World Gold Holdings Reach Record High: International Shift to Reliability

News

|

Posted 02/10/2023

|

2792

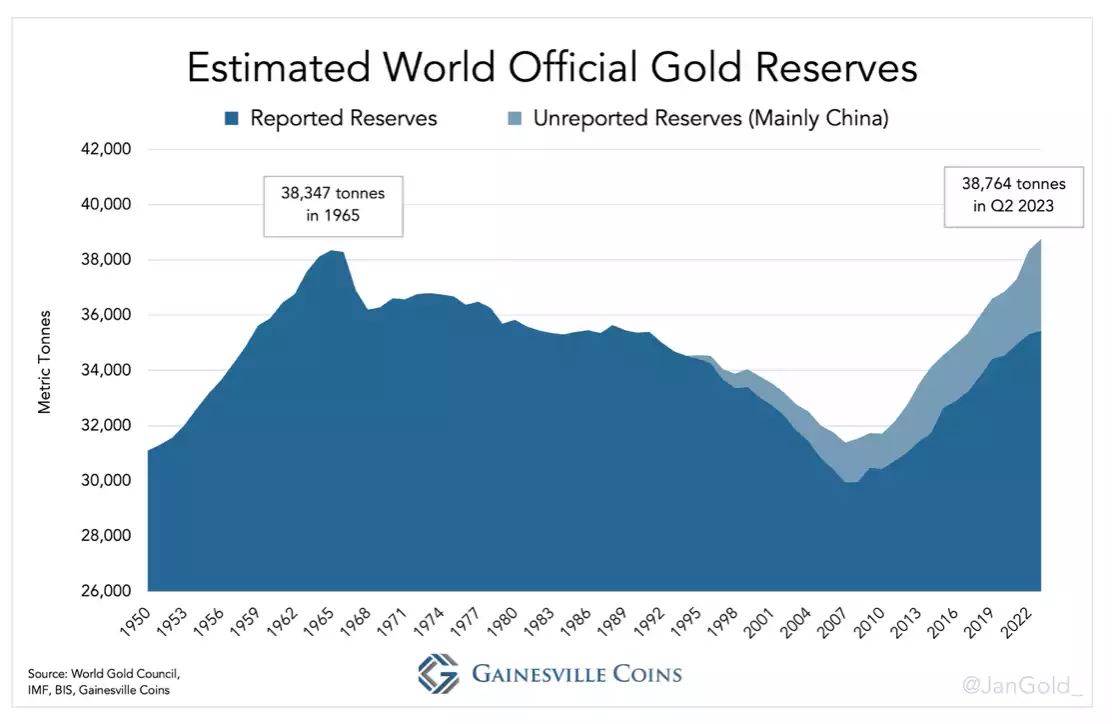

In the turbulent first half of 2023, a significant shift underscored global economic sentiment as world gold reserves peaked at an unprecedented 38,764 tonnes, shattering the 1965 record. This surge signals an intentional move by nations to shield their economies amid global financial uncertainties, contributing to an ongoing march away from the once domineering US dollar.

This economic transition has been closely tracked by some experts, with a keen focus on understanding the unreported excess, particularly emanating from Chinese reserves. The officially reported 2,113 tonnes held by China's central bank (PBoC) contrasts sharply with the industry whispers, suggesting holdings near a staggering 5,000 tonnes. This shadow inventory unveils a deliberate strategic move towards gold accumulation, further reinforcing the significance of this precious metal in the prevailing economic climate.

Examining International Monetary Fund (IMF) calculations delivers some intriguing insights around 4 key areas that are regularly overlooked.

- Base Evaluation: Incorporates the latest registered volumes from global central banks, including those whose reporting ceased years ago.

- Unreported Acquisitions: Unveiling the unreported purchases, contributing to the expanded gold reserves.

- Sovereign Wealth Funds: Incorporation of known reserves held by sovereign wealth funds.

