What is Bullion & Different Bullion Options Explained

News

|

Posted 16/09/2022

|

20047

Today we look at ‘what is bullion?’ and the main types of bullion available to purchase so you have a better understanding of each. There are essentially 5 main types of bullion you can buy your precious metals in.

What is Bullion?

Before we look at the options it is worth a reminder of what constitutes ‘bullion’ in Australia and most parts of the world. For a precious metal to be classed as bullion and hence GST free they must be at least 99.5% pure for gold (though you should never see less than 99.99%), 99.9% for silver and 99.0% for platinum. They must be in investment form having the character of the metal rather than the character of a thing made from the metal. Items such as jewellery or collectible coins that happen to be made of gold, silver or platinum are not investment form bullion. They must also bear a widely accepted hallmark (or brand) the purity and weight. The Ainslie brand has been around for nearly 50 years and hence meets that test of a widely accepted hallmark. Likewise this is the case for Perth Mint for which we are the Primary Distributor.

So what are the different forms of bullion? There are of course coins and bars but let’s have a look at the different types of bars first.

Bullion Bars

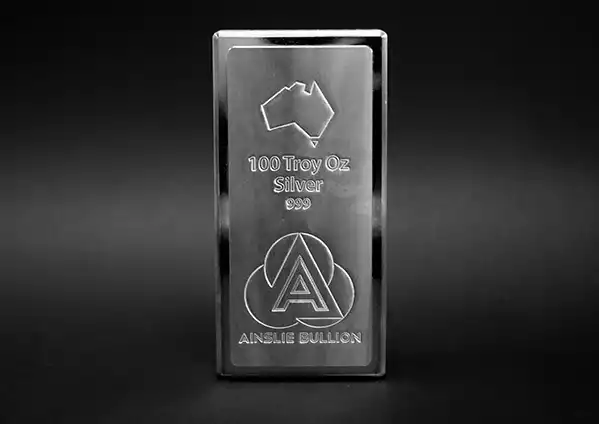

Cast bars – are generally made with pre weighed granules melted in moulds under high heat. For larger (in particular silver) bars, some ‘cast bars’ are actually hand poured with molten metal into a similar mould. The resulting bars are then stamped with the brand/hallmark, weight and purity. This ‘organic’ process means every bar is slightly different to the next. Some bars can then be etched or stamped with a serial number as well. Ainslie has a full range of gold and silver cast bars to choose from. These range from 1/2oz to 1kg gold and 5oz to 5kg silver. We of course also stock the full range of Perth Mint cast bars in both metals too.

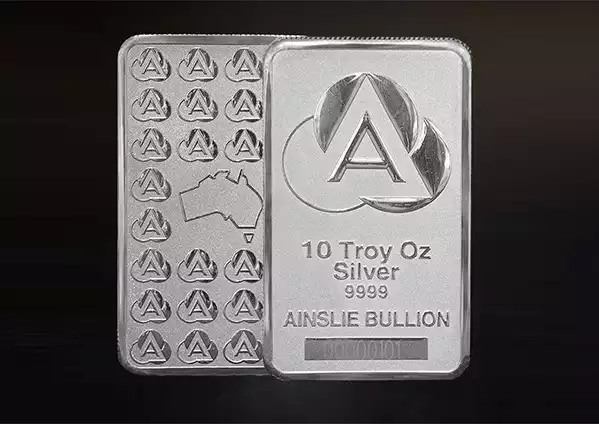

Minted Bars – are made under extreme pressure where premade ‘blanks’ are struck by a press with plates encompassing a design above and (usually) one below to produce a perfectly uniform, exact and high quality finish bar. Gold and platinum minted bars in particular are often then packaged in a blister pack or ‘certi card’ that holds more information and often a serial number. Some minted bars are etched with a serial number (like Ainslie’s 10oz minted bars). Ainslie currently have the 1oz and 10oz minted silver bars and will very soon have 5oz joining the stable and then 1 kilo minted later as well. Ainslie 1oz come packaged in acrylic tubes of 20 or mini monster boxes of 10 tubes (200 bars). Our 10oz minted bars are sealed in a tough plastic shrink wrap to prevent tarnishing common to silver.

Machined Bars – These are particularly rare given the work and machinery required to produce them. Ainslie’s Silver Stacker bars are manufactured by Scottsdale Mint in the US. This is how they describe the process: “Scottsdale Mint’s Stacker bars all begin as raw silver grain or bars. A furnace is heated and the silver is melted and turned into rough bars, then they are machined to perfection on our specially designed Silver minting equipment, giant CNC machines.

Our equipment was custom designed and state of the art, designed to achieve the ultra precision and smooth finish our Silver Stackers are known for. Once the bars are machined, a stamp kisses the surface leaving the impression of [Ainslie brand] as well as the purity, weight and serial numbers.” The stacker bars then interlock with precision to form a very stable, beautiful stack.

Extruded bars – as the name suggests these bars are made by forcing partially molten metal through an aperture and cut to the length equating to the required weight. Some of the older Perth Mint 100oz bars are made in this way and there are still some of the discontinued Reserve Vault Kangaroo bars in store at any time too.

Bullion Coins

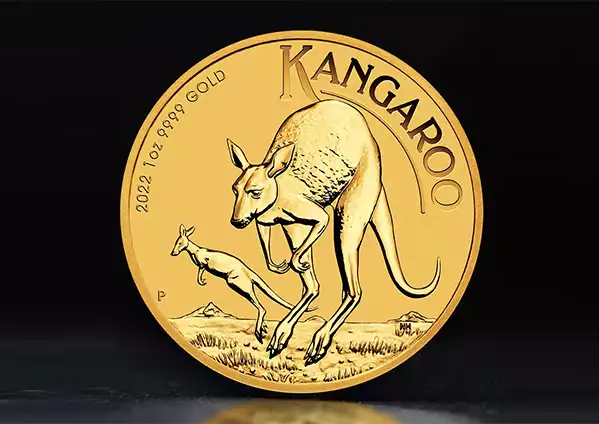

Coins are essentially a round minted bar but with the added attribute of being legal tender in whichever country they are from. As mentioned above, in Australia there is a distinction between numismatic or collectible coins and bullion coins. The former have value above that imparted by the gold, silver or platinum content and are not bullion. Importantly too, the Australian Tax Office treats ALL coins as collectibles when it comes to your Self Managed Super Fund and, just like art or fine wine, you need to independently store, insure and annually independently audit them to comply. Both Reserve Vault and The Melbourne Vault offer all 3 solutions in the most cost effective and secure way available. Alternatively if you want 1oz in your SMSF, you can opt for our bars.

Bullion Coins can come in either individual acrylic capsules (like the Perth Mint Koala, Kookaburra, Gold Kangaroo and Lunar Coins) or in acrylic tubes of 20 or 25 coins (like Perth Mint’s silver Kangaroos and US Mint’s American Silver Eagles). Ainslie sell a huge range of Perth Mint and various world mint coins from 1/20th oz to 1kg, and even 10kg on request.

Pricing

Bullion is never available at the spot price as the spot price is effectively an international benchmark rate of unprocessed gold, silver or platinum. To achieve a retail bullion bar there are costs of refinement, production, packaging, freight and insurance etc. Generally, a cast bar is cheaper to produce than a minted or machined bar and hence attracts a lower premium on sale. Further a coin is more expensive again due to the minting process and the cost of the effigy on the back. As we write this article we are on the cusp of that effigy in Australia, the UK and Canada changing from the Queen’s head to the King’s for the first time in 70 years!

The next step in the pricing equation is the amount of metal. As you would expect there is not a lot more human effort to make a 1oz bar to a 1kg bar. Therefore that cost as a percentage of the weight of metal is less and hence diminishing premia as you get into larger bars. The choice then for investors is one of paying a slightly higher premium for smaller bars or coins against the greater liquidity flexibility provided by smaller bars. In other words, you have the choice to sell smaller amounts if you want (or more maybe NEED) to.

We trust this leaves you a little wiser on the world of precious metals bullion, but as always feel free to email, phone or pop on our discord channel with any questions.

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************