What the RBA Rate Hike Means.

News

|

Posted 02/11/2022

|

11025

Yesterday saw some winners on the track but a lot of losers on yet another rate rise from the RBA, albeit a more modest rise of 0.25% as opposed to the 0.5% some analysts say was needed. Whilst the 7th rate rise in a row, the RBA, as opposed to most other central banks, are progressing more carefully so lets look at why and what the implications may be.

We have written many times of why Australia, more than most countries, is in a particularly precarious position when it comes to rates. Simply, we have the highest personal debt levels in the world (sometimes 2nd depending on the source). Much of that is leveraged into one asset, housing, and a bunch of those houses were bought at record highs and on the RBA’s now infamous false assurance of ‘no rate rises till 2024’. Enter rampant inflation, the breaking of that ‘no hiking’ promise, clear signs of a global recession and tepid wage growth. No prizes for guessing where this goes and why the RBA are a little gun shy at hiking rates aggressively despite inflation getting worse not better. The guys at MacroBusiness have done some excellent work on this.

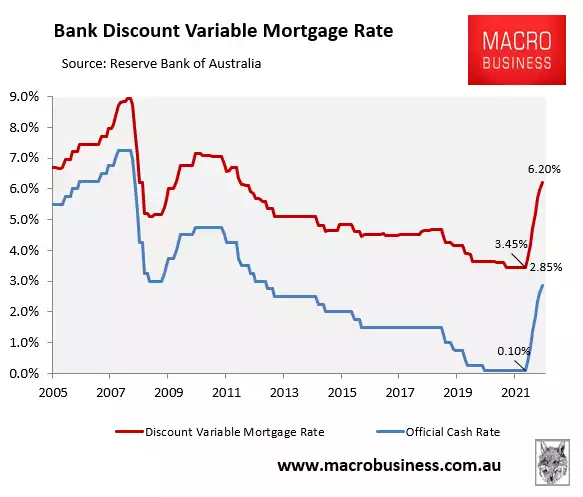

The 2.85% cash rate now sees an average discount variable mortgage rate of 6.2% - nearing double that before the hiking began:

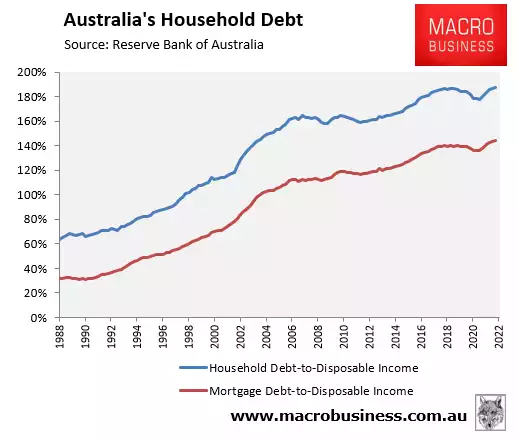

As stated above this comes at the same time that Australia’s household and mortgage debt is at its highest level on record:

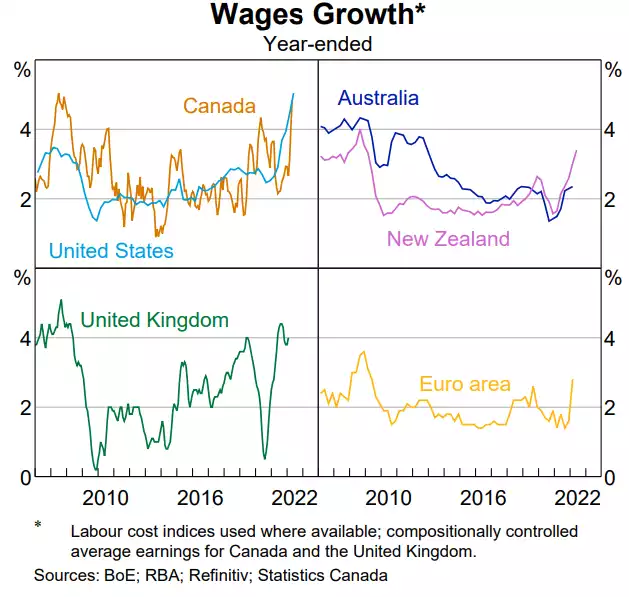

The double whammy then is that servicing this record high, world leading debt pile comes at a time when our wage growth lags the rest of the world, painfully below our 7.3% inflation rate, and the RBA now upping their (stagflationary) forecast to inflation peaking at 8% by the end of this year but GDP plummeting to 1.5% next year and the year after (providing little hope of more wage rises).

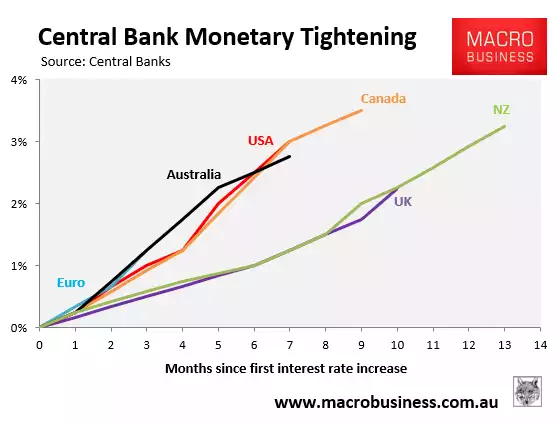

Macro Business provide the following chart showing how the RBA is tightening amongst the fastest in the world but respectfully, that misses the critical point that they started way too late and are still well under the rate of other developed countries.

