When Banks Fail – Who Really Pays?

News

|

Posted 15/03/2023

|

11555

On Friday we saw the second largest institutional financial collapse in the past 15 years. And unlike that Lehman Brothers debacle, this time there is a bank bailout, no matter how the US Government is trying to convince you otherwise.

As we discussed earlier in the week, the Silicon Valley Bank crisis is causing shockwaves throughout the global economy.

Obviously, SVB’s bankruptcy was their own doing, though the main driver of the collapse was not overly risky lending practices like we have seen in the past.

This is because, relative to its respective peers, Silicon Valley Bank had a very unique structure between deposits and loans. More specifically, a large portion of their customer base were tech entrepreneurs, which meant that they had significantly more deposits than outstanding loans, effectively labelling them as a safer bank than most by traditional standards.

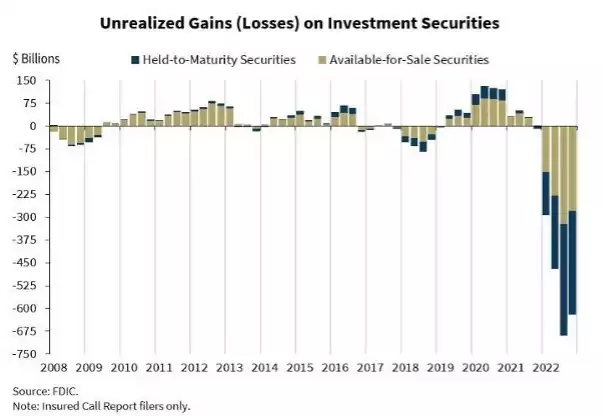

The main culprit was a lack of appropriate investment diversification, including a greater than 50% reliance on US Treasury bonds, which have cratered the past 2 years given the interest rate hikes.

Under normal circumstances, only deposits of up to $250,000 are insured by the Federal Deposit Insurance Corporation (FDIC).

However, in an attempt to lessen the economic damage, the US Government is insuring all of the customer deposits.

As a consequence, the FDIC will require increased funding to cover the extra depositor funds. That money has to come from somewhere, with the main candidates being increased tax revenue, the government borrowing money, or possibly worst of all, quantitative easing, the result of which will only exacerbate the current inflation crisis.

Government officials are refusing to state the obvious, making a conscious decision to not necessarily classify this policy choice as a bailout.

Janet Yellen, the treasury secretary told CBS on Sunday: “Let me be clear that during the financial crisis, there were investors and owners of systematic large banks that were bailed out, and the reforms that have been put in place means that we’re not going to do that again.”

The Chair of the Council of Economic Advisors under Barack Obama, Jason Furman, strongly disagreed with Yellen.

“Regulators probably needed to do what they did top prevent potentially chaotic damage across the economy. But make no mistake – it does have an expected cost to taxpayers.”

Additionally, Ross Sorkin, financial columnist for the New York Times and author of Too Big to Fail (bestselling book on the 2008 GFC) also thinks it’s a clear bailout.

“It is a bailout. Not like 2008. But it is a bailout of the venture capital community + their portfolio companies. That’s the depositor base of SVB.”

As we discussed in the Insights interview on Monday, this goes far further than guaranteeing deposits as shareholders are left out to dry and who now would invest in a small bank? Not coincidentally, the so called SIB’s (Systemically Important Banks) in the US are getting flooded with deposits as people run from the smaller banks. This concentrates more and more in to fewer and fewer and increasingly powerful (or vulnerable?) banks. In Australia our deposit guarantee scheme is limited by ADI, so the bigger the bank the less there is to go around. ADI’s include subs like St George to Westpac and BankWest to CBA etc. All the while, lurking in the background, is the Government’s ability to bail in our banks not bail them out like this example. If this is a new concept to you, you MUST read these articles here and here.

Ainslie has been absolutely swamped of late with high net worth individuals getting their money out of banks and into gold and silver. Property settlements are coming directly to us via solicitor trust accounts, bypassing bank accounts to minimize risk.

Likewise SMSF’s are on the rise and moving decisively into gold and silver and out of this financial system house of cards.

The Fed, as always happens, were going to keep hiking until something breaks. That point may be very very soon.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

*********************************************************************************