Weaponised Currency “Tsunami is Coming"

News

|

Posted 08/08/2019

|

10497

If you hadn’t noticed, there is a ‘little’ currency war playing out at the moment and it is sending shockwaves through markets.

Last night gold hit the USD1,500 for the first time since 2013. However that is only a 50% retracement of the fall from the 2011 high of USD1,900 to the 2015 USD1,050 low. But that is only half the story. The currency wars are seeing countries around the world devaluing their local currency to compete in the weakening global economy and the accompanying loosening monetary policy driving up their sharemarkets.

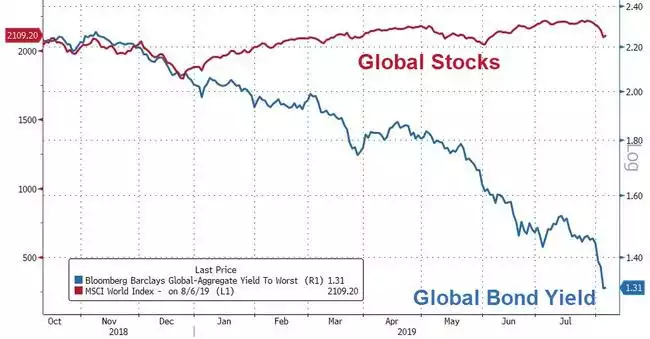

You can see the disconnect this is delivering between the normally correlated share prices and bond yields, the latter the proxy for interest rates and ensuing weaker currency. One of these will be correct…

And so, whilst the USD gold spot price is still well off all-time highs we see record gold prices of course at home in Australia, but also in the likes of the UK, India, Canada, Japan and South Africa. With the central banks of these countries striving to devalue their currencies, holders of gold have been enjoying the gains in the local gold price. With the EU seemingly heading to a recession and further into negative rates, and China devaluing their currency in retaliation to tariffs, these two have been the star performers of late but still off all-time highs. For now…

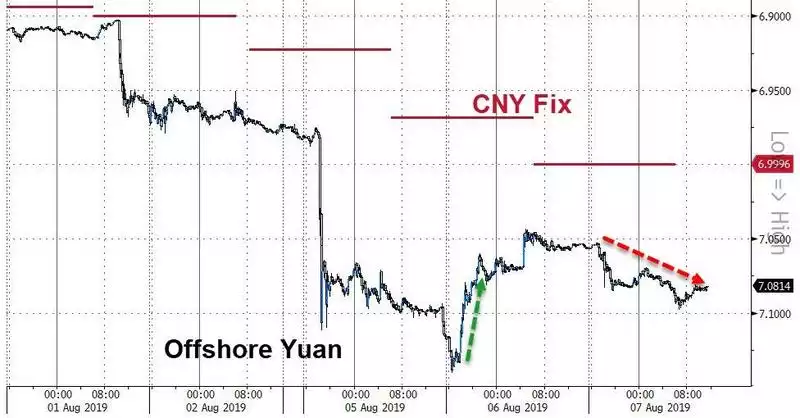

All eyes are, however on China. It let the Yuan sink below ‘the line in the sand’ 7 against the US dollar which saw shares plummet along with bond yields and gold surge on Monday night. As the tension between Washington and Beijing escalates all eyes are on how much more the Chinese will unleash and who will blink first. Kyle Bass told CNBC he thinks the Chinese could drop another 30-40%!

"What’s happening in China is they have to have dollars to sell to buy their own currency to hold it up. If they were to ever free float their currency, I think it would drop 30% or 40%.....And the reason is they claim to be 15% of global GDP in dollar terms, but less than 1% of global transactions settled in their own currency……And so, they prop their currency up...everyone calling them a currency manipulator – they are trying to hold this whole thing together."

One could only imagine the carnage such a drop would cause…

Those who were across the bullion scene back in August 2015 when China first had that shock devaluation and sharemarkets crashed over 10% will remember how bