World’s Worst Debt Pile Just Got Downgraded

News

|

Posted 25/05/2017

|

8070

The front page of today’s AFR says “China angry at Moody’s Downgrade” and well they might as the world’s worst debt pile just got more expensive to service.

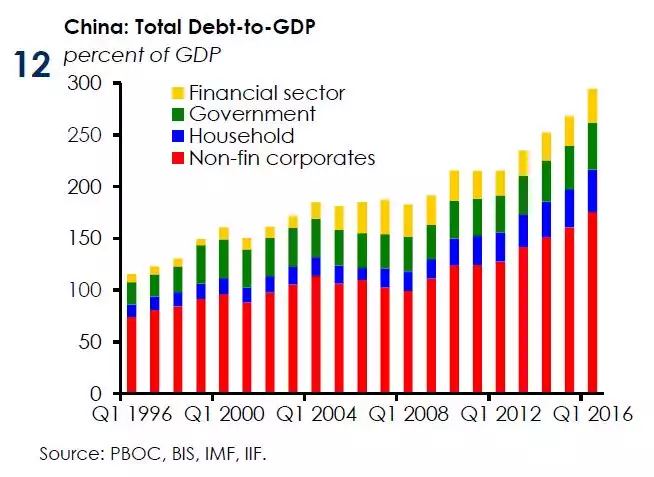

Forecasting the 2016 year end Debt:GDP ratio of 256% to worsen, Moody’s, one of the world’s pre-eminent ratings agencies, “delivered a scathing assessment of Beijing's economic policy making and downgraded the country's debt for the first time in 26 years.”

The IIF recently established that Debt:GDP is now 300% per the following:

China’s challenges were succinctly summarised by one analyst in the AFR article - "The downgrade is yet another sign of the challenges faced by China, which is juggling rising leverage issues, declining economic growth rates and ongoing structural reforms,"

Regular readers won’t be too surprised as over the last month we have reported on the warning signals 4 times (here, here, here and here).

However if you cast your mind way back to September last year we published the article “China Banking Crisis Near” which talked to the historically critical ‘credit to GDP gap’ being at record highs. That article talked of a study by Hyman Minsky from whom the famous “Minsky Moment” phrase was based. A Minsky Moment is defined by Investopedia as “When a market fails or falls into crisis after an extended period of market speculation or unsustainable growth. A Minsky moment is based on the idea that periods of speculation, if they last long enough, will eventually lead to crises; the longer speculation occurs the worse the crisis will be. This crisis is named after Hyman Minsky, an economist and professor famous for arguing the inherent instability of markets, especially bull markets. He felt that long bull markets only ended in large collapses.”

The graph below illustrates the usual lead up to such a ‘moment’ and to which UBS recently said China’s rate of credit growth compared to GDP growth (hence that increasing ratio) puts it in the Ponzi phase of the cycle and fast approaching it’s Minsky Moment. A credit downgrade makes all that debt even more expensive to service and accelerates the process. Arguably too, the credit contraction outlined in some of our articles linked above show we could well be in the early phase of the Minsky Moment right now…

As a contextual reminder, we are talking about the world’s second biggest economy here…