Why Bullion Beats the Bank

News

|

Posted 11/11/2025

|

2947

Australians are reconsidering what money really is: what sits in your bank account is not really in the traditional sense—it’s credit. You’re effectively an unsecured lender to your bank, and your savings are recorded as the bank’s liability. In contrast, gold and silver held in Ainslie Saver are not promises—they’re property. Tangible, allocated, and entirely outside the fragile framework of the financial system.

The Fiat Trap: Banks and the Erosion of Value

The Australian dollar—like all fiat currencies—continues to lose real-world value. Since 2000, it has shed around 35–40% of its purchasing power against consumer goods, and far more when measured against housing, energy, or gold. Meanwhile, banks offer interest rates below inflation, meaning your real return is negative. A nominal 4% return, offset by 5% inflation, equates to a 1% annual loss—a silent tax on savers. And these deposits are nothing more than digital entries. In a liquidity crunch, bail-in scenario, or centralised emergency response, those digits can be frozen, restricted, or quietly devalued overnight.

Ainslie Saver: Real Money, Outside the System

Ainslie’s Gold & Silver Saver lets you save directly in bullion, fully backed by physical gold and silver stored securely, verified, and insured. You’re not a creditor—you’re an owner. Each dollar saved represents real metal, not a paper IOU.

It’s simple and accessible. Set up automatic contributions just like a regular savings account, but instead of accumulating digital liabilities, you build a store of real wealth. You can take delivery, sell it back to Ainslie, or hold it—while remaining outside the risks of policy missteps and currency debasement.

Macro Reality: Negative Real Rates and the Great Debasement

In 2025, the argument for physical savings is only growing stronger. US national debt has passed US$38 trillion, guaranteeing ongoing debasement through monetised deficits. Australia’s latest figures show net government debt at AUD$846.6 billion. With the RBA poised to cut rates again, real yields are likely to fall further below zero.

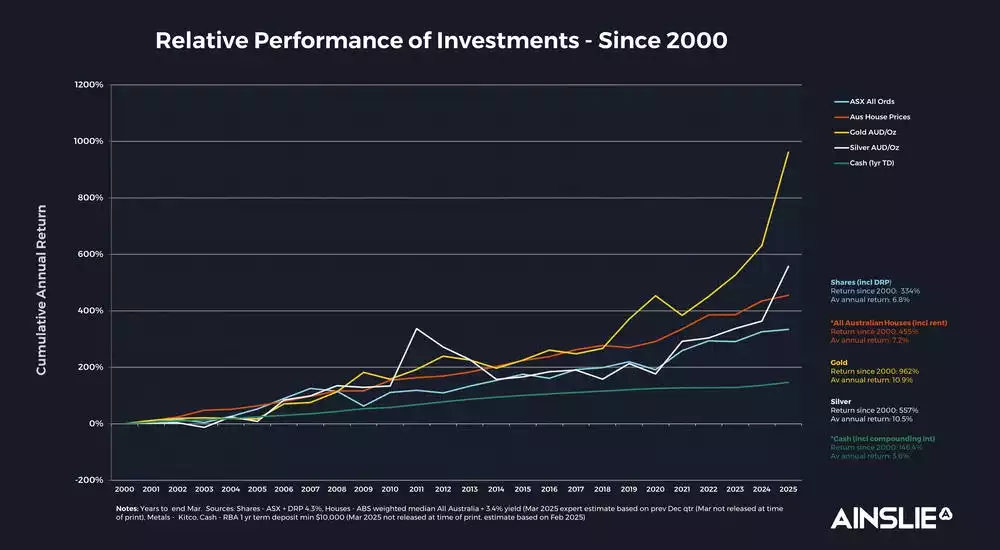

History is clear: negative real rates support higher precious metals prices. While fiat currencies steadily lose 3–5% annually, gold and silver have retained purchasing power across centuries. A gold sovereign from the 1800s still buys roughly what it did then. As the chart below shows, gold has outperformed all major Australian asset classes since

2000, including shares, property, and cash—even before accounting for the real-world impact of inflation and monetary policy distortions.

The Strategic Edge: Optionality, Privacy, and Real Security

Control matters. Ainslie Saver provides direct, unencumbered ownership of real assets—insulated from bail-ins, central bank restrictions, and financial surveillance.

Unlike speculative ETFs or leveraged contracts, Ainslie bullion is never re-hypothecated. It’s full-reserve metal— no leverage, no fractionalisation, no counterparty exposure. That’s an important distinction when systemic risk begins to reprice across global markets.

The Bottom Line

Gold and silver aren’t about chasing yield—they’re about avoiding erosion.

Bank deposits offer disappearing returns. Bullion offers lasting value. In a world of overleveraged governments, and weaponised currencies, saving through Ainslie Saver isn’t just prudent—it’s a declaration of financial independence. You’re not just saving for the future. You’re protecting it.