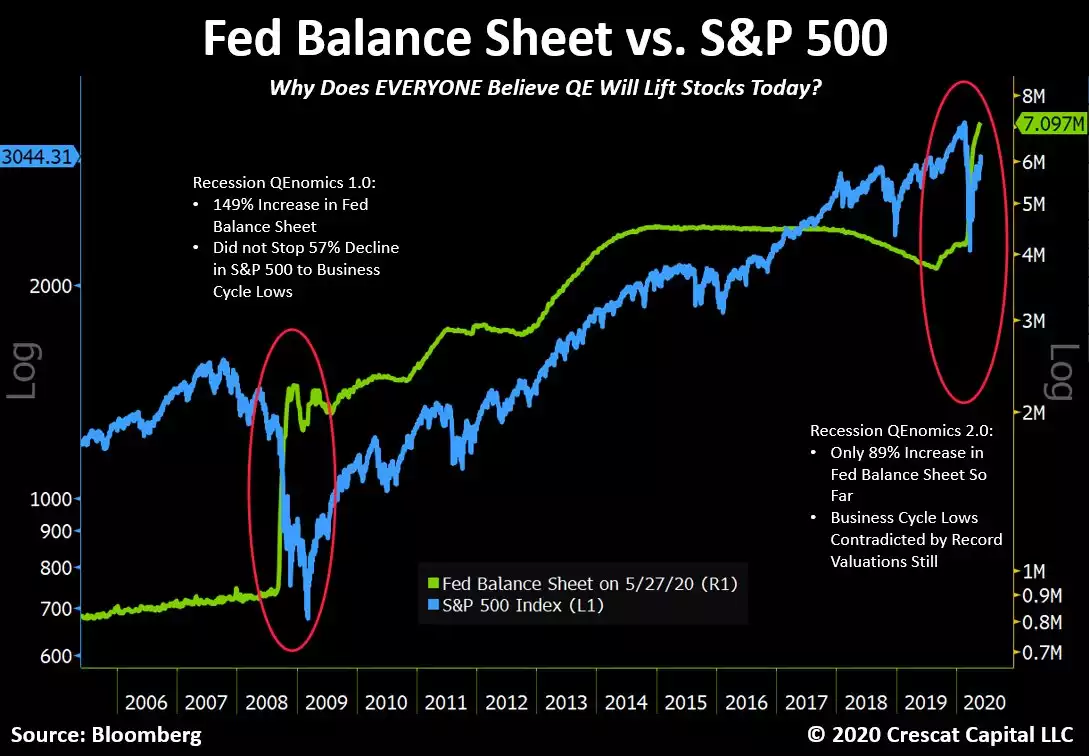

The chart below debunks the theory that QE has an immediate effect on markets. Whilst, as you can see, markets responded immediately this time to the stimulatory measures unleashed by the Fed, that was most certainly not the case in 2008 where the market crashed another 57% AFTER the Fed unleashed this new thing called QE.

That reinforces the Pavlovian theory as in 2008 we hadn’t actually been through the impacts of QE given it was a new thing. Looking closely at the chart above, and as we’ve reported over the years, you can see clearly whenever the Fed stopped QE (1, 2, 3) the S&P500 came off. Cause and effect were firmly learned. Many know the theory of Pavlov’s Dog or Pavlovian Theory defined as:

“Pavlovian theory is a learning procedure that involves pairing a stimulus with a conditioned response.

In the famous experiments that Ivan Pavlov conducted with his dogs, Pavlov found that objects or events could trigger a conditioned response. The experiments began with Pavlov demonstrating how the presence of a bowl of dog food (stimulus) would trigger an unconditioned response (salivation). But Pavlov noticed that the dogs started to associate his lab assistant with food, creating a learned and conditioned response. This was an important scientific discovery.

Pavlov then designed an experiment using a bell as a neutral stimulus. As he gave food to the dogs, he rang the bell. Then, after repeating this procedure, he tried ringing the bell without providing food to the dogs. On its own, an increase in salivation occurred. The result of the experiment was a new conditioned response in the dogs.”

Without wanting to draw offence, maybe Fed = Pavlov, QE = bell, Market = Dog, Salivation = BUY!

Now we are by no means inferring QE is purely Pavlovian. Clearly there is still the direct application of newly created money into banks providing cheap money to ‘rich folk’ to pour into the only self reinforcing (because the bell just rang…) ‘risk free’ risk-on asset being shares.

With the Fed quietly reducing their QE (albeit of sky high levels) there is clearly however a large dose of Pavlovian behaviour here. Whilst the dog might miss out on a biscuit, investors have much much more to lose when they learn the bell was, well, just a bell.