- International Financial Institutions: Accounting for gold owned by international bodies such as the European Central Bank.

The comprehensive evaluation, incorporating these overlooked dimensions, confirms the unprecedented spike to 38,764 tonnes in world gold holdings in June 2023.

The seismic shift towards gold post the 2008 Great Financial Crisis has seen central banks worldwide augment their reserves by over 7,000 tonnes. This movement not only underscores a diversification strategy but also highlights the escalating concerns regarding the US dollar's continuing reliability as the global reserve currency.

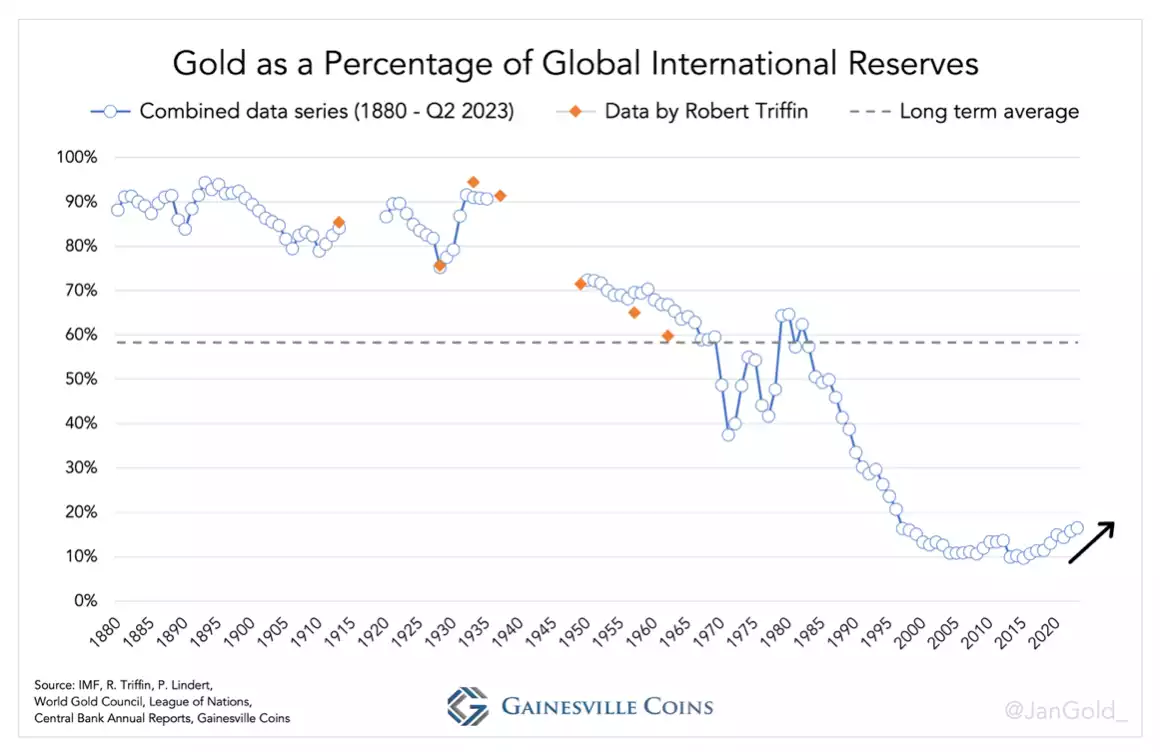

The accelerated value growth of global gold reserves, up by 66% compared to the more modest 30% increment in foreign exchange reserves, clearly shows the mounting confidence in gold. The flow on impact could see the price of gold soar, potentially touching the $8,000 mark in the coming decade, as projected by several analysts.

Amidst escalating geopolitical tensions, the weaponised dollar, and surging global debt levels, gold's lustre shines brighter as a stabilising force. The perpetual gold accumulation trend by central banks is poised to continue, underscoring the growing emphasis on economic safeguarding against uncertainties and potential future fiscal upheavals.

