When Bad News Becomes Bad News Again

News

|

Posted 11/08/2016

|

6693

It was timely that we wrote yesterday of the risk associated with bonds at the moment. Just overnight, Stephen Isaacs of Alvine Capital appeared on CNBC and said “fixed income has absolutely no value”. Yesterday we also briefly referenced the seemingly unjustified rally that the stock market is in the midst of and today we elaborate on that theme. The uncertainty of the Brexit decision, the appeasement exercise that was the Euro bank stress test and everything in between has had an overall positive influence on the equity market, illustrating that the “bad news is good news” mantra (referring to the subsequent expectation of further easing policies) is alive and well. Let’s look at that view objectively however.

US non-farm productivity has just experienced its third consecutive quarterly decline – something not seen since 1979. Why is this important? As the graph below suggests, productivity is historically well correlated with equity valuations and it makes sense that the share market reflects the underlying productivity of an economy. Our current distortion however is part of a bigger picture where obfuscation and mal-investment are primary drivers rather than more fundamental metrics. Again referencing the graph below, twice in recent history we’ve seen that bad news does ultimately become bad news again at some point and it would be hard to argue against the case for the third recession bar.

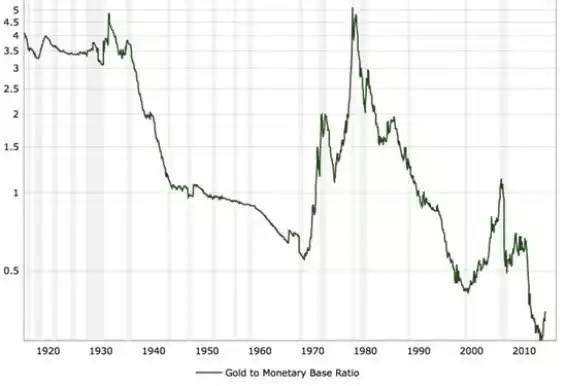

Furthermore, there is a simple chart made available by Bill Holter and originally posted by Peter Degraaf which plots the US gold price as a ratio of the monetary base. It clearly identifies a number of themes including the impact of the debasement of the currency and the fact that gold is currently at a discount. Comparing the charts above and below, it’s fairly obvious which investment is more attractively priced.