“Must Read” Chinese Crisis Warning

News

|

Posted 25/09/2019

|

10240

Australia’s economic ‘elephant in the room’ is the faltering Chinese economy and our utter reliance on their consumption of our commodities and services. Crescat recently has this to say about China and every Australian should read it and take serious heed:

“The Chinese economy is at the outset of a debt and currency crisis. No other country has grown debt so aggressively for so long and in such an extreme manner. China built an oversized banking system that now undergoes a rising nonperforming loan problem, a precarious housing bubble, and a political leadership that remarkably resembles a crony-kleptocracy. China’s declining current account problem imperils its entire mercantilist approach, while its push towards a consumer-driven growth model never seemed so far-fetched. Rising social unrest, trade tensions, and food inflation are just icing on the cake for these macro inconsistencies.

The yuan just had its worst month since 1994, even bigger than the 2015 devaluation. We expect much further currency dilution as the PBOC continues to mobilize aid for its failing banking system. We are at the early stages of all these issues. Just this year, the Chinese government was forced to engineer three bailouts: Baoshang Bank, Bank of Jinzhou, and Hengfeng Bank. In aggregate these banks hold close to $420 billion in total assets. Although accounting for a small portion of China’s $42 trillion colossus on-balance-sheet banking system, it’s a sign that the economy is under severe pressure. We expect much larger loan losses to soon surface. According to Bloomberg, China’s central bank recently concluded its first review into industry risk and 420 firms, all rural financial institutions, were considered “extremely risky” and just two received a top rating. China’s debt levels are overwhelming, and a significant currency devaluation is likely on the way.

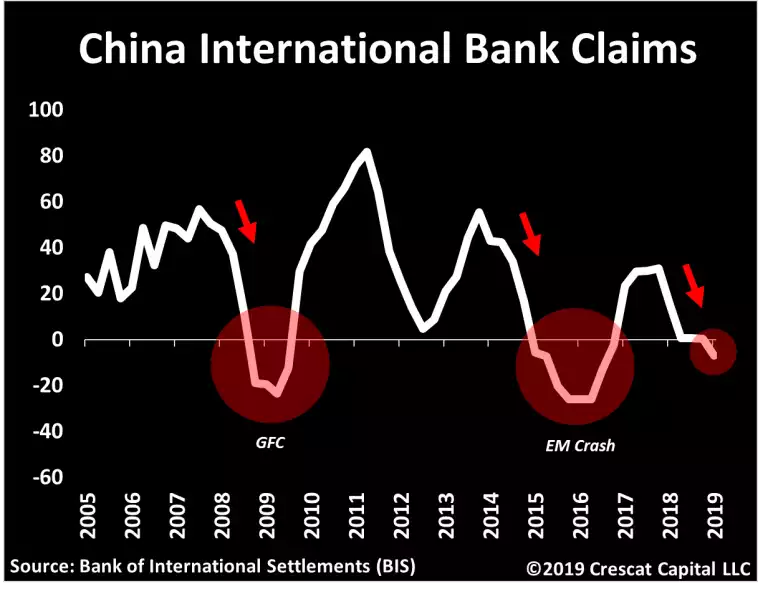

Per the Bank of International Settlements (BIS), China’s total international bank claims have just contracted for the first time in three years reflecting an early warning sign of financial stress. These claims, valued at $920 billion, comprise cross-border transactions in any currency plus local claims of foreign affiliates denominated in non-local currencies. Chinese banking activity similarly faltered during the emerging market crisis in 2015 and the global financial crisis.”

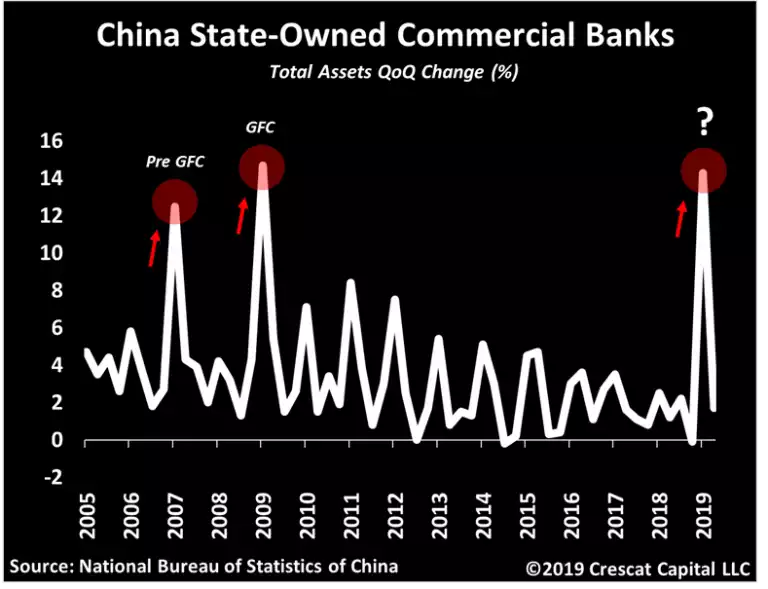

“In our previous letters we noted that the median Chinese stock had fallen close to 40% during the 4th quarter of 2018. Since then, the PBOC has attempted to revive its economy through aggressive monetary policies that continue to put downward pressure on its currency to depreciate against the dollar. The Chinese central bank targeted specific forms of liquidity injection, one of them being through its state-owned commercial banks. Their quarterly rate of change in total assets just surged as much as it did times prior to and during the global financial crisis.”