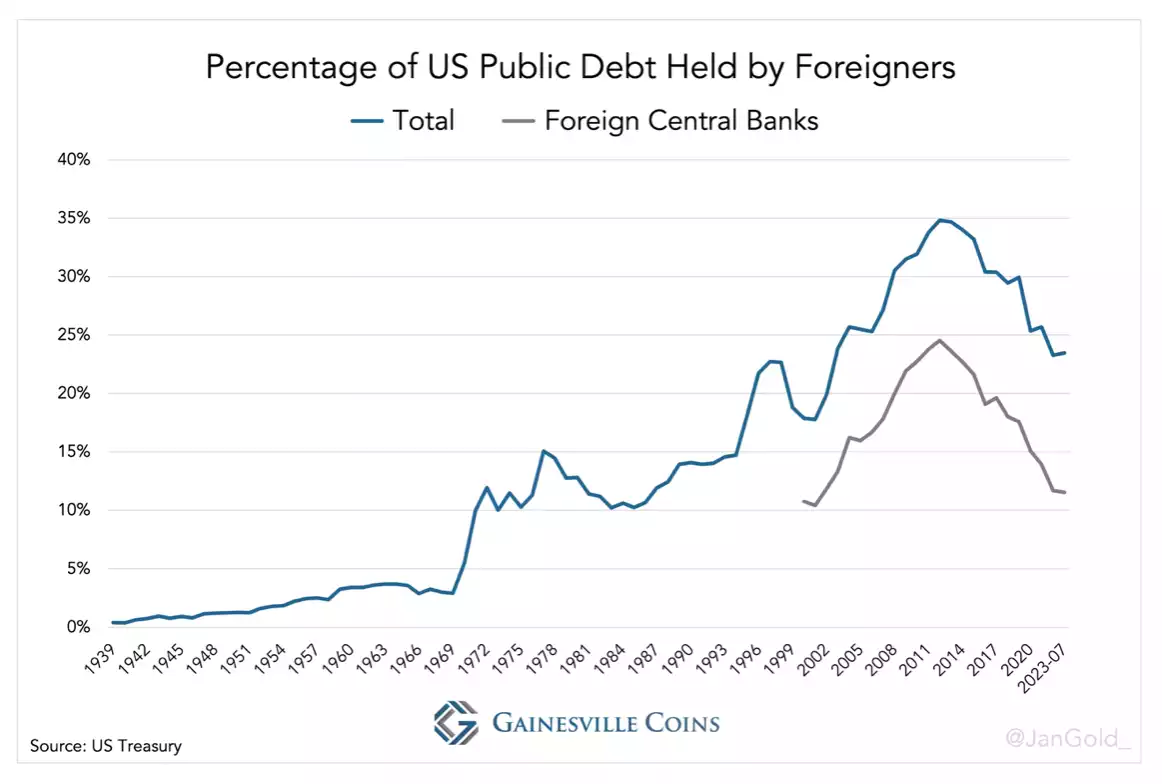

Beyond the symbolic milestone, the record gold reserves signify an emerging economic recalibration. The stagnant nominal holdings of US government bonds (Treasuries) by foreign central banks against the backdrop of the relentless surge in US public debt underscores a declining global confidence in the US fiscal framework. This evolving dynamic highlights the potential for a looming funding crisis in the US, further eroding the dollar's global standing as a reserve currency.

Given the ongoing increasing nature of economic uncertainties that we have been reporting and discussing on Insight lately, gold continues to have a place in the conversation as a beacon of stability and assurance. The unfolding trends, combined with the symbolic milestone of these new all time highs in global holdings, show that the growing global commitment to enhancing gold reserves can’t be ignored or dismissed. Gold will continue to play an important role in the international monetary ecosystem, and individuals have an opportunity to participate in that by simply holding some physical metal, or some digital AUS tokens backed by the physical metal, as a part of their personal portfolio.