World Gold Council Gold Demand Trends Q3 2023

News

|

Posted 06/11/2023

|

4069

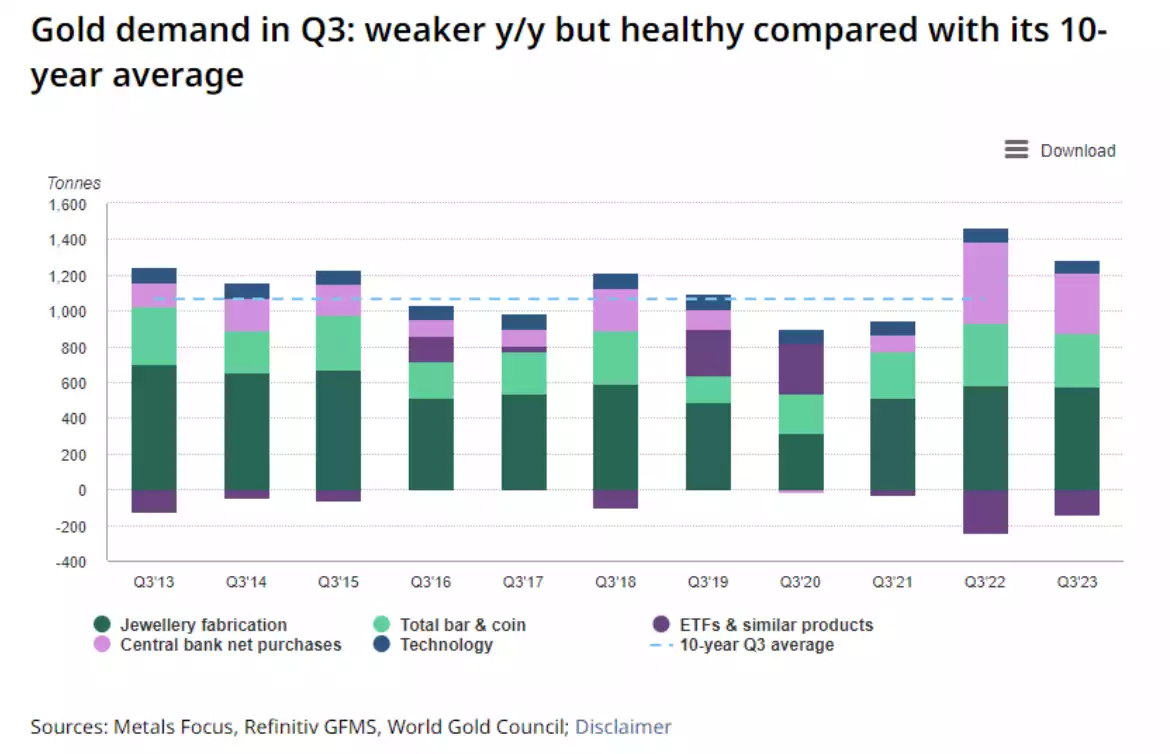

Another quarter has flown by so lets get the quarterly snapshot from WGC as we do each quarter. In short, central banks gold buying maintained a historic pace but fell short of the Q3’22 record. Jewellery demand softened slightly in the face of high gold prices, while the investment picture was mixed being strongly up year on year but ETF’s dragging down below 5 year average. Overall gold demand (excluding OTC - over the counter) in Q3 was 8% ahead of its five-year average, but 6% weaker y/y at 1,147t. Inclusive of OTC and stock flows, total demand was up 6% y/y at 1,267t.

Let’s break it down:

Central Banks

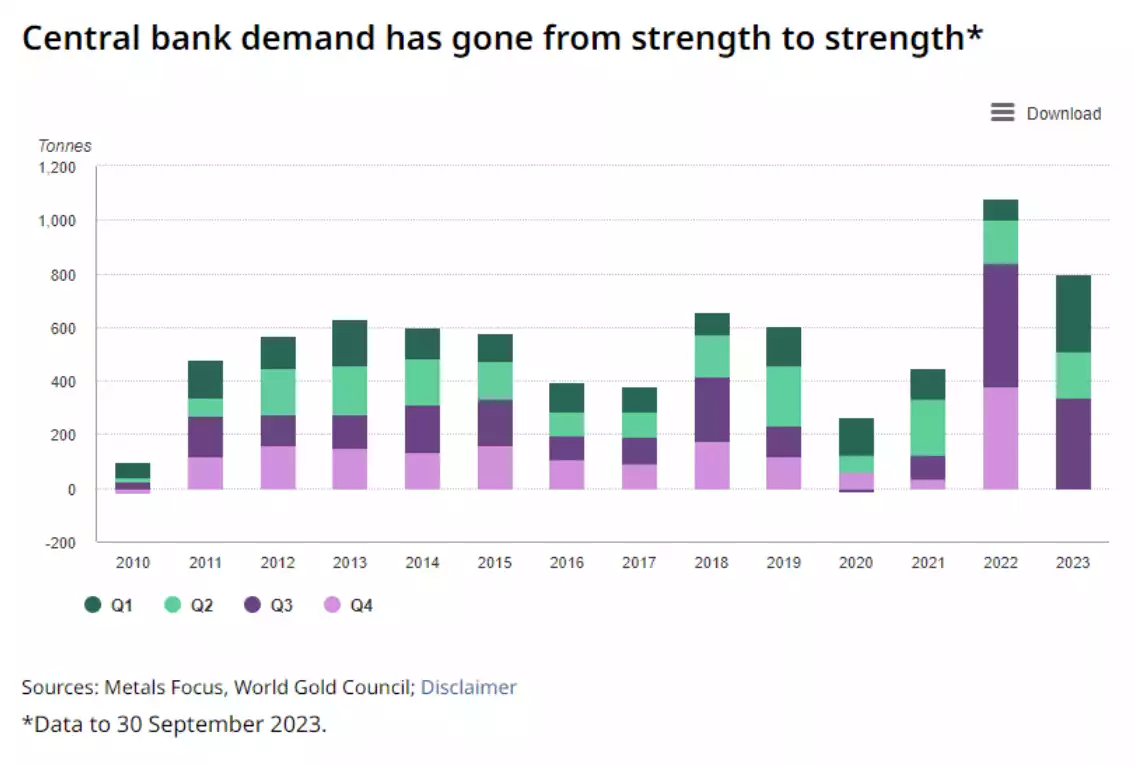

Robust central bank demand in Q3; hits year-to-date record

- Central banks collectively bought 337t in Q3, the second highest third quarter on record

- Added to the record-breaking H1 total, y-t-d net purchases now stand at 800t

- Looking ahead, central bank demand is on course for another strong annual total.

Central bank demand for gold saw no let-up in Q3, building on the record-breaking first half of the year. Global official gold reserves rose by 337t, 120% higher q/q and the second highest third quarter total following Q3 2022. On a y-t-d basis, central banks have bought an astonishing net 800t, 14% higher than the same period last year.

As we reported last week the People’s Bank of China (PBoC) regained the title of the largest buyer globally, increasing its gold reserves by 78t during the quarter. Since the start of the year, the PBoC has increased its gold holdings by 181t, to 2,192t (equivalent to 4% of total reserves).

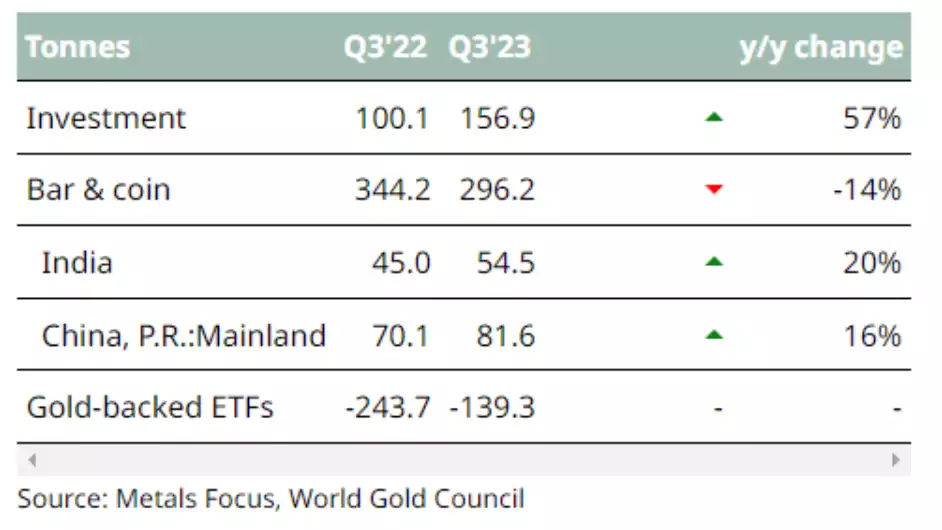

Investment

Investment demand in Q3 was 157t – a significant improvement on the paltry Q3 2022 but weak in comparison with longer-term average levels.

