40 Year High CPI Only the Headline - “None of us own enough tangible assets”

News

|

Posted 13/12/2021

|

8453

On Friday night the much anticipated CPI inflation print came out in the US. Whilst it hit a 40 year high 6.8% many in the market were expecting an even worse 7% and so it was a bit of a fizzle despite that 4 decade high number. However, was 6.8% actually a fair depiction of inflation in the US?

First let’s look at what happened. Headline CPI, at 6.8% was the highest since 1982:

The make up of that number was very broad, not just a couple of ‘supply constraint’ items…

The rate of increase in inflation, despite a US labour market practically at full employment, is translating to real wages actually shrinking, now for the 8th month in a row:

This tells us a couple of things. Firstly, we are seeing this level of inflation without reflective wage growth. What happens when that catches up! (not transitory…). Secondly, we have yet another example of the wealth dislocation in the US. As wild as this inflation is for goods, it pales against financial assets. Last week we saw the headline that the top 1% in the US own $22 trillion of shares whilst the bottom 90% own just $4.5 trillion.

The other notable component of this print is the change in how house prices are dealt with now compared to 1982. Back then they used actual house prices, now it is just a non-market rent index called ‘Owner’s Equivalent Rent’. Alliance Brenstein’s chief economist Joseph Carson explains:

“In 1982, the CPI shelter component included house prices for owners' housing costs. But nowadays, the shelter component for owner's housing is based on a non-market rent index. House prices are up close t0 20% in the past year versus a 3.5% increase in owners' rent.

Adjusting today's shelter measure for the rise in house prices and removing the owner's index would result in a significant boost to the reported inflation rate. Based on my calculation, todays' inflation rate would top 11%.”

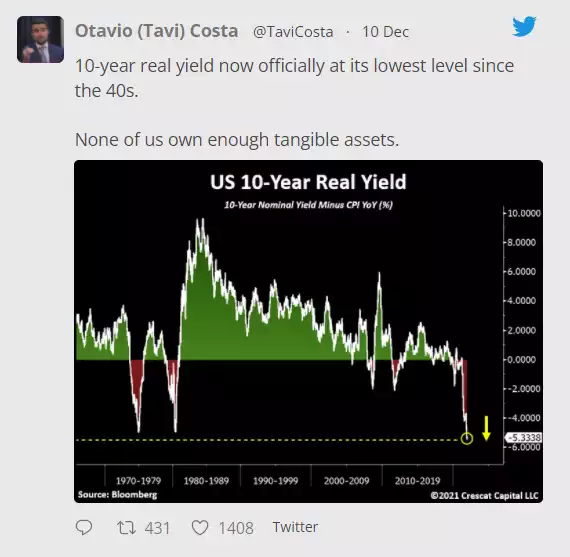

Just remember too that we have this level of inflation at the same time as rates are held near zero and QE still going hard, albeit slowly tapering to the middle of next year. The price distortions in things like shares and houses will obviously be perverse. When we look at this against the risk free benchmark of the US 10 year treasury bond it should come as no surprise that in real terms this distortion is one not seen since 1940’s…

Over the weekend Allianz Chief Economic Advisor Mohamed El-Erian again warned:

"The characterization of inflation as transitory -- it's probably the worst inflation call in the history of the Federal Reserve…. It results in a high probability of a policy mistake…..So the Fed must quickly, starting this week, regain control of the inflation narrative and regain its own credibility. Otherwise, it will become a driver of higher inflation expectations that feed off themselves."

To illustrate just how big this ‘policy mistake’ could be quantified there were numerous references to The Taylor Rule over the weekend too. From Investopedia:

“The Taylor rule has been interpreted both as a way to forecast Fed monetary policy and as a fixed rule policy to guide monetary policy in response to changes in economic conditions. The rule consists of a formula that relates the Fed's operating target for short-term interest rates to two factors: the deviation between actual and desired inflation rates and the deviation between real GDP growth and the desired GDP growth rates.”

Whilst normally it would use the Fed’s preferred inflation metric, the Core PCE, if you use the Core CPI print of 4.9% (perversely removing most of what we would consider daily expense items from the Headline CPI of 6.8%) the Taylor Rule would indicate the Fed interest rate should be 9.15% not 0.25%.... You can see from the chart below how they lost control since the GFC when QE and zero interest rates were the new norm to ‘fix things’….

Can we just reiterate the sentiment of Crescat’s Otavio Costa tweet above…

“None of us own enough tangible assets”

There is quite simply nothing as tangible, hard or without counterparty risk as gold and silver. Period. Nearly everything else is a paper promise inflated by this monetary madness.

Nothing goes on forever.