Why Are Billionaires Selling Shares?

News

|

Posted 23/11/2023

|

2823

Several weeks ago, billionaire and CEO of JPMorgan Chase Jamie Dimon filed to sell shares in the bank for the first time in his 18 years as CEO. Not only was it his first time selling, he chose to unload a whopping 8.6 million shares. His peers say that he is simply planning for retirement, while others see this huge insider sell as a warning signal.

Jamie Dimon helped JPMorgan Chase navigate through the 2008 financial crisis, and how many of the company's shares did he sell at that time? Zero. This adds weight to the argument that Dimon could be seeing something bad on the horizon. He has not exactly been biting his tongue either. As covered before, Dimon has been notoriously bearish about the global economy.

Dimon is not alone. Last week, billionaire Jeff Bezos unloaded $240 million in Amazon shares. If that is not a bad enough omen, he is expected to continue his "aggressive" selling according to CNBC.

So what constitutes "aggressive?" According to CNBC's sources, this could be 8-10 million shares. This would equate to about 1 billion dollars of his stock. The share price took an immediate hit from this news, but has since bounced back.

Amazon in the recent week

Buyers Ignore The Fed & Insider Selling

In the wake of the transition from monetary tightening to speculation about the first rate cut in 2024, the recent release of FOMC minutes failed to put a dent in market sentiment. Despite the Federal Reserve's acknowledgment that rates would persistently remain restrictive, investors seem unfazed. Currently, markets are reflecting a 95% probability that the rate hike cycle has concluded. While the Fed has frequently mentioned the possibility of further tightening if needed, this stance lacks substance unless there is a notable upturn in prices.

The October US leading index has marked its 18th consecutive month of decline - a signal for a looming recession. This economic backdrop may prompt the Federal Reserve to prematurely return to monetary easing, especially if the situation continues to worsen. The market's cautious optimism about the end of the rate hike cycle contrasts with the potential necessity for the Fed to take more accommodative measures in the face of economic challenges.

Nasdaq 100 recently broke resistance and has reapproached all-time-highs

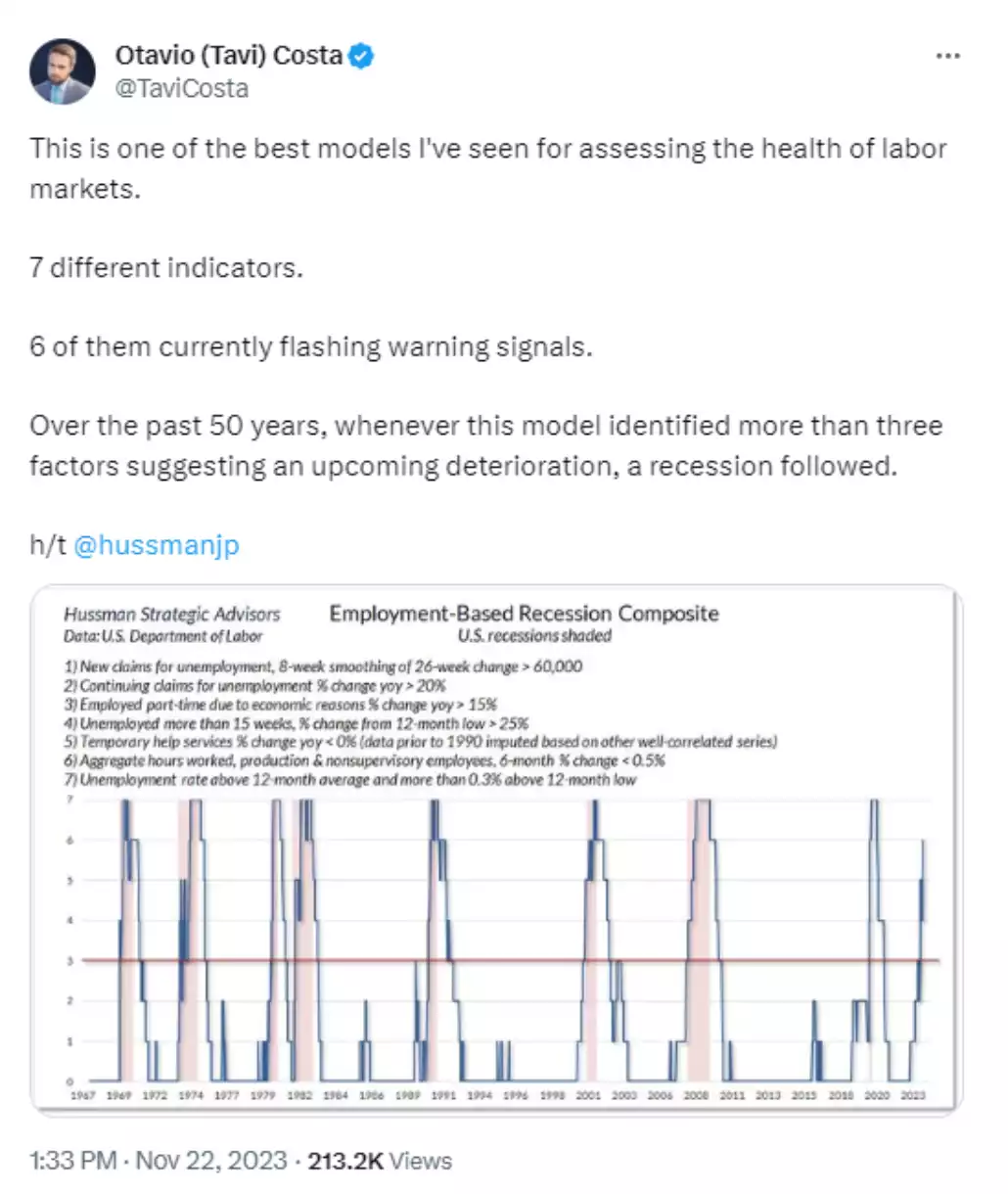

The ‘smart’ or ‘insider’ money also has perfect insights into the ‘rubber hits the road’ metrics like the following from Crescat’s Tavi Costa too…

So who is correct? Are the investors driving the stock market higher ahead of the curve, or are the billionaires and the Fed potentially knowing something that we do not? The chart above paints a pretty compelling case.

The $1trillion question is where are we at in regards to the liquidity that drives everything. Tomorrow we present our monthly Global Liquidity update – be sure not to miss it.