So yes it has been short and sharp but that lower rate puts more and more pressure on the poor old AUD which dropped back into the 63’s on the announcement and has an almost certain 0.5% hike by the Fed tonight or God help it a 0.75% hike which is still well and truly on the table. That is awesome news for AUD gold holders and exporters but puts yet more pressure on our inflation rate.

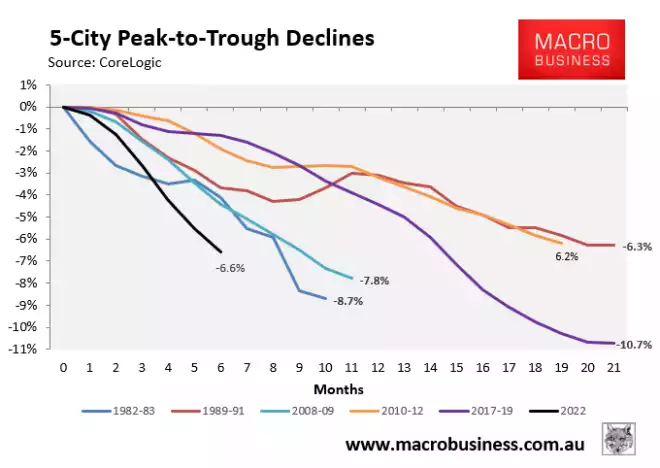

But the elephant in the auction room is of course Aussie property where so many Aussies have their ‘savings’ concentrated on one bet. To carry over the Melbourne Cup theme, their bet is on a wet track pig and the RBA keeps raining on the parade. According to CoreLogic’s latest results for October, Aussie property has already seen the its sharpest falls since 1980, down 6.6% in just 6 months with most analysts predicting more to come:

By total it still has ways to go but yesterday and the forecast continuation of hikes promises it is likely to surpass the 2017-19 total drop of 10.7%. The nation’s biggest home loan lender, CBA had this to say yesterday:

“Our central scenario sees home prices fall 15% from their April peak. This means that we expect a further fall in home prices of ~9%. And we expect the trough to be achieved in mid-2023. These forecasts are conditional on a peak in the cash rate of 3.10%, to be reached by the end of 2022. We would anticipate a bigger fall if the RBA continues to lift the cash rate in 2023.”

As the biggest lender, that is hardly ‘talking up one’s book’ now is it… Importantly this is not just about the price of houses. Its about the wealth effect of housing growth and what that does to our “houses and holes” economy. CBA reminds us:

“the RBA does not target dwelling prices and they have made that explicitly clear. But home prices cannot be divorced from the broader economy and changes in home prices influence the economic outlook. Indeed they are a forward looking indicator (changes in home prices impact wealth, consumer confidence, spending decisions and employment). Housing turnover also impacts spending as turnover and consumption are positively correlated. More turnover in the housing market means more spending on household goods, all else equal. The reverse is also true. The RBA will be monitoring activity in the housing market closely for these reasons.”

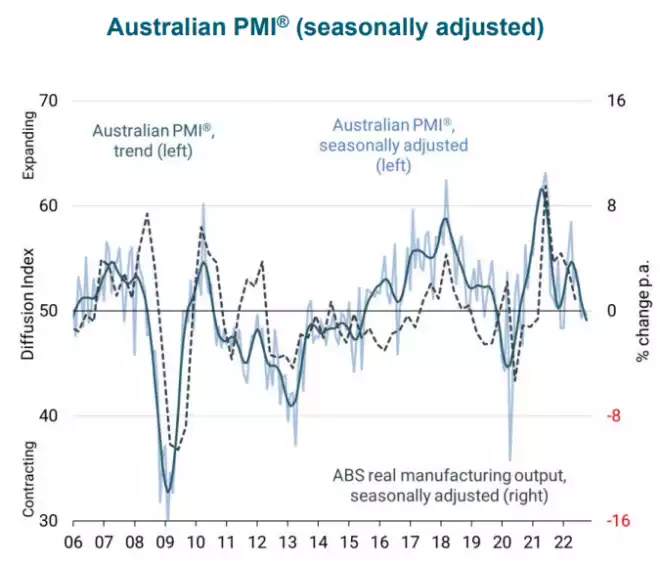

Just yesterday we saw the Australian PMI officially drop into contractionary territory at 49.6.

Australians have done exceedingly well out of the hard asset that is property. Every market peaks and troughs. There is a strong case that another hard asset, gold and silver, are about to come off a trough as housing comes off its peak. Flexibility and balance are exceedingly important in such uncertain times. Precious metals are highly liquid and fractional. That means they are not the ‘all in’ proposition property tends to be. You can own fractional amounts that can be sold in part or in full with little cost and immediate payment. You can also mix with other assets to get a better balance of uncorrelated assets.

Balance your wealth in an unbalanced world…

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************