When Jawboning stops working is it time to change tactics:

News

|

Posted 13/02/2023

|

8872

Jawboning (to use one's position or authority to pressure (someone) to do something), has been an effective tool during times of disinflation with an arguably strong track record in recent times among multiple heads of the world’s Central Banks.

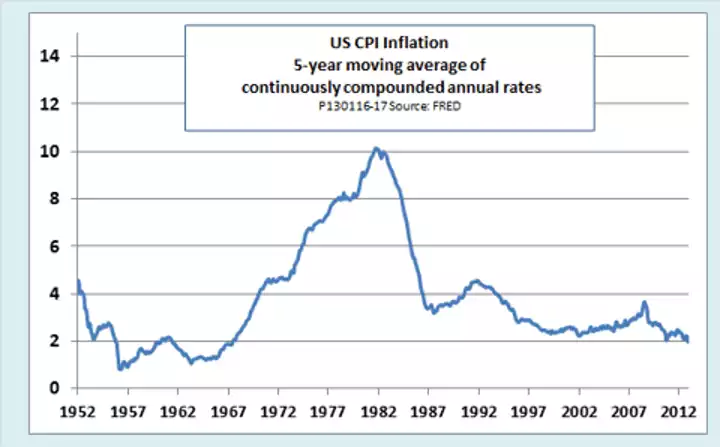

But looking back in history a similar period to our current inflationary mess was actually a jawboning failure. Jawboning during times of inflation has a shakier effectiveness. Lyndon Johnson discovered this when he began jawboning the USD whilst simultaneously spending on the Vietnam War, seeing inflation rates rise from 1.2% in 1964 to 5.9% in 1969 and then in the 70s began a steep unstoppable climb.

Source: CPI Unchanged In December, 5-Year Inflation Rate Hits 45-Year Low | Seeking Alpha

So why when jawboning has failed against inflation do the Central Banks continue and could this in fact be doing more harm than good?

Helicopter Ben

The extreme of Principle 2 of the (ex US Fed Chair) Ben Bernanke doctrine was the use of ‘helicopter money’ as a last resort. We’d argue that during Covid this was the point where the room was read wrong – not by any Central Banks – but by most governments in the world. No more do we see this than when we look back at discussions with friends in different parts of the world, or specifically a friend residing in Dubai related that towards the end of 2020, where life in Dubai had almost returned to normal, vaccines were taken, whatever was available, Covid was dealt with as best as they could, and financial assistance was not given out.

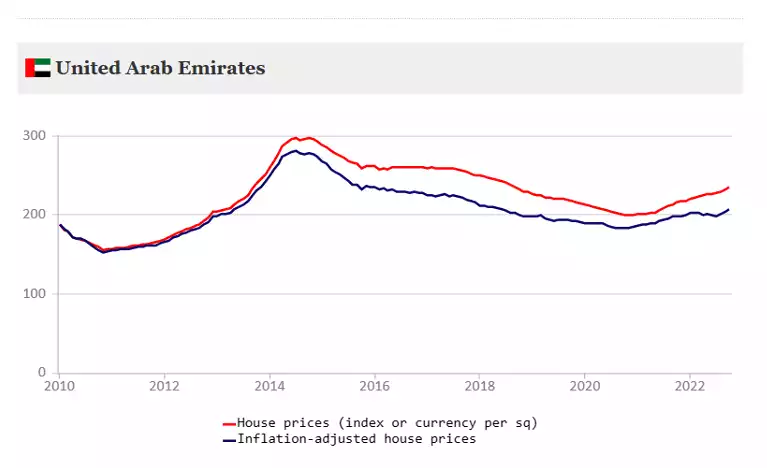

While Australians and particularly Melbournians languished in lock downs and were showered in helicopter money, that friend sent photos of trips to Europe we could only dream of here. Most notably now – the United Arab Emirates has not seen the inflation spike of the rest of the world, reaching 6.7% in 2022 and forecast for 3.5% in 2023; good energy policy, minimal asset bubbles (house price grow index moved from 209 in 2018 to 192 in 2020 back to 231 in 2022) and NO helicopter money has tempered the current inflation and asset bubbles playing havoc to the world…

Helicopter Money was actually an economic idea posed in 1969 by Milton Freidman

‘Let us suppose now that one day a helicopter flies over this community and drops an additional $1,000 in bills from the sky, which is, of course, hastily collected by members of the community. Let us suppose further that everyone is convinced that this is a unique event which will never be repeated’ [Friedman 1969].

Helicopter Money has been used since 2008 with quantitative easing (QE), and more recently as government fiscal intervention for support during Covid (more direct Helicopter Money). It has flowed (but never really ebbed) and you would say is now not seen as a unique event but rather as a given.

