Fed Hawknado Smashes Markets – Start of next leg down?

News

|

Posted 29/08/2022

|

8743

As we previewed last week, Fed Chair Powell’s Jackson Hole speech ended up being as hawkish (tighter monetary policy) as you could imagine. For a market that was simply gagging for even the remotest bit of dovish note, it was nowhere to be found and EVERYTHING barring the USD fell hard. The NASDAQ fell hardest by 3.9% but even the mighty S&P500 was close behind at 3.4%. Even gold got smacked down $19 (1%) and silver nearly 50c (2.5%). Again the weaker AUD against that stronger USD softened the metals falls for us. So what happened?

Just before the meeting we got what market’s feared and that was the print of the PCE Deflator data, the Fed’s preferred measure of inflation, which saw only a modest drop and so still at near 40 year highs. The headline print was 6.3% (down from 6.8%) and the Core was 4.6% (down from 4.8%).

And then Powell flagged “pain” ahead:

"While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain."

To be clear though, this is not just a US thing. Jackson Hole is indeed a gathering of all major central banks from around the world and it was a consistent message. From Bloomberg:

“Top officials from the world’s biggest central banks coalesced around a simple message in Jackson Hole this weekend: They are ready to follow through with higher interest rates, even if it does some damage.”

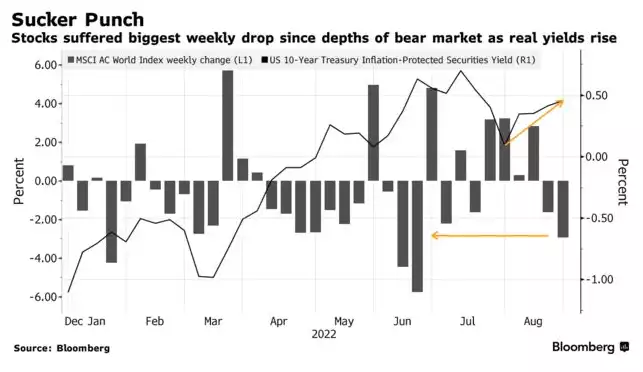

The effect on sharemarkets around the world (and no doubt ours today) was immediate with the global index seeing its biggest weekly drop since markets bottomed in June. The ‘surely they will turn dovish’ rally could be over.

Indeed we saw a similar hope rally, or bull trap, during the GFC before the real pain played out on the final leg down:

Gold rallied strongly on that final sharemarket leg down to finish up almost double whilst shares literally halved over the GFC period. As with what we’ve seen so far, gold initially got sucked down lower amid the liquidity squeeze before share margin calls were settled and the rotation into safety saw it take off.

Not discounting this could be more jawboning and remembering the next Fed meeting is not until next month, the market is now believing this and the odds for a whopping 75bps hike in September leapt to over 60% after the speech. If they do keep hiking as promised what does “pain” mean exactly? We will for a while see the confluence of painful stickier than expected inflation whilst our record level of debt gets harder and harder to service on higher and higher interest rates. That inevitably flows through to renters who will already be suffering with wage growth not keeping up and job losses growing. Sharemarket valuations are still very high, earnings are about to fall and the free money to buy the shares ignoring that is drying up at a pace not seen in decades. We are talking a recession amid inflation, we are talking stagflation like we saw in the 70’s. The 70’s was one of gold and silver’s strongest bull markets in history.

Crescat’s Tavi Costa paints a clear picture:

“Today’s restrictive Fed policies in a rapidly deteriorating economy are the preconditions for a steep recession.

Contrary to the unprecedented monetary and fiscal support we had following the last economic downturn, we are currently experiencing a major withdrawal of liquidity at a time when corporate fundamentals are starting to contract.

Despite the deepest yield curve inversion in decades, the Fed is raising rates at its fastest pace since '84 as it prepares to shrink its balance sheet by $90B/month, starting in Sept.

Already, in the last 3 months, M2 money supply also contracted by its largest amount in 63yrs!

In the meantime:

Inflation remains deeply entrenched in the economy.

These are arguably the most challenging set of circumstances the Fed has confronted in decades.

Central banks can sacrifice economic growth as long as unemployment rates stay low, which is highly unlikely.

Looking back at the Great Inflation period from the late 1960s to the early 1980s, the rise in consumer prices preceded substantial increases in unemployment rates.

On average, after two years of the initial appreciation in inflation rates, labor markets started to falter.

Today, it has been exactly two years and three months since CPI rates began to trend higher.

With such a level of monetary tightening with already eroding economic conditions, we strongly believe unemployment rates are poised to rise significantly from their current levels.

In 1973-4, it took a decline of 48% in stocks for inflation to start trending lower for the next couple of years.

The persistent increase in consumer prices at the time forced the Fed which had to radically tighten financial conditions.

As a result, a brutal inflationary recession followed and, outside of precious metals, overall equities and Treasuries collapsed together.

A similar macro setup is unfolding today.

The US and most other developed economies have decisively entered an inflationary regime.

Consequently:

The role of monetary policy will be much more directed towards price stability which inhibits the backdrop of excessive central bank liquidity that drove overall market prices to today’s unsustainable levels.

We believe January 3rd marked the peak for US stocks and this is just the beginning of a bear market from truly historical overvaluations.

Equity markets are not priced for the vicious stagflationary environment that we envision.

Overall, stocks are behaving as if we were still in a secular disinflationary environment which allows the Fed to loosen monetary conditions without causing inflationary pressure.

As prices for goods and services continue to increase at historically elevated levels, so will the cost of capital.

That is not a positive scenario for growth stocks, particularly relative to value companies.

The Russell Growth vs. Value index spread still is near the peak levels reached in the Tech Bubble of 2000.

This further supports our view that the decline in the overall equity markets is just the beginning.”

Finally, in terms of ‘rubber hitting the road’, here’s an update of household pain. Savings are plummeting and personal debt soaring. It’s a very telling chart. “Pain” is already here Mr Powell…

This week will be a very telling week on sharemarkets as a mountain of money positioned for a dovish speech now needs to exit. That second chart comparing now to the GFC could well be prescient.

Balance your wealth in an unbalance world.

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************