World Platinum Investment Council Quarterly – More supply deficit

News

|

Posted 14/05/2024

|

2007

The World Platinum Investment Council have just released their Q1 2024 quarterly report and it is nothing short of staggering for the ‘forgotten’ precious metal. Continued supply deficit and sustained demand paint an enticing picture for the platinum price going forward. We summarise the full report.

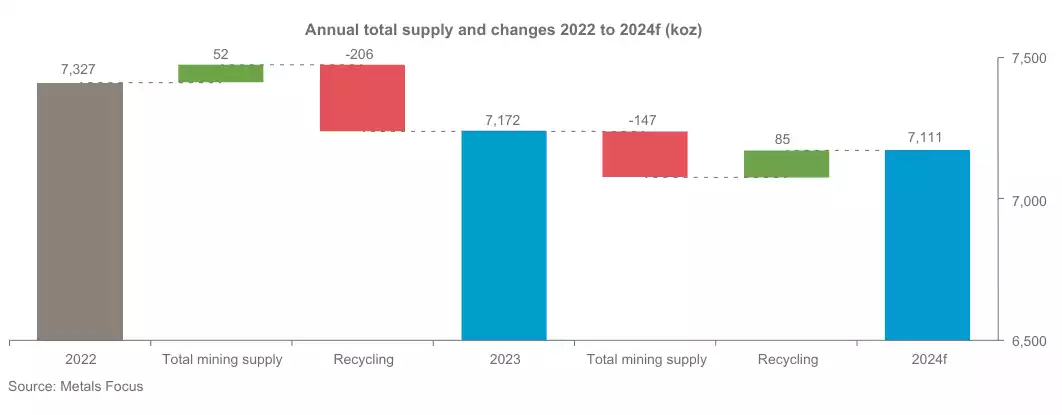

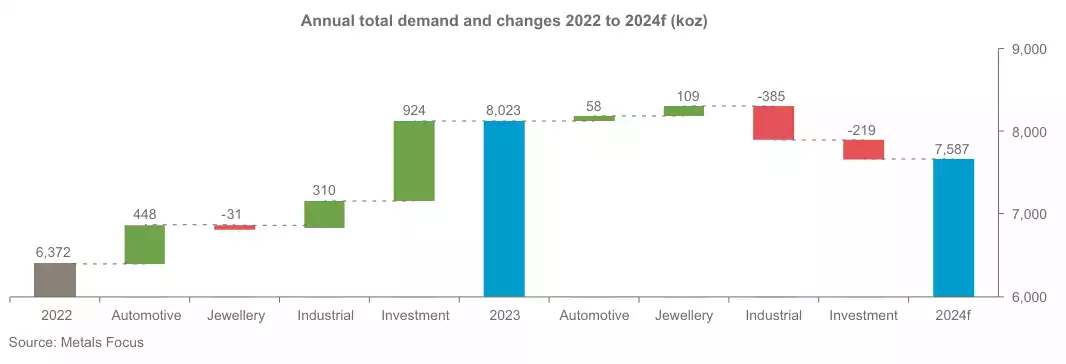

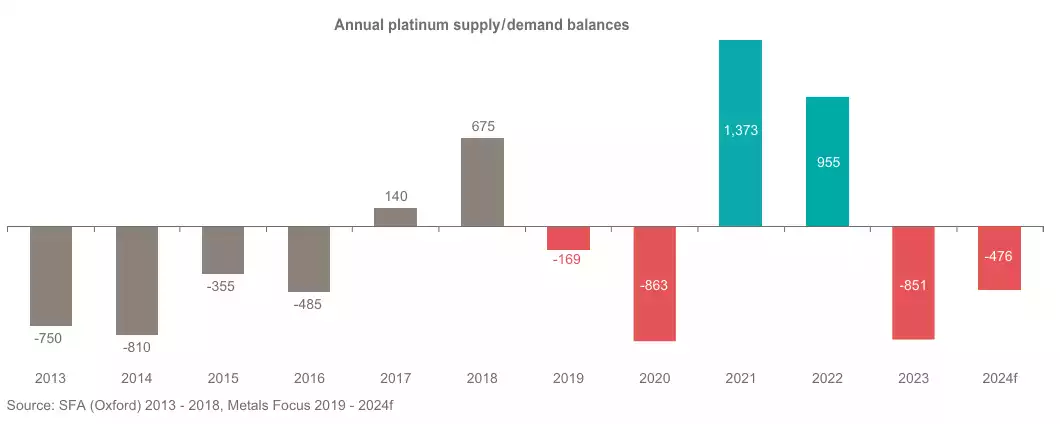

The platinum market enters its second year of substantial deficit. In the first quarter of 2024, the platinum market recorded a deficit of 369 koz, while for the full year a 476 koz deficit is forecast, which follows an 851 koz deficit in 2023.

Platinum Supply

Supply risks remain a prominent theme in 2024. Continuing a multi-year trend, total mine supply is forecast to decrease by 3% year-on-year, underpinned by lower output from South Africa and Russia, where the vast majority comes from. Recycling supply in Q1 2024 was stable versus a year earlier, potentially indicating the first green shoots of the recovery forecast through 2024, although there are risks to the pace of the recovery.

