Why are Gold and the DXY Rising Simultaneously? The Dollar Milkshake

News

|

Posted 24/10/2024

|

9470

The DXY, or the U.S. Dollar index represents the relative strength of the U.S. dollar, against a basket of fiat currencies - namely the Euro, Swiss franc, Japanese yen, Canadian dollar, British pound, and Swedish krona. A rising DXY represents a strengthening U.S. dollar - usually giving it an inverse relationship to assets priced in dollars, such as gold. However there have been instances, where the DXY and gold rise together - we have seen 2 such cases this year itself, in March and since September - marked below in blue.

Let’s explore this unique dynamic, underpinned by the “Dollar Milkshake” theory (coined by financial strategist Brent Johnson in 2010).

As the DXY represents the U.S. dollar-priced against a basket of other fiat currencies - if this basket of currencies is losing value - while demand for U.S. dollars and gold are simultaneously rising - the DXY and gold will rise together.

What might cause global currencies to fall - while gold and the U.S. dollar rise in tandem?

If the U.S. has relatively higher interest rates compared to the other currencies in the DXY basket, central banks and global financial institutions will increase their holdings of dollars for higher comparative yield – strengthening the dollar. During phases of global economic volatility, or geopolitical uncertainty, investors seek safe haven assets, gold being the obvious choice.

With the U.S. dollar currently holding the title of the strongest horse in the glue factory, investors tend to flood into the dollar as well, while seeking shelter from the storm. This dynamic feeds into itself, with further dollar strength - drawing further investment. With a simultaneous increase in demand for both U.S. dollars and gold, the DXY and gold, will both rise together – breaking the traditionally inverse relationship between the DXY and Gold prices.

Where is the current uncertainty stemming from?

A spike in bond yields has caused bond market volatility to reach a 2024 high while reducing the value of U.S. bond collateral. With U.S. bonds being the primary form of collateral held by U.S.

banks and nation-states around the world, lower levels of collateral for key players in a debt-based system are always a cause for concern.

Escalating geopolitical instability and the uncertainty leading into the U.S. elections are additional key factors causing investors to exercise caution, for now.

How much longer can we expect this simultaneous increase in the value of the DXY and gold?

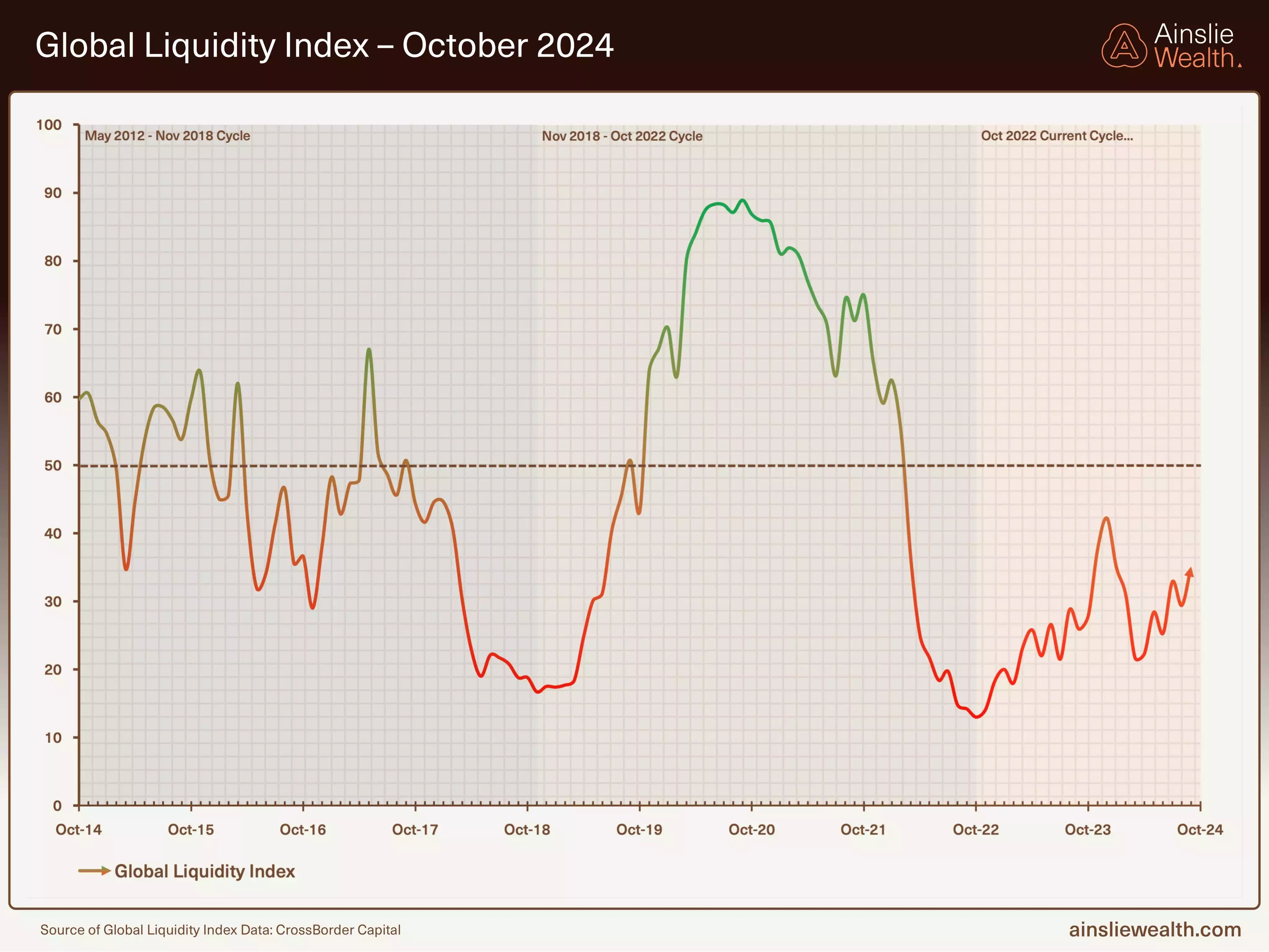

While gold benefits from being a safe haven asset in such environments, it also benefits from increasing liquidity (money supply) in the financial system. The DXY, however, loses value amid rising global liquidity. As the uncertain phases always pass, we look forward to what comes next.

While global liquidity remains under pressure with lower bond collateral values, higher bond volatility and central bank tightening - we are currently about 33% of the way through a macro liquidity cycle - expected to significantly increase the liquidity in the financial system, amid a phase of rising global uncertainty. So while the DXY and gold are rising together right now - this relationship will soon once again find normality in an inverse dynamic - with the expectation of the DXY to fall, and gold to continue rising, amid increasing global liquidity.