Will We See A Debt Jubilee?

News

|

Posted 04/11/2022

|

14536

With trillions and even quadrillions of dollars of derivatives floating around the global financial markets, there are increasing references to “debt jubilees”. The term goes back to Biblical times, where God rested on the Sabbath, the seventh day. In the same vein, the seventh year was a sabbatical year. Then after seven sets of seven years, the 50th year would be a jubilee year where debts are forgiven, slaves are freed, and land lost to creditors in poor harvest years is returned.

The concept and justification are a story as old as human civilization. As the total interest being paid throughout the system handicaps the economy and its participants to catastrophic levels, the only way out is a major shakeup. Examples of this go back as far as ancient Sumer and Babylon, more than 4,000 years ago. Ancient Kings were said to write off societal debts as a matter of public stability.

Pandemic-era spending has set off surging inflation, and now that interest rates are rising up, debt-forgiveness is becoming more and more common. Student debt forgiveness in the United States has been slated, and the Vatican calls for debt relief for African nations on an annual basis. In 2000, $100 billion of developing country debt owed to G8 countries was written off, in principal.

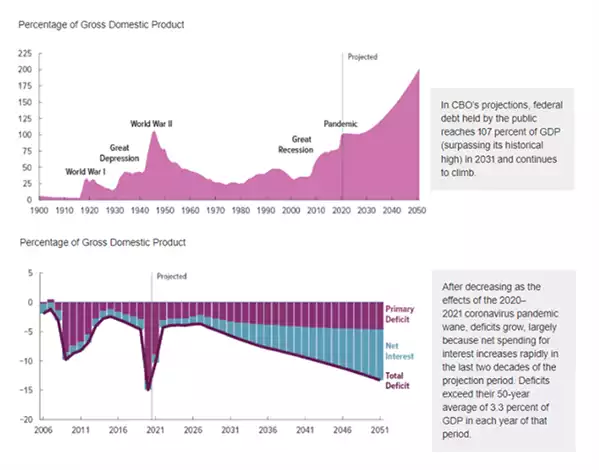

As the charts below show, debt and projected net interest as a percentage of GDP over the next thirty years is expected to snowball.

The most well documented example comes from the 6th Century BC in Athens, where Solon used a part debt jubilee to avoid a massive class based conflict. The disparity between the rich and poor had reached breaking point, and the poor could see their conditions deteriorating year on year. The rich had corrupted courts, which always ruled in their favour, and parts of the government were already under what we today would describe as ‘regulatory capture’. This is a scenario where the very people regulating an industry (pharmaceuticals for example), derive the majority of their organisational funding from the companies they are supposed to be policing. The result is regular citizens lose faith with all of the institutions, and violent revolt is the only option left.

Globally, all of that sounds pretty familiar in 2022. So, how exactly do these “Jubilees” shake out?

Solon devalued the currency (surprise, surprise) to reduce the burden of debtors. Next, they cut personal debts and stopped imprisoning people for debt. Tax debts were forgiven and mortgage interest written off. The most extreme aspect of the debt jubilee was the confiscation and redistribution of land. For creditors and asset holders, it all sounds pretty unappealing. That is the role of a Debt Jubilee however, to reset and reinvigorate the balance between the haves and have-nots, to wipe out the iniquities developed over previous generations.

We may be heading for a debt jubilee, or a “Great Reset”. Looking back at history, there aren’t many good places to hide. The only things which couldn’t have been confiscated in those times, and today, are the physical precious metals, gold and silver, and crypto currencies on decentralised blockchains where the private key is held by the holder and not a government or bank.