They got Jawboning wrong with ‘transitory inflation’

Jawboning has become less effective as not only does it give wrong expectations, it can also go spectacularly wrong. No more can this be seen than with the RBA’s stance throughout 2021/2022 that interest rates will “remain low till 2024”. This created an unprecedented Australian asset house bubble, which now we all know is false, has trapped Australians in a debt trap, with the possibility of bankruptcy as their house prices fall rapidly with the interest rate rises in stark contrast to that statement.

Jawboning – good for inflation bad for deflation

From 1997, when Greenspan changed his tune and began to use subtle jawboning, to the 2008 Financial Crisis when Bernanke used it to create inflation, to 2020 Covid response jawboning, jawboning was an effective tool to help inflate worldwide economies. But inflation is different to deflation, and what we recognized last week listening to Lowe talk at the Press Club is this; he was negative, not positive, inflation is high still possibly rising especially with the crazy Non Farm payroll numbers and this meant that the very likely outcome is rates would not only go higher longer but may have an even higher terminal rate. Did this sink the dollar, no? the dollar reacted positively and the news reports talk not about his obvious negativity but more about the ‘but’ which gave a glimmer of hope that as wages were not rising as quickly there was hope.

So let’s examine what this is and why jawboning becomes less effective when there’s inflation. ‘Toxic Positivity’ is the belief that no matter how dire or difficult a situation is, people should maintain a positive mindset. While there are benefits to being optimistic and engaging in positive thinking, toxic positivity rejects all difficult emotions in favour of a cheerful and often falsely-positive façade.’ What Is Toxic Positivity? (verywellmind.com)

Sound familiar? – ‘its ok the Fed will have to reintroduce Helicopter Money’; ‘ its ok I think they said the rates can’t go much higher’; ‘its ok they said but…’

In order to stop inflation and asset bubbles the governments and Central Banks now need to prove this Helicopter money was unique, but every time banks or governments Jawbone there is the ability of everyone to misread or misconstrue or misinterpret. And toxic positivity says individuals will always try to align a neutral position to be positively construed to them.

In the recent interview of Powel by Rubenstein on the 6th of February 2023 this ‘toxic positivity’ is apparent. This interview was seen as ‘dovish’ by commentators and saw the USD fall against other currencies and equities rise. But his comments aren’t dovish, he said;

“The labour market is extraordinarily strong”

“So for example, if the data were to continue to come in stronger than we expect and we were to conclude that we needed to raise rates more than is priced into the markets or than we wrote down in our last group forecast in December, then we would certainly do that. We would certainly raise rates more” (in response to a question on the surprise strength of Non Farm Payroll…

“…And what I’d like to point out is that we’re seeing disinflation in the good sector. We expect to see it in the housing services sector. And these are the three parts of the core PCE inflation index we look at. There’s 56% of the economy, which is the rest of the services sector, it’s the biggest part obviously, and we’re not seeing disinflation there yet. And that’s going to take time and we need to be patient and we think we’re going to keep rates at a restrictive period for a long time before it comes down”

But as Bloomberg commentary on markets perception on this hawkish speak, was in fact dovish, “US stocks hit session highs during the interview, reacting to a what was then perceived as a dovish Fed Chair. Equities then erased their gains as soon as the event ended, after Powell said that if strong labor data persists, the peak rate in the current tightening cycle may be higher.”

Powel’s comments in summary (our perception) were;

- NFP was a significant upside surprise.

- If surprises like these happen we may have to raise rates higher

- 56% of PCE is still seeing high inflation which is not coming down

- Rates will be held for a long time at a restrictive level

But the toxic positive market showered for years in presumed helicopter money saw these comments as dovish…

How to fix this mighty mess

We know among those whose lives were saved and loved ones protected what we are saying may not be palatable. But what we are saying is that Helicopter Money misuse over 20 years and more specifically when not needed during covid is the cause of these chaotic house and asset prices, followed by the now seemingly economic misread of every central bank in the world with the term ‘transitory inflation’ and the jawboning to influence markets into this belief.

So the Bernanke Boomer Doctrine needs to be retired or revisited. When institutions around the world make such spectacular misreads it’s time to go back to the drawing board. Since 2002 the world has changed, technology has come in leaps and bounds making so many different careers redundant, demographic dynamics will continue to play havoc on the definition of full employment and government populism reaches new heights a new way of looking at Monetary policy and fiscal policy use needs to be depopularised before it’s too late.

Jawboning is failing and arguably as inflation causes interest rate rises, as mandated by most Central Banks, and interest rate rises are damaging to house prices, stock prices and people’s confidence by continually jawboning. The psychological toxic positivity in the financial sector who have always been saved rightly or wrongly by Helicopter Money means jawboning is arguably doing more damage than good. When the world changes – models need to change, to adjust, and so far this lesson has been missed.

Therefore if this mess is going to be fixed a couple of practices need to be changed….

- No more quantitative easing or generous government handouts - in it not being unique, it failed – people need to know this to be true

- No more jawboning it only plays with people’s toxic positivity