Platinum Demand

Demand of 1,994 koz in Q1 2024 was resilient, albeit 6% lower compared to a year earlier. Lower demand was primarily underpinned by a 68% year-on-year decline (-134 koz) in investment demand as Japanese retail investment slowed and higher interest rates weighed on ETF demand. Elsewhere, industrial demand decreased by 7% year-on-year in Q1 2024 on weaker chemical demand, with fewer plant commissioning’s as China moves beyond a period of elevated capacity investment. On the positive side, automotive platinum demand increased by 3% and jewellery demand rose 5% year-on-year in the first quarter. Automotive demand benefitted from rising vehicle production of both light and heavy-duty vehicles, drivetrain hybridisation and some ongoing platinum for palladium substitution. Jewellery demand reported broad-based global growth, except for China where jewellery decreased by 10 koz.

Platinum Deficit

It becomes simple math that there continues to be more platinum used than produced, some 476,000 oz forecast after an already 369,000 oz deficit in Q1 alone.

Some highlights from this Platinum Quarterly data set that support platinum’s investment case: Total supply is continuing a multi-year downward trend, with 2024 expected to be the weakest year in their time series from 2013. Automotive demand is underpinned by a higher-for-longer ICE theme, with 2024 projected to be the strongest year for automotive demand for platinum since 2017. Jewellery demand, boosted by India and the Middle East is showing its first growth momentum since 2021. Industrial demand is down year-on-year as expected, but remains elevated versus historical levels, with stationary and other hydrogen demand a growing component (+128% year-on-year). The current projection for investment demand in 2024 is relatively muted (we test this assertion below), but within the data there is rapid growth in bar and coin demand in China. Collectively combined demand growth and weak supply results in a second consecutive deficit in 2024 of almost 500 koz, and current indications suggest that deficits will continue in 2025 and beyond.

