Will Deutsche Bank Be the Next to Collapse?

News

|

Posted 29/03/2023

|

10864

The largest bank in Germany, Deustche Bank saw its share price dip by almost 9% on Friday (partially rebounding this morning) amid rumors of potential insolvency following systematic contagion effects associated with Credit Suisse and other medium to large size financial institutions going bankrupt.

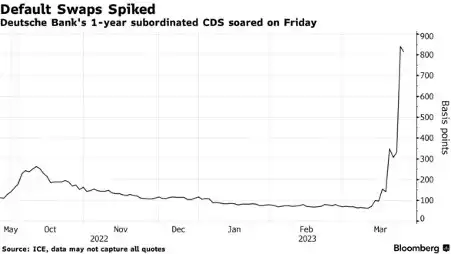

The significant decrease in Deustche Bank’s share price was a reaction to its 5-year credit default swaps widening the most since the COVID Pandemic was officially declared in early 2020.

A credit default swap is a financial contract where the purchaser effectively bets that the issuing firm will default on their corporate bonds. It is often used as a hedging tactic for bondholders in times of macroeconomic instability.

Deustche Bank is down more than 25% since March 8, which is roughly when the confidence in the international banking system began to tumble amid Silicon Valley Bank insolvency rumors.

Other European Banks such as UBS (-5%), HSBC (--5%) and BNB Paribas also saw the share prices succumb to industry wide panic on Friday.

“We are still on the edge waiting for another domino to fall, and Deutsche is clearly the next one on everyone’s minds,” Chris Beauchamp, analyst at IG Group believes.

Similarly, to the systematic bank collapses themselves, the narrative control of these events is also continuing, with some “analysts” saying this Credit Default Swap blowout was only the result of a single $5 million trade.

A much more likely reason is that this is bondholders protecting themselves after witnessing how they were treated during the Credit Suisse fallout.

More specifically, $17 billion in Credit Suisse bonds became worthless the day of the UBS takeover, as it was announced that these bondholders would not get repaid a cent. Hence now, we are likely seeing a large portion of sophisticated Deustche Bank debt holders hedge their risk, as opposed to just one person making a somewhat sizeable trade.

We discussed other potential trends that could impact global banking in last weeks insights here.

“It’s a clear case of the market selling first and asking questions later,” FlowBank analyst Paul de la Baume told Bloomberg.

While Baume is correct in this analysis in that nothing of particular substance regarding insolvency has been substantiated as of yet, no one needs reminding that like Credit Suisse and Silicon Valley Bank before it, all these collapses start as effectively unsubstantiated rumours.

And while Deustche Bank might be perfectly financially stable, the risk/reward ratio for depositors and bondholders specifically, especially in the current unstable macroeconomic environment, is one too skewed in great uncertainty.

While bondholders may be turning to Default Swaps to hedge their risk, many depositors in Banks around the globe are taking their money out of the bank and buying gold to hedge their own.

Whatever option is best applicable for you, the overall trend of people diversifying their portfolio to best position themselves for more global fallout and institutional failure within the banking system is most definitely a trend that will continue to grow amongst the populous.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

****************************************************