0.25% rates and QE for Australia Next Year

News

|

Posted 28/11/2019

|

19293

As we wrote of the prospects of QE yesterday and previewed last week here, our Reserve Bank Governor, Philip Lowe gave his anticipated speech on our central bank joining the global trend of ‘unconventional monetary policy’ – aka QE - aka central bank money printing.

Lowe predictably played down the prospects and effectively ruled it out before we get to 0.25% rates (from our current record low of 0.75%). He cited many reasons why near zero rates and QE should be avoided but focussed on five:

- Employing QE could create an “inaction bias” and take the pressure off Morrison to step up with fiscal policy.

- It could “damage bank profitability” and curtail their propensity to lend

- Support ‘zombie’ firms (that a normal recession would flush out) and reduce economic productivity

- Destabilise our financial system by inflating asset prices despite the moribund economy (‘horse bolted’ meet property market….)

- The risk of the RBA buying up cheap government bonds being perceived as “money-financed government spending” and negative ratings agency implications.

Somewhat tellingly the Aussie market rallied as potentially more are learning that the opposite of what a central bank says is what normally plays out and money (well, currency, not real money like gold) is about to get even cheaper. This was supported by one of the country’s most respected economists, Westpac’s chief economist Bill Evans revising Westpac’s forecast to have 2 more rates cuts next year to take us to 0.25% by June and QE to follow in the second half of 2020.

On the cut he said:

“In identifying the likely timing of the second cut we need to make a number of points:

• The Governor has indicated considerable reluctance to adopt Quantitative Easing. Consequently the RBA will be attracted to convincing the market that it has a strong commitment to ease policy, to keep downward pressure on the AUD, without actually implementing its last cut too soon.

• It is also likely to be attracted to holding back its final cut until after it gets an indication around the structure of the Federal Budget.

• Our forecast is that the unemployment rate is likely to reach 5.6% by March 2020 and hold around that level through 2020. Consequently, the case for further stimulus following the February cut will be strong throughout 2020 with no apparent progress in bringing the unemployment rate back towards full employment.

Taking these issues into account we expect that a cut in June to 0.25% would be the most prudent approach.”

On QE:

“Taken at face value, it would appear that the hurdle for Quantitative Easing is high with a further deterioration in the unemployment rate and, potentially, the inflation rate required.

However we expect that with the unemployment rate “stuck” at around 5.6%; the US Federal Reserve easing rates (we expect three FOMC rate cuts in 2020) and no further interest rate flexibility available, Quantitative Easing will surely become an attractive option.

Note that the Governor did observe that “there are, however, circumstances where QE could help… QE does put additional downward pressure on both interest rates and the exchange rate”. However, as discussed, he did put a fairly tough pre condition for using QE, “if we were moving away from, rather than towards, our goals for both employment and inflation.”

Moving too slowly towards QE runs the risk of an unwelcome rise in AUD.

If we look forward to the second half of 2020, with no interest rate flexibility available, and the RBA still holding, at best, its current inflation and unemployment forecasts – 1.9% trimmed mean inflation in 2021 (outside 2–3% target zone); 2.3% wage inflation in 2021 (totally inconsistent with the inflation target); and 4.9% unemployment rate (well above the 4–4.5% full employment target); it seems a reasonable prospect that the QE option will become quite attractive.

Note that we qualify the comment “at best” given our own comparable forecasts of 1.7%; 2.3% and 5.3% respectively.”

That saw bonds rally in anticipation and the AUD soften.

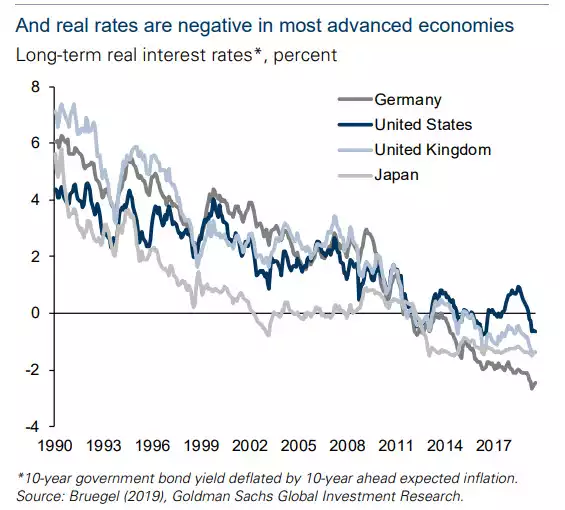

Those figures also highlight the extent to which we will find ourselves in negative real rates (cash rate less inflation rate). As you can see this has become the global norm:

The AFR had a very firm and supportive view as well:

“No end of funny money policy can drive longer-term economic growth and prosperity. The Financial Review argues against blowing the first budget surplus in more than a decade just to give a kick-start to an economy that is subpar, rather than in crisis. This, too, would be counterproductive by undermining business and household confidence that the political system can manage the nation’s finances without resort to higher taxes.

That leaves an agenda of structural policy reforms to help the Australian economy compete its way to prosperity. Yet political leadership now mostly amounts to reacting to scandals and crises - from so-called “wage theft” and Westpac’s money-laundering breaches to droughts and fires - with promises of more regulation or more spending.

Unless the Morrison government finds purpose in driving a genuine prosperity agenda, the financial market economists may end up being right in betting that Australia is drifting into a world of counterproductive funny money that would undermine the nation’s prosperity framework of the past generation.”

The implications of all this for gold are very clear. Gold historically loves negative real rates and a very clear and overt agenda of lowering the AUD also adds wind to the sails of AUD priced gold.