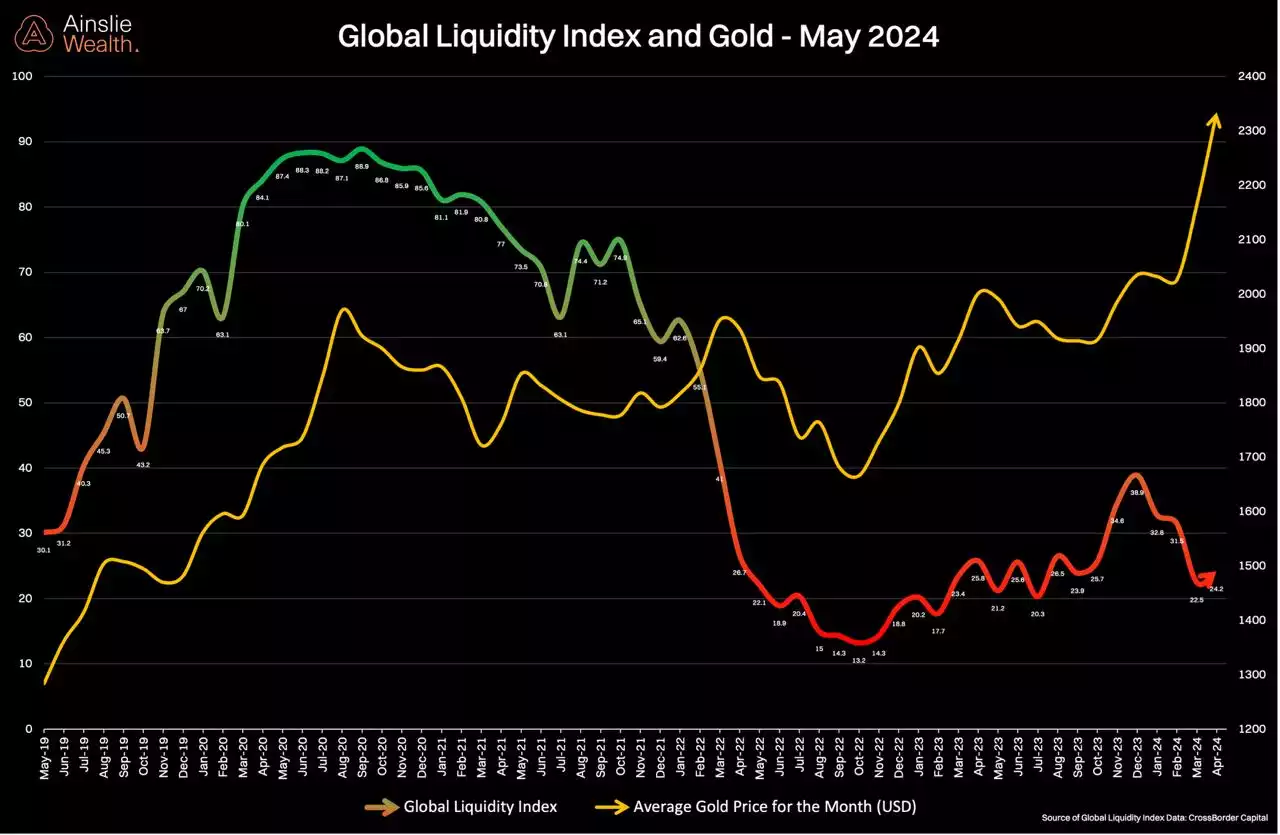

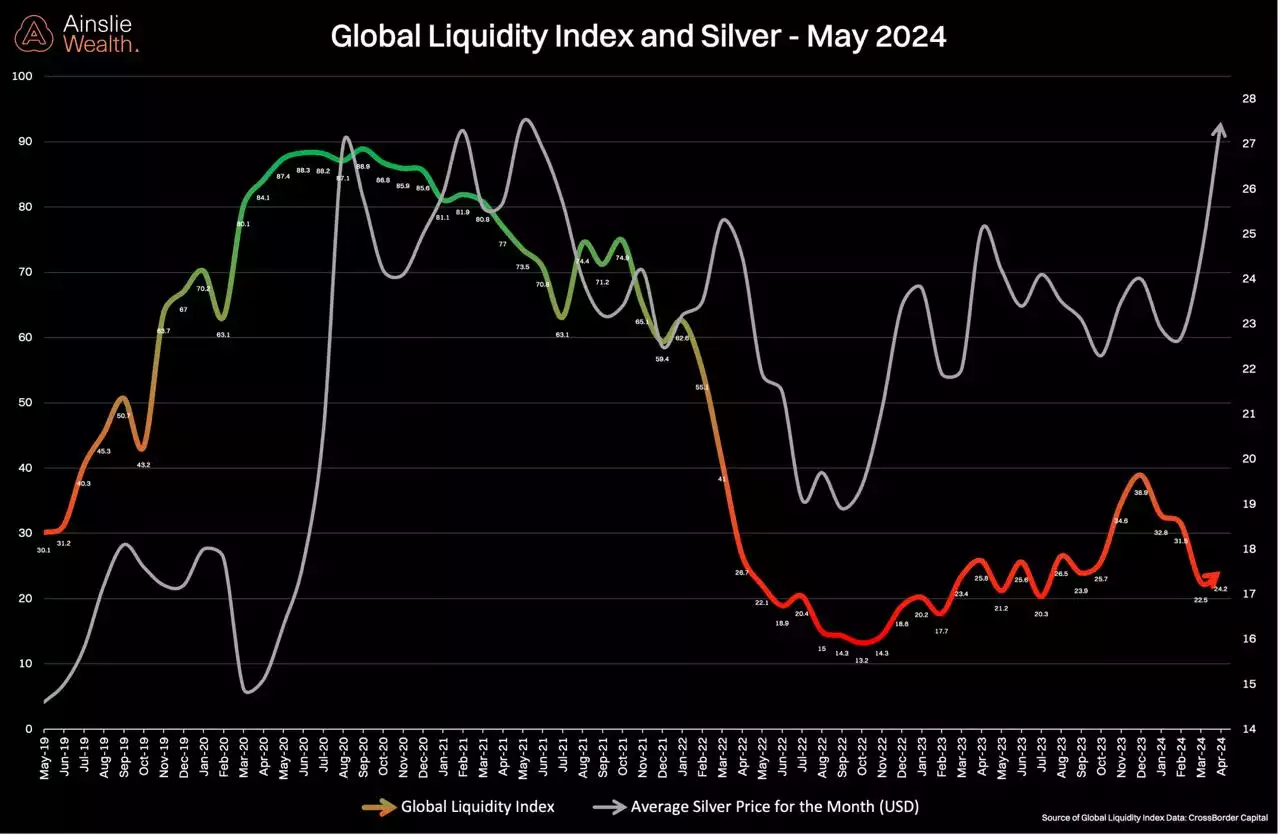

Platinum has frustrated some investors who bought in 2023 on these same fundamentals of supply/demand/price only to see the price effectively chop between roughly US$850-1100/oz and not revisit the US$1350 of early 2021 post that record 2020 deficit. You will note from the demand chart above they forecast a small drop in investment demand in 2024. This, we believe, falls into the same trap of the ‘high rates = low precious metals’ narrative that gold and silver have demonstrably ignored so far. To be fair too, the platinum price is up 15% since early this year and last night breached US$1000/oz. Smarter market participants are looking through that narrative and seeing the increasingly clear and only response to this debt burdened, stuttering growth, sticky but comparatively low inflation environment, and that is loosening monetary policy and fiscal stimulus coming soon to financial markets near you… Followers of our https://ainslie.to/research Macro & Global Liquidity analysis know this. Last night we received the very latest data on Global Liquidity and the U.S. Tax / TGA ‘air pocket’ of liquidity we have seen recently appears now in the past with an (albeit small) uptick in the liquidity index. The freshly updated charts below for gold and silver are instructive too for platinum. This could indicate that the precious metals are poised to take off again. A contrarian play could be to buy the one that has lagged the rest so far, particularly when faced with a supply deficit like this….