Why Bitcoin AND Gold, not “or”

News

|

Posted 25/08/2020

|

11393

That debate rages over whether gold or Bitcoin is the best reserve asset and best collateral asset in history might seem unfair when comparing a 5000 year old tried and tested asset like gold against one barely over a decade old. It is not an argument that needs to be combative. The 2 assets share many similarities and arguably both belong in a portfolio right now more than ever.

Like gold it can be argued that Bitcoin is the hardest asset ever produced, with an impossible to change formula for supply, giving it predictability like no other asset ever. It's distributed nature also makes it one of the most anti-fragile systems ever created. Nothing can change the supply of bitcoin that is mined. Nothing.

But isn’t there other fundamental risks associated with owning Bitcoin?

Experts argue no.

Power outages aren't a risk because the entire blockchain is stored on over 10,000 nodes, all unconnected, spread all across the world. The risk of destroying or changing the ledger is only that of total thermonuclear global war or complete destruction of the planet i.e. the risk is super low, and we’d have bigger problems on our hands.

Others talk about the risk of quantum computing breaking the cryptography. Well, that is at least a decade away and maybe many decades. It is also a ‘known’ risk, and many are working on anti-quantum protection. The cryptographic arms race is in play and there is too much money at stake to assume this risk is super high – the incentives are as high to solve this, as they are to break it.

The other key pushback on bitcoin is that governments will ban it.

Globally, this is impossible due to the distributed nature of the blockchain and because regulatory arbitrage will allow others to go against any ban for their gain. And let’s face it, no one is going to ban a $240bn asset even if they could.

Bitcoin presents an incredibly compelling risk/reward equation given its infancy and fundamentals, and the timing right now appears near perfect.

Firstly, this year we had the halving when bitcoin supply is halved by the algorithm (as we explained here). With increasing demand and less supply, prices tend to rise dramatically post-halving.

What happens is that the stock to flow of bitcoin keeps rising, meaning new supply is more marginal each time it happens and thus the asset is rarer over time. Plan B has done the heavy maths using the stock to flow around halvings and projects a price of $280,000 in this cycle into 2022...

