Why Money is Leaving US Treasuries for Gold

News

|

Posted 30/05/2023

|

8916

Yesterday, in explaining the debt ceiling “deal” we raised the issue of the world reigning in its US Treasury purchases. Today we talk to the move from Treasuries to Gold further in what is an extremely important phenomenon to understand and hence a must read article.

Crescat Capital addressed this in their recent market update as follows:

“Foreign Buyers Are Far Gone

It is worth noting that the recent positive developments related to a potential resolution of the debt ceiling have coincided with upward pressure on long-term interest rates. Market participants are beginning to recognize that the true risk this time around lies not in the failure to reach an agreement, but rather in the escalating and concerning nature of the debt problem. This concern is further amplified by the diminishing availability of buyers for Treasury securities.

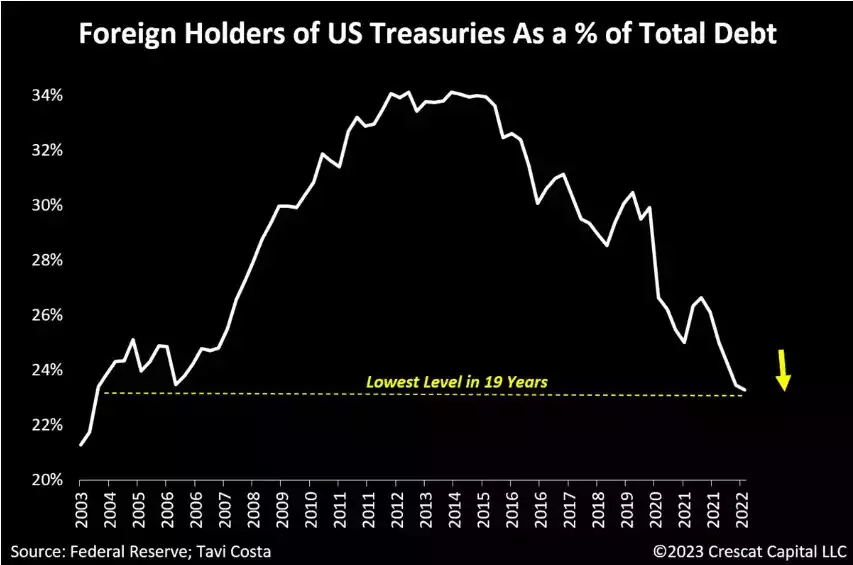

In the last three years, the responsibility of absorbing this debt fell on the Fed and US banks, but now both entities have withdrawn from that role. Additionally, as shown in the chart below, foreign investors have not been net purchasers of US Treasuries despite the substantial influx of issuances in the last decade. The current lack of demand is indeed a growing problem that may ultimately necessitate the intervention of the Fed as the buyer of last resort.

We can recall the historic selloff of UK Gilts last year, triggered by a tax cut announcement that investors perceived as posing a significant risk to the country’s financial stability. This situation led the Bank of England to reverse its quantitative tightening (QT) course and intervene as a buyer of UK bonds.

In our strong opinion, the US is primed to have its own BOE moment.”

US Treasuries have enjoyed being considered the pre-eminent safe haven financial asset and their yield the ‘risk free return’ rate. Central Banks around the world bought them, fund managers would employ the so called 60/40 portfolio of shares / UST’s as the perfect balanced investment portfolio.

But when the issuer of said Treasuries abuses that privilege with reckless hubris it starts to get noticed. When the very debt they represent becomes the problem, a 60/40 portfolio no longer performs and indeed has been one of the worst in the last few years.

As this secular credit cycle debt party started not long after leaving the Gold Standard and as globalisation expanded, central banks sold off their gold and bought UST’s. That continued right up to the ‘oh sh!t’ moment that was the GFC when they started to realise such debt fuelled growth has its limitations and they saw the response of the US Fed in unleashing QE, rampantly debasing the world’s reserve currency like never before in history. They then became net buyers ever since…

From Crescat:

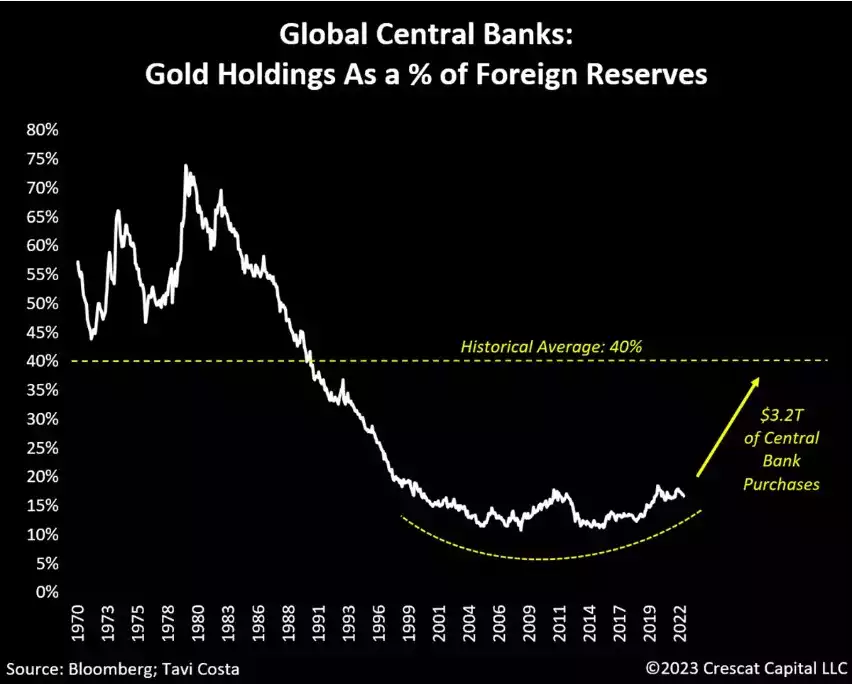

“Now, foreign central banks have reversed their stance again. They are significant buyers of gold while some have become major sellers of US debt. Escalating geopolitical conflict has increased the importance of owning a neutral asset with no counterparty risk that also carries centuries of credible history as a haven. Gold is the only asset that qualifies. Central banks have thus pivoted to being substantial buyers over the last several years leading to a rising percentage of gold ownership on their balance sheets. As a percentage of foreign reserves, if this measurement were to return to its historical average of 40%, all else equal, it would be an injection of approximately $3.2 trillion of new capital into the gold market. Price would have to be the reconciling factor in accommodating this demand. Since $3.2 trillion is 25% of the total value of all above-ground gold, or essentially all the gold ever mined, which now stands at $13 trillion, a 25% upward adjustment in price would get the gold price to $2,500 an ounce, Crescat’s minimum one-year target. More importantly, this dynamic is expected to prompt other major institutions and individual investors to follow suit, triggering an even greater influx of capital into the gold and precious metals markets. We expect much of this new demand will flow into the mining industry where the deep value is substantially more compelling in this macro environment with multi-fold appreciation potential in companies with big, viable new and incipient discoveries.”

The Fed simply cannot allow bond yields to rise substantially as there is simply too much debt to service at higher rates. They need to intervene:

“Therefore, in a world where policymakers must inevitably intervene to suppress the cost of debt, irrespective of varying perspectives on the potential effectiveness of such actions, gold would likely emerge as a key monetary asset to own carrying centuries of credibility as hard money. This is particularly relevant today as the valuation of US Treasuries remains historically expensive.”

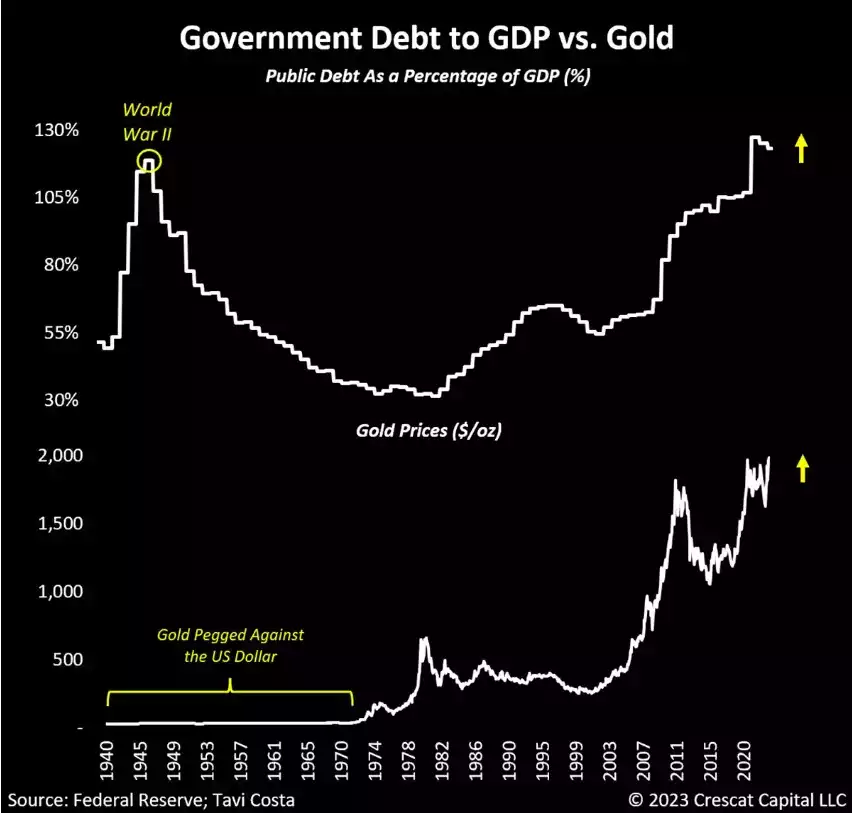

Some pundits raise the fact that as a percentage of GDP we had similar debt levels immediately after the debt funded World War 2. However:

“While the 1940s serve as an important historical parallel due to the seriousness of the current debt issue, there is a significant distinction: during that period, gold was effectively tied to the US dollar, rendering it an impractical investment alternative. Today, with prices unpegged, it is highly probable that capital will divert from US Treasuries and flow into gold.”

The following summary of the case for gold right now is one of the more compelling you will read and from a fund manager with excellent credentials and more importantly, track record.

“Triple Tops Almost Never Work

We note that gold is the only macro asset trading near record prices today. While there are inexorable fundamental drivers to push it much higher, from a technical perspective, the metal has recently encountered historical resistance after re-testing previous highs. More importantly, triple-top formations often prove to be temporary with prices eventually breaking out to the upside in a significant way.

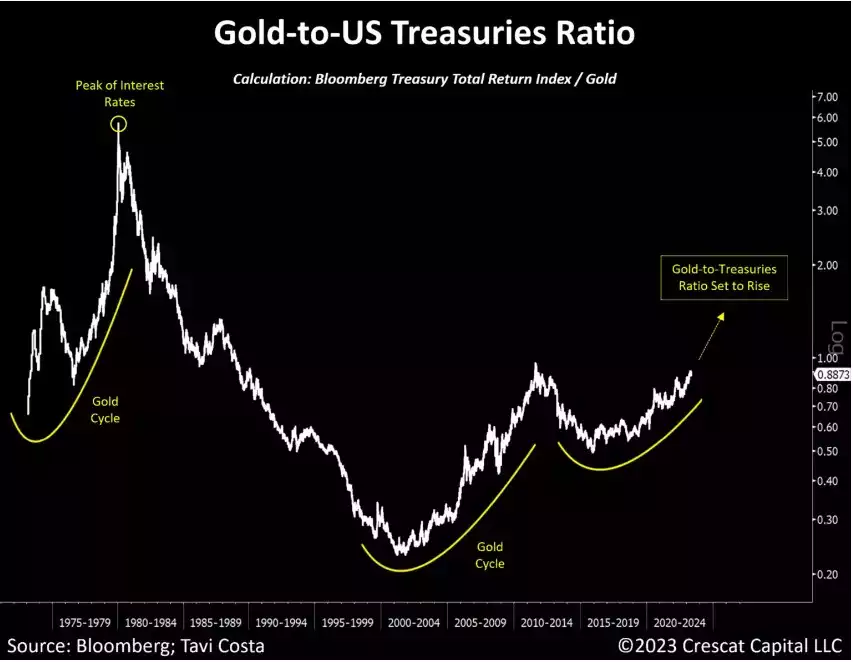

Once the metal decisively achieves record prices, it is likely to spark a new gold cycle. These cycles, characterized by long-term trends, have occurred only twice in the past 50 years: during the 1970s and the 2000s. The current market conditions present an exceptionally strong array of fundamental and macro drivers for precious metals, arguably the most robust in history, which include:

- Central banks compelled to purchase gold to enhance the quality of their foreign exchange reserves;

- The likelihood of global gold production entering another secular decline, akin to the bull markets of the 1970s and 2000s which supports the supply side;

- Failing 60/40 portfolios seeking alternative safe-haven assets;

- Inflation expectations exceeding the historical average for this decade, driving the need for tangible assets;

- Commodities being historically undervalued compared to financial assets;

- A significant number of yield-spread inversions in the US Treasury curve, surpassing the 70% threshold, making a compelling case for owning gold and reducing exposure to overvalued stocks;

- Major mining companies inclined to ultra-conservatism, prioritizing returning capital to shareholders over investing in the current and future production of precious metals;

- Insufficient investments in exploration resulting in a lack of new gold and silver discoveries, compounded by the geological challenges of finding new mineral deposits;

- ESG mandates and government pressure deterring the development of new resource projects;

- Institutional investors pressuring traditional gold-focused companies to pivot to green metals;

- Doubt surrounding precious metals due to the surge of speculative interest in digital assets, totally unwarranted due to the credibility and historical significance of gold as the one enduring and truly scarce monetary asset in contrast to a plethora of easy-to-produce digital assets; and

- The US and other developed economies are currently facing a trifecta of macro imbalances:

- The debt problem reminiscent of the 1940s

- A speculative environment like the late 1920s and 1990s

- Inflationary concerns akin to the 1970s”