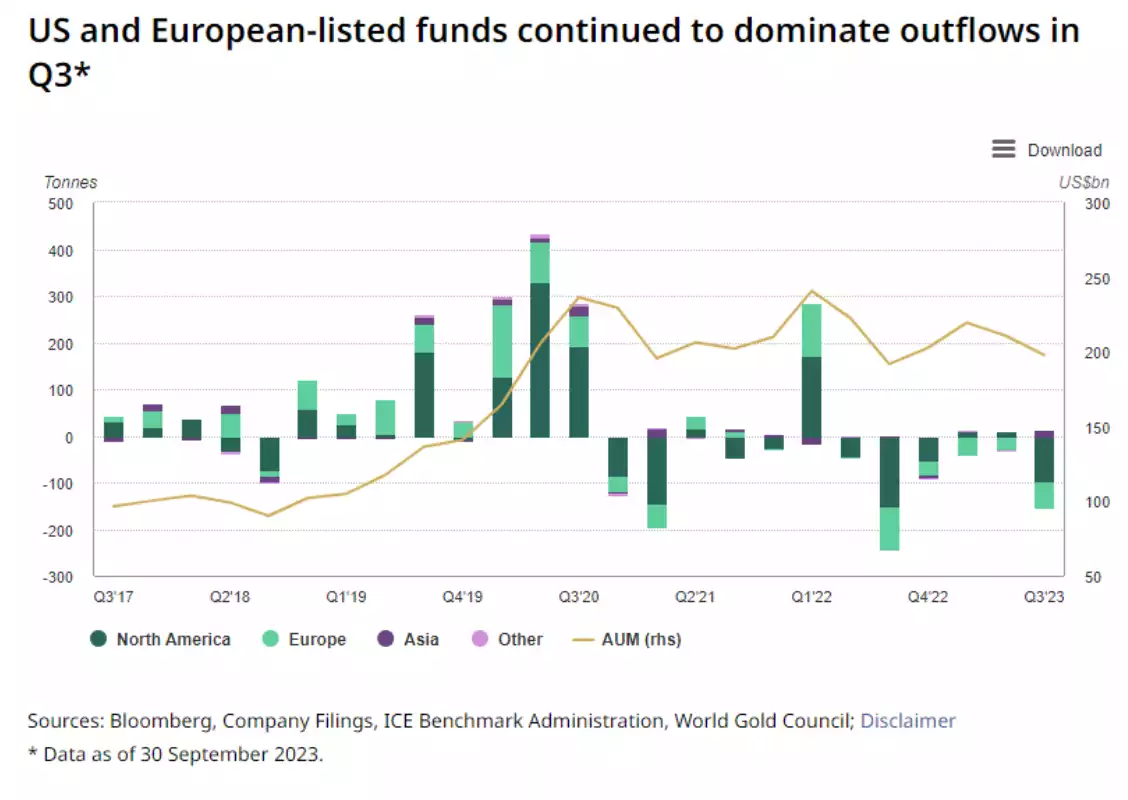

- Global gold ETFs sustained a sixth consecutive quarter of outflows in Q3; holdings fell by 139t (-US$8bn), although this was at least an improvement on the hefty 244t outflows of Q3’22

- Total bar and coin investment in Q3 was down 14% y/y at 296t, weighed down by European weakness; but Q1-Q3 demand from this segment is in step with that of 2022, which was the strongest year for almost a decade

- On a y-t-d basis total investment demand is 21% lower at 687t, almost exclusively driven by the prolonged period of ETF outflows, which have centred on funds listed in Western markets.

Q3 saw continued outflows from gold ETFs (-139t; -US$8bn), particularly in the US and Europe, as investors increasingly took the view that major central banks – notably the US Fed – will keep rates ‘higher for longer’ without thinking about the consequences of that course of action.