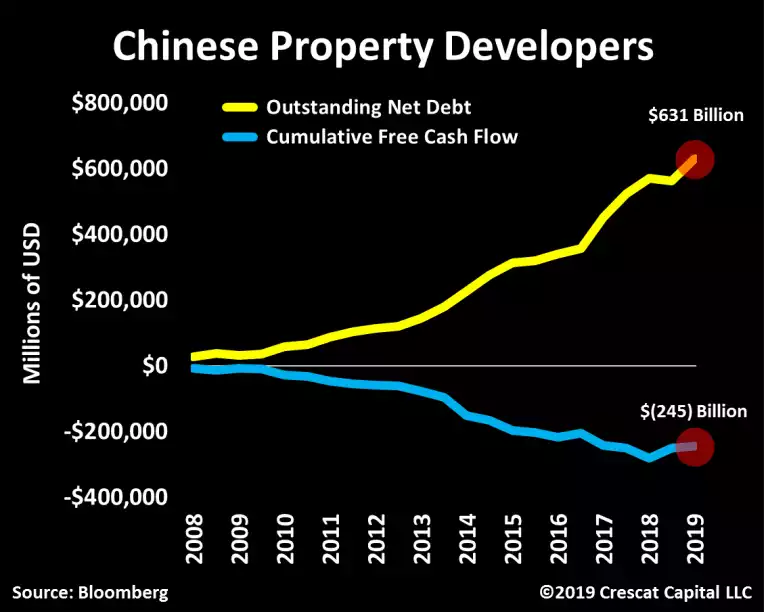

“Large sums of investment into non-productive assets, that’s China’s real estate conundrum. Across publicly traded companies, the industry of Chinese property developers and homebuilders is now worth over $1.25 trillion in enterprise value. In contrast however, these businesses only generated about $1.5 billion of free cash flow in the last 12 months, in aggregated terms. Also, close to 55% of Chinese property developers aren’t even profitable on a free cash flow basis, according to their latest report. These companies have now accumulated close to $631 billion in outstanding net debt while total equity value accounts for $585 billion – or equivalent to 108% net debt-to-equity ratio. To put into perspective, that’s the exact same proportion US homebuilders had right at the peak of the housing bubble.

Since 2008, Chinese property developers have accumulated close to $245 billion in free cash flow losses while debt levels continue reaching record levels!”

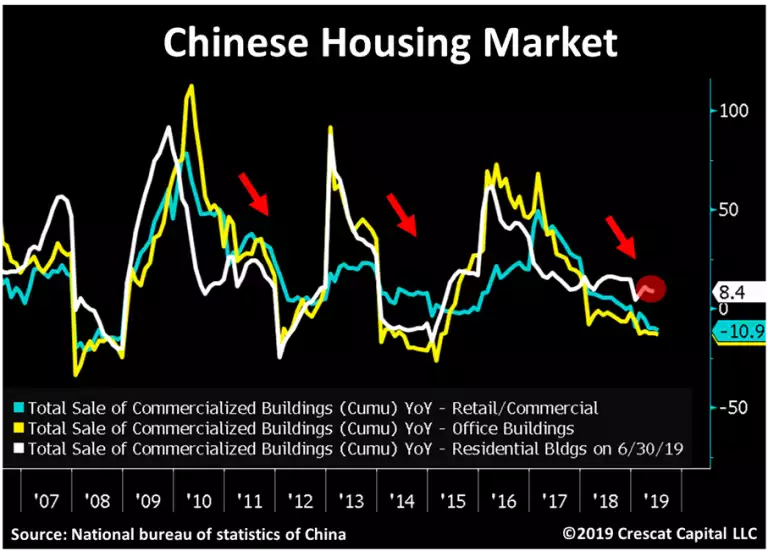

“China’s sales of commercialized retail and office buildings are down 13 and 10% for the month of June. Its residential market continues to rise, but historically it tends to follow these other two markets closely. It’s important to note that office buildings are now falling the most since the global financial crisis.”

Coincidentally, news.com.au ran this article over the weekend with the key takeaways:

“Everyone knows Australia depends on China’s economy, and everyone knows China is under siege right now. The burning question is this: Just how bad have things become?

New data out of China has given us a startling glimpse of how much its economy is suffering. Growth in industrial production fell to its lowest in 17 years in August — still growing, at 4.4 per cent — but much more slowly than the pace China has become accustomed to.

China’s economy is extremely dependent on factories, so when industrial production growth falls that matters a lot. You can already see the impact on Chinese households.

Growth in retail sales fell too, down to 7.5 per cent in August. That number might not sound high to Australian ears, but in a country that depends on persistent high economic growth for stability and is used to retail sales growth over 10 per cent, it represents a veritable slump.”

And:

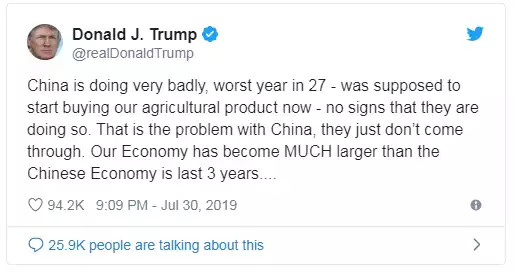

“Mr Trump has been boasting about China’s economic slowdown on Twitter, calling it their “worst year in 27.”

Their worst year in 27 has also been with an ordinary year for Australia, economically.

Our string of years without a recession is, you will recall, 28.

It is no coincidence that our unbroken streak of economic growth coincides with China’s long surge from poverty to strength.

Trump’s enthusiasm for China’s economic malaise might be fuel to the fire for his fans but it should send a chill through Australians.”