Australia’s Migration Ponzi Scheme Exposed

News

|

Posted 08/07/2020

|

22160

Warren Buffet famously said “Only when the tide goes out do you discover who's been swimming naked.” COVID-19 has been the catalyst for such a lowering of the tide and possibly a more apt analogy is this is the sucking out of the water before the tsunami comes.

The closure of our borders has seen the suspension of immigration and foreign students and it has exposed what some are calling the Aussie economy Ponzi scheme. An economy based largely on building accommodation for immigrants and educating foreigners.

Terry McCrann wrote to this in The Australian over the weekend:

“Abandoning the ‘Big Australia’ population Ponzi that has been — chaotically — the foundation of our economic policy framework for the past 20 or so years and which has not only substituted for the productivity growth that is the only basis of real national advance and wealth improvement but has worked to actively undermine it.

Does any sentient person really believe that a prosperous future lies in pouring more and more people into Melbourne and Sydney, building more and more high-rise apartment buildings, and then requiring more and more infrastructure from roads and rail to hospitals and schools just to try to catch up?”

The huge role immigration (Net Overseas Migration or NOM) has played in Australia’s overall population growth is captured in the chart below showing annual population change:

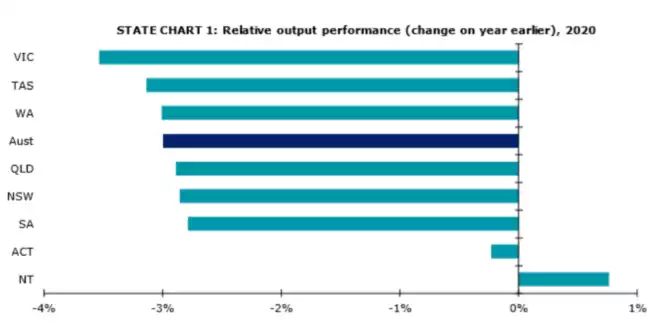

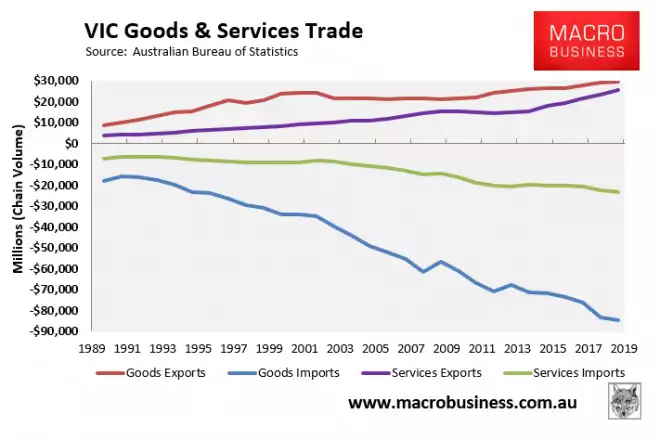

Victoria was once the nation’s manufacturing heartland when Australia made things such as cars for us to drive, clothes for us to wear, etc. However with the trend of globalisation all of this was left to die as we chased the cheaper alternatives from China, Korea, etc etc. Without a resource sector, Victoria then relied on the aforementioned immigration Ponzi scheme as its economic driver. As the chart below illustrates, Victoria’s economy, more than any other, has been left naked as the tide has receded.

Since the turn of the century goods exports have effectively flat-lined whilst what needs to be imported for all those new people grows at a staggering pace comparatively, and the growing services exports dominated by overseas education. 2019 was already nearly a record balance of trade deficit and 2020 promises to blow that record away.

The headline Gross State Product (GSP) looks strong but when it is measured per head of population you can see in the chart below it has effectively flat-lined since the GFC. You will note too the real divergence starts at the turn of the century when immigration really ramped up.

Not surprisingly then, Victoria ranks near or at the bottom in a host of economic metrics including, equal weakest GSP growth per capita since the GFC; second worst Gross State Income per capita since the GFC; weakest Real Gross Household Income since the GFC; by far the weakest growth in Real Gross Household Disposable Income per capita as well as lowest in dollar value (yep even lower than Tassie) at just $43,283; and that is not a regional thing, Melbourne has the 3rd lowest median income of capital cities behind Hobart and Adelaide. This is not to pick on Victoria, but rather to highlight the impacts on the most exposed state to migration.

To add to the state’s woes, it is of course now the epicentre of COVID-19 with the second wave taking hold. This even prompted AMP’s Dr Shane Oliver to worsen his already bad 10% price drop call for property in both Melbourne and Sydney to 20% stating “The market is in a pretty precarious situation at the moment.”

This does more broadly however speak to the shift away from globalisation that started even before the pandemic. Trump and Brexit are clear populist votes supporting a de-globalised world. Many experts are predicting this trend will accelerate beyond any forced border closures as the pandemic has highlighted the need for self reliance and China continues to rattle the sabres adding fear and emotion to the mix.

A de-globalised world sees us making more of our own stuff for ourselves. Over many years we have managed to put ourselves well down the list of international rankings of costs to both produce and do business through endless red tape, taxes and draconian IR laws. That doesn’t simply get ‘unwound’ and hence any locally produced goods will be more expensive to make. And so at a time when our government has amassed huge amounts of debt, our central bank unleashed unprecedented monetary stimulus and the inevitable inflationary pressures that will come (after the intervening deflationary pressures) these pressures would be further exacerbated by the inflationary impacts of ‘buy Australian’. That is not a Victorian issue; that is a whole of country issue.

One asset reigns supreme in such an environment and that is gold.