Jewellery

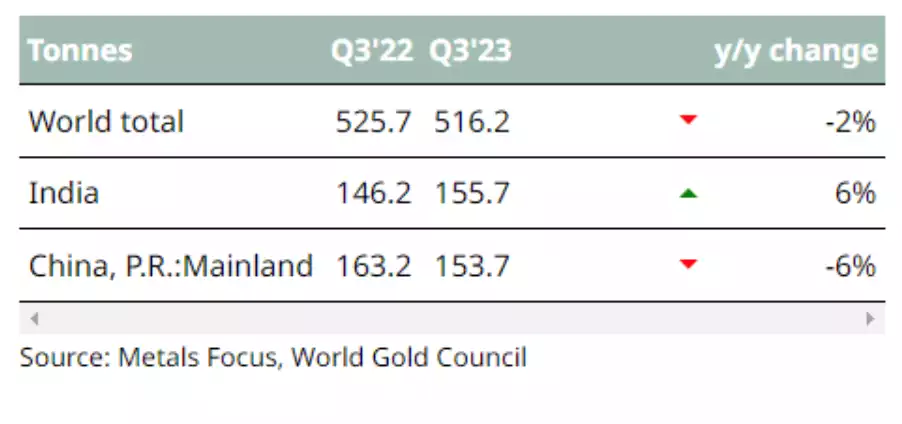

Jewellery demand softens slightly in Q3; holds steady y-t-d

- Jewellery consumption in Q3 was slightly weaker y/y (-2%), although it held 4% above its five-year average

- The environment of high gold prices and economic uncertainty was a key driver of the y/y decline, particularly in some of the more price-sensitive markets in Asia and the Middle East

- Y-t-d jewellery consumption is virtually flat on the same period of 2022, at 1,467t (vs 1,462t).

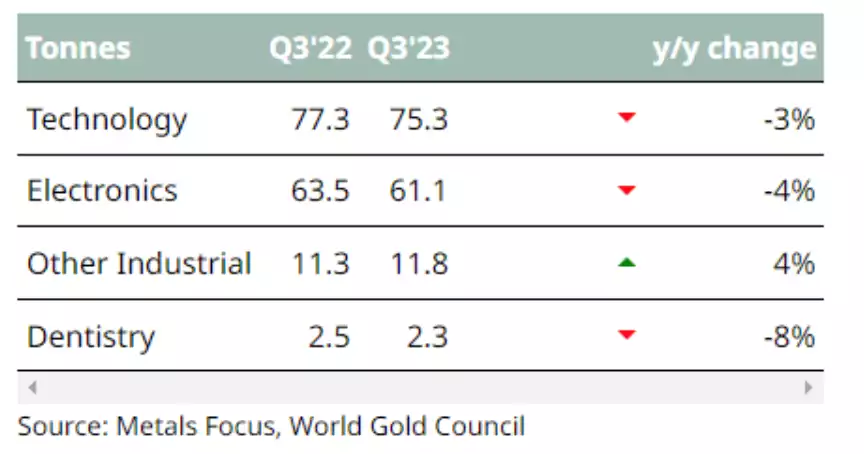

Technology

Q3 saw some recovery from the weak first half, but demand remained restrained compared with previous years

- Gold used in technology during Q3 fell by 3% y/y to 75t

- The electronics sector, which dominates technology demand, fell by 4% y/y to 61t

- Other industrial applications recorded a 4% y/y increase to 11.8t.

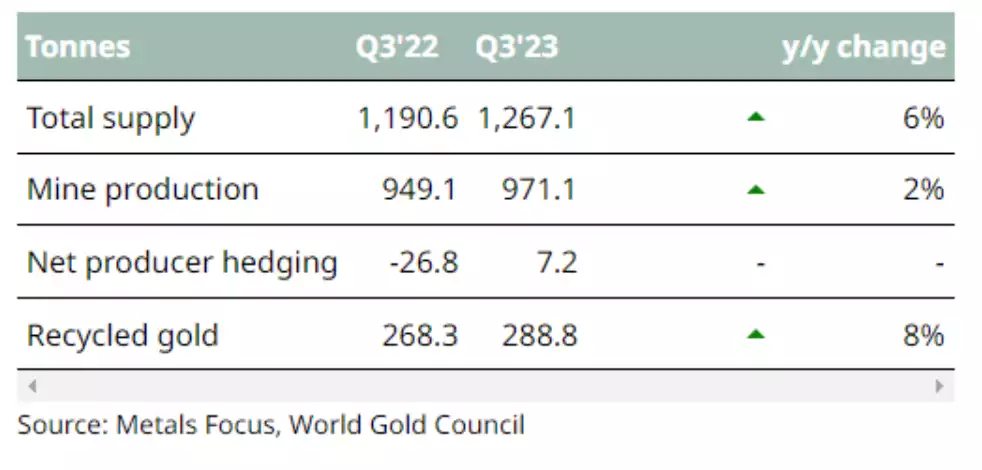

Supply

Total Q3 gold supply rose 6% y/y; mine production reached a quarterly record

- Total gold supply increased by 6% y/y in Q3, driven by growth in mine production and recycling

- Mine production hit a record 971t in Q3; recycled gold rose y/y to 289t

- Higher mine production and recycling contributed to a y-t-d total supply of 3,692t.

The following gives the overall summary of the last quarter and where it sits historically.