World Bullion Shortage See Premiums Spike

News

|

Posted 29/04/2020

|

35429

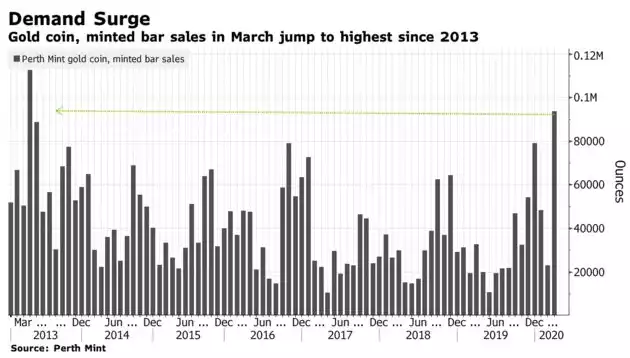

These last few months have seen demand for metal at levels not seen before. Some of the biggest bullion dealers in Australia have struggled to maintain supply of gold and backorders for silver the norm, for some out as long as July delivery. Premiums have risen as refiners pay more for the raw metal and freight costs spike on reduced freight avenues. Perth Mint has long since stopped taking orders for any minted gold, gold coins (except 1oz Kangaroos), minted silver, any cast silver bar excepting 1kg, and any silver coins allowing them to concentrate on core products of cast gold bars, cast silver kilos and working in the background through a massive 1oz Kangaroo coin backlog.

Last week we shared the Silver Institute survey which showed Perth Mint sold 12.7m silver coins last year ranking them 3rd after Maples and American Silver Eagles.

We also reported recently on the big gold supply issue affecting COMEX and LBMA (here and here). We always maintain a large number of kilo Perth Mint gold bars but of late the supply has slowed. That mystery was solved on Friday when Bloomberg reported:

“Australia’s largest gold refinery has ramped up production of one kilogram bars to ease the supply squeeze in the U.S. that helped propel a surge in the premium for New York futures.

The collapse in air travel that’s grounded passenger jets -- frequently used to transport gold products -- and virus-related disruptions to some refining capacity has tightened availability of the rectangular bars, typically used to settle the Comex futures contracts.

“We’re producing as many kilobars as we can, we’re probably churning out seven and a half tons of them a week at the moment and we are forward sold well into May,” Richard Hayes, chief executive officer of the Perth Mint, said in an interview. “A very large portion of those kilobars are ending up as Comex deliveries.”

In a chaotic couple of days in late March, the premium for New York futures over the London spot price rose above $70 -- the highest in four decades. The spread has narrowed to about $21, yet that still compares with just a few dollars in normal times.”

In terms of retail demand, that too is incredibly high:

“For every coin we make, be it gold or silver, we could probably sell five or six of them,” he said. “That strong demand will be a little longer-lasting, I expect, as people have been quite badly frightened by this whole Covid disaster.”

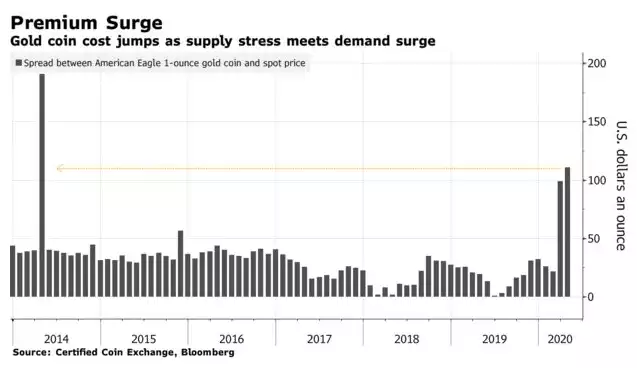

Of course this is not limited to Australia and indeed premiums have spiked far greater overseas than here. Over the weekend Bloomberg also reported with the headline “Gold Buyers Are Forking Over Lofty $135 Premiums for U.S. Coins”:

“Retail investors can’t seem to get enough of gold during the coronavirus crisis, and they are willing to pay staggering amounts to get their hands on it.

Consumers who want to buy gold coins typically have to pay more than the per-ounce prices quoted on financial markets in London and New York. That premium has jumped to $135, more than tripling from two months ago, said Robert Higgins, chief executive officer at Argent Asset Group LLC in Wilmington, Delaware.

“There has never been a time for American Gold Eagles at this premium level,” Higgins said in an interview, referring to the popular U.S. bullion coin.

The surge is being exacerbated by coronavirus-related lockdowns, which have led to a squeeze in the supply of coins and bars available for shipment around the globe. At the same time, bullion’s status as a haven is luring investors rattled by worldwide market and economic turmoil.

“Until the world catches up with the imbalance and gets back to a normal balance of supply and demand, the premiums will stay,” Higgins said.

Higgins, a 40-year industry veteran, operates a wholesale business that typically deals with an average of 1 million to 1.5 million ounces of gold each month. That jumped to more than 6.5 million ounces in March as premiums surged, he said.”

Indeed premiums haven’t spike liked this since the Crimean Russian Conflict in 2014.

The same as been the case with silver coins with Bloomberg quoting premiums of 50% over spot and stocks selling out everywhere as both the Royal Canadian Mint and US Mint halting production due to lock downs at the same time as demand surges. Perth Mint haven’t taken new wholesale orders for silver Kangaroos for some weeks now as they work through their backlog.

As an update for Ainslie customers, you can at any time see what we have in stock and what we have ordered awaiting delivery in our webshop (here) and premium rises have been modest given what’s reported above.

In essence we have the full range of gold cast bars, both Ainslie and Perth Mint together with Perth Mint gold coins in stock for immediate delivery. For silver we have a number of bars and Kookaburra coins available now for immediate delivery and most silver bars on back order should arrive in the next couple of weeks together with more 1oz Kangaroo and Wedge Tailed Eagle coins.