What are the 3 Y’s Telling the Market: Yen, Yuan, and Yellen?

News

|

Posted 01/05/2024

|

1804

This week has been dominated by three crucial 'Y' indicators. Starting Monday with the Yen, on a public holiday with low liquidity, the USDJPY soared to 160 only to plunge back down to the closely watched 155 level. The Yuan, not wanting to disappoint, followed the Yen's devaluation and subsequent bounce. Who intervened? It remains unclear, but it possibly, if not coordinated, at least seemed that on the 29th of April, when Japan was on a public holiday, someone sold U.S. Dollars and bought both Yen and Yuan on two separate occasions. The final 'Y' indicator occurred last night when Yellen, who oversees Treasury auctions amid significantly lower tax receipts (despite booming U.S. employment numbers), delivered a significant warning with her concerns about the U.S. deficit, stating, 'The U.S. needs to take significant steps to reduce the budget deficit.' Powell, her Federal Reserve counterpart, has indicated for more than a year that the deficit is fuelling inflation, but Yellen seemed to be a holdout in criticizing the Biden deficits. Last night, that appeared to change—six months before the U.S. election and two days after the latest treasury auction numbers were calculated, this seems a bit panicky, especially from someone who confidently stated in September 2023 that she wasn’t worried yet about the US$33 trillion debt. It's interesting how an additional $1.7 trillion in 7 months, with no Federal Reserve support on interest rates, can change the tune.

Let’s Start with the Yen

As Japanese inflation levels finally move above zero, the Bank of Japan has quietened. In the past decades, Japan has attempted to support the economy through quantitative easing, essentially buying their own debt and creating liquidity. Now, rather than supporting their economy, as their interest rates have been lower than the rest of the world, they created a gigantic carry trade and moved that liquidity into the rest of the world. With a deficit of 260% of their GDP, they now face the impossible task of needing to raise interest rates and pay interest. Basically, they can’t, which everyone knows, and if eventually these carry trades unwind, which with interest rate differentials where they are looks unlikely now albeit inevitable in the future, traders are knowingly punishing Japan for the predicament they are in and rewarding the USD, although they appear to be in a similar situation. So, on Monday, as the Japanese celebrated Showa Day (the Emperor's birthday), someone started selling USD and buying Yen. The BOJ has chosen not to comment on this. This saw the USDJPY rapidly drop back to 155 and appeared to happen 2-3 times during the day.

The market had been speculating when the BOJ may intervene— previously in 2022 in response to a similar Yen devaluation the BOJ had spent $60 billion in reserves defending the Yen when it reached 146. Now these efforts appear to be futile, with the Yen currently sitting back up at 157.7 only 2 days after the intervention.

Without U.S. economic data supporting rate cuts, which no one wants coming into an election, this currency conundrum and economic miracle looks to continue into the November 2024 U.S. election.

The Yuan

Unlike the Yen, the CBC pegs the Yuan to the USD and tries to maintain the rate. There has been much talk about the Chinese government looking to devalue the Yuan to support economic growth in the ailing Chinese economy. On Monday, a similar occurrence happened to the Yen—with the Chinese Yuan losing the peg and apparently needing some type of intervention. The Yuan first lost its control in the closing hours of Friday the 26th, which may have impacted the USDJPY, and then again, several hours after the BOJ intervention. We don't profess to understand currencies, but ultimately, it looks like a tug of war between the Yuan and the Yen over the USD.

Interestingly, on the 30th of April, the PBoC reduced its reference rate to the USD to 7.1063 from 7.1066, despite it currently trading around 7.225. This does not appear to be a country trying to devalue its currency.