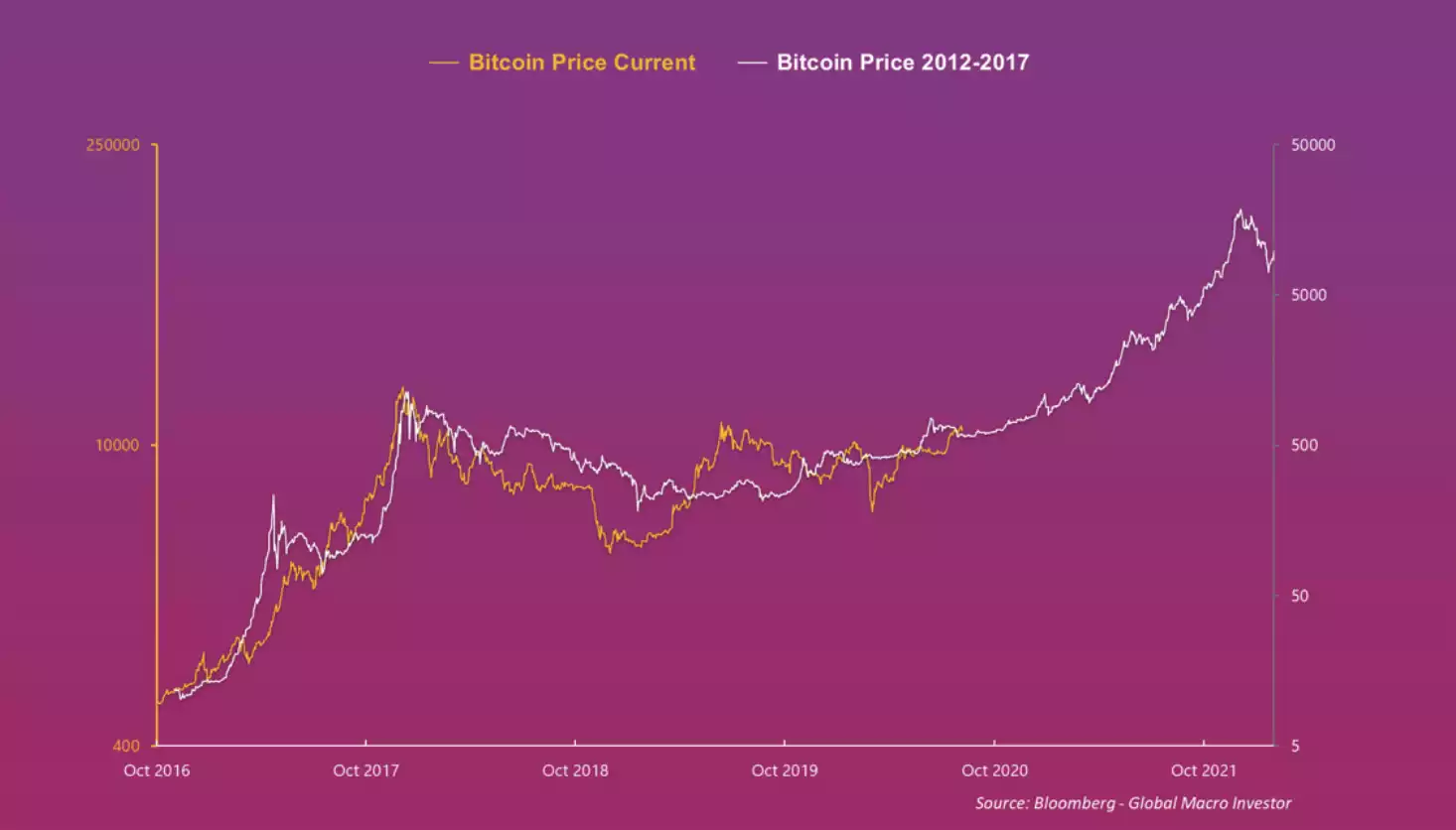

We get a similar projection if we use the previous halving period and overlay it...

The price chart is also one of the best examples of a wedge pattern ever and it’s broken out...

And on a log chart suggests even higher price targets than the stock to flow model...

In the shorter-term, it broke out of an inverse head-and-shoulders...

Bitcoin is currently correcting and consolidating – and that is a good thing – it could be a pause that refreshes and a great time to jump in.

What is going to lead the next phase of the bull run? Demand from institutions - and the beauty is that we can front-run it.

The US has just approved more regulation towards bitcoin and it is now accepted as an asset across the world by regulators. It is no longer the payment method for drug dealers (the FBI proved that it is traceable so that ended that game). In the US, banks are now allowed to custody bitcoin and that means that prime brokers can offer prime broking and custody for bitcoin, leaving the door wide open for every hedge fund.

Financial services giant, Fidelity, with $2.5 trillion under management, has built out a custody business too for family offices and endowments and are actively talking to pension funds.

ICAP the giant interdealer broker has set up a digital asset group to broker to hedge funds, banks and asset managers.

Bitwise is very close to getting approval on an ETF which will bring in every US Registered Investment Advisor (RIA) into the space.

Silvergate, a US bank, offers a 24-hour cash/crypto exchange for brokers, market makers and asset managers where other banks wouldn’t touch it and now have billions of dollars flowing through each day.

All the brokerage platforms for retail brokers are adding bitcoin as quickly as possible.

Crypto hedge funds are in general up over 100% YTD and are attracting new assets at a rapid pace.

And finally as we reported recently, MicroStrategy, a US tech firm, just switched $250m of its treasury cash into bitcoin, paving the way for others to diversify their treasury cash into an inflation-proof, high-performance asset.

But right now, it's only a $240bn asset but, the more it goes up, the larger its market cap grows, the more institutions can't ignore it. It's a market that is essentially short calls or is convex in nature, and it will form a reflexive loop between asset managers, endowments and pension funds all driving up the participation of hedge funds, RIA's and retail investors, which drives up the market cap and thus sucks in more institutions.

Right now we have a very rare setup where some of the brightest macro economic minds, looking at the macro setup unfolding right now, are in complete agreement on just 2 trades – precious metals and bitcoin.

Speaking of rare opportunities…. We’ve just secured the last 2020 Double Pixiu silver coins. Last time we had 1200 and they sold out in a little over a day. This time, the last 600, again exclusive to Ainslie and on sale now. Be quick.

You can buy Bitcoin securely, dealing with a human, in store, over the phone or online with Ainslie Wealth for any amount over $2000.