Why Gold is Oversold

News

|

Posted 01/08/2018

|

9437

Goldmoney’s economist Stefan Wieler recently released his Goldmoney Insights for July with the title “Gold Sell-Off Overdone”.

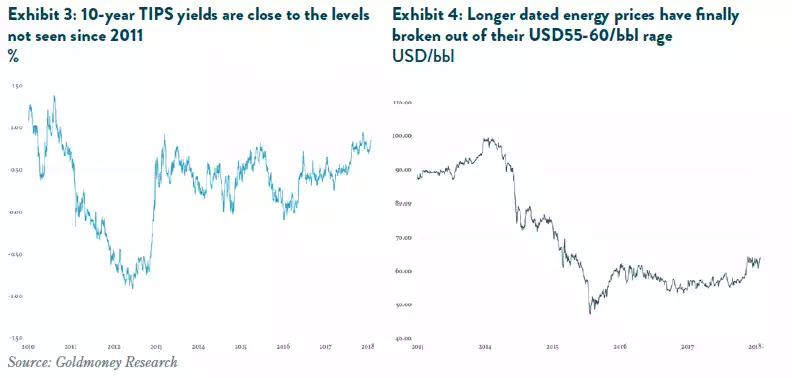

Wieler has done extensive back analysis on what drives the gold price. In essence there are 3 main determinants, being longer-dated energy prices, real-interest rate expectations driven by central bank policy, and central bank gold holdings. Their current view is that the sell-off of the last few months (per Exhibit 2 below) has been overdone. They believe the current round of hikes (of nominal, not real interest rates) by the US Fed are having little impact as they were largely priced in and hence gold trending up since they started.

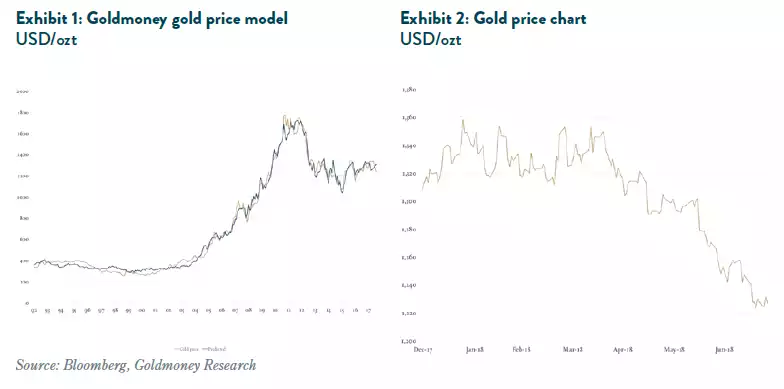

This 3 factor analysis has demonstrated an 82% correlation with the price of gold over the last 25 years per Exhibit 1 below.

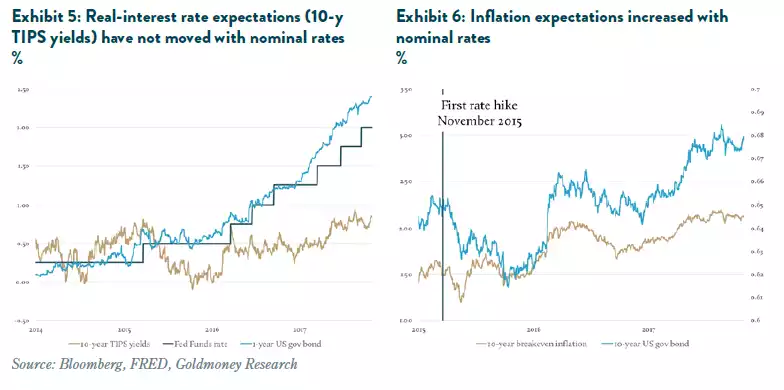

The reason for the ‘over sold’ call is that this sell off has occurred whilst real interest rates (nominal less inflation) has hardly changed per the measure of the 10yr TIPS yields (Treasury Inflation Protected Securities - treasury securities indexed to inflation). Likewise the 5 year forward Brent oil (proxy for longer dated energy price) price has recently broken out to the upside on a narrow $55-60 range it’s been stuck in for the last few years.

Part of the reason for the over-sold market is just lag but they put a lot of it down to misinterpretation of the USD strengthening. A USD strengthening off strength in the US is understandably a headwind for gold, but a stronger USD off weaker global currencies should be supportive of gold. The latter is the main driver and hence we should see a reversal of that effect. This is particularly evident when we see that real interest rate expectations, despite the Fed hiking nominal rates, is not strong against expectations of rising inflation per below:

So where to from here?

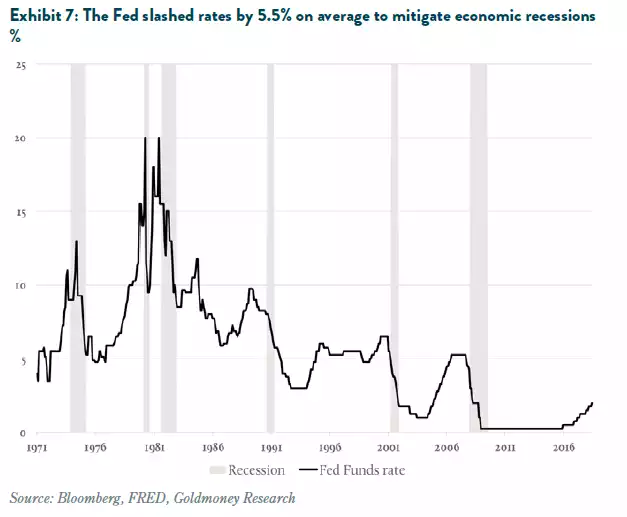

They don’t see real rates rising much from here which is supportive for gold. They also point out we are now just 11 months from the longest economic expansion in history, over 9 years against a century long average of just 4.1 years. Importantly on each previous contraction the Fed has slashed rates by 5.5% (average) to try and mitigate the effects. Even the Fed’s most bullish predictions see them at just 3.375% by the end of this hiking cycle. That leaves them nowhere to go other than maybe negative rates and more QE, both of which will drive real rates negative and gold up.

Add in their view that longer-dated energy prices are due for a strong rally and central banks continue to buy up gold, particularly in underweight China, and the prognosis looks particularly strong for gold.