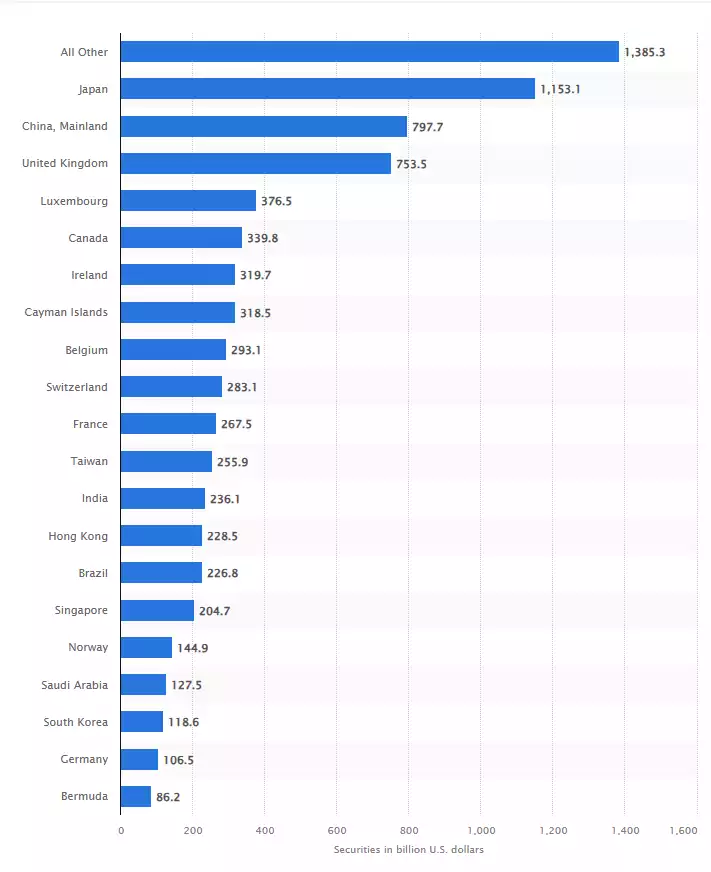

Yellen Cracking

At this point, if you can’t see the stress in the currency markets, you’d need to be blind, but to add another dimension to the panic, Yellen last night came out with a few statements starting to show the cracks in the U.S. Treasury market. With countries like Japan and China defending their currencies against the USD steamrolling, Yellen must be worried as they will sell treasuries to support their currencies—right when the U.S. needs them to buy. Japan and China together own around US$2 trillion of outstanding treasuries—by far the two biggest owners, and as Yellen’s auctions for new treasuries grow, China and Japan are looking to sell.

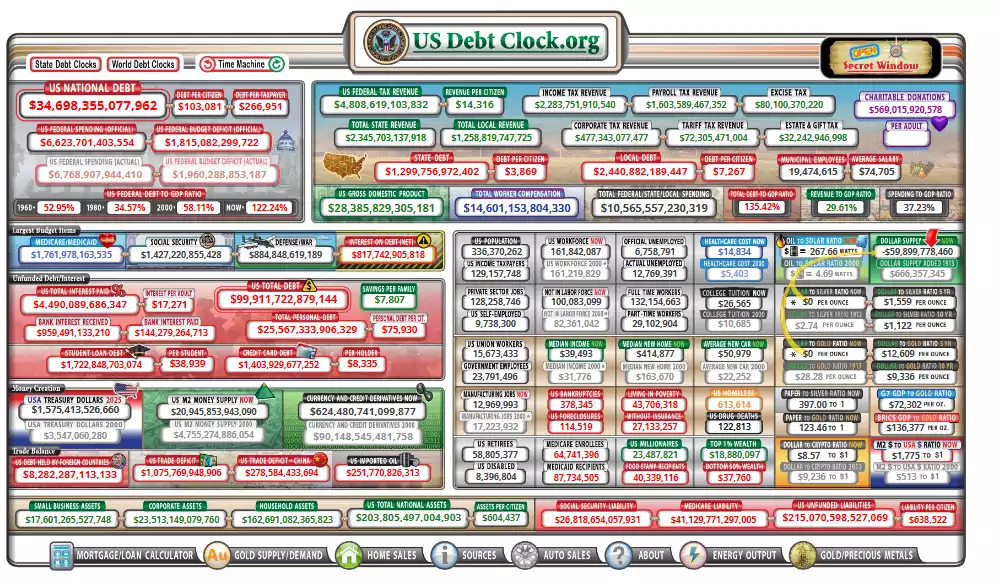

In last night’s testimony to the U.S. House Panel, in response to Larry Summers, ex-Treasury Secretary's recent comments that the Fed may still need to raise rates to tame inflation, Yellen stated, 'He’s a person who’s been wrong in the past,'—well, there’s always wishful thinking to help a market. In September last year, Yellen stated all was well and US$33 trillion was fine… last night she finally acknowledged that the U.S. needs 'significant steps' to reduce the Budget Deficit. Is this maybe because the rate of debt increases is skyrocketing under Yellen’s support for the Biden deficits?

Since September last year, the deficits have added US$1.7 trillion to the debt load.

Finally, let’s examine Yellen’s recent change of mind and the timing. April 19th was tax day in the U.S., where all citizens settle their tax returns and pay the difference. On the 30th of April, with these returns tallied, the Treasury Refunding Announcement announced the treasury is anticipating borrowing an additional US$41 billion in debt, due to lower-than-expected tax receipts. We can only surmise that the lower-than-expected tax receipts may not be painting as rosy a picture of the U.S. economy as politicians would like you to see, and this may be the reason Yellen has changed her tune, with deficits increasing and tax receipts decreasing, the Treasury's job just got a lot harder.

So Do the Y’s Have It?

It appears this week's Y indicators are pointing towards a more worrisome currency and treasury situation than has been observed so far, the stress is becoming worse meaning volatility will follow. Get ready for the roller coaster, as banks fail, currencies crash, and indicators are harder to manipulate. The panic is likely to start appearing on more faces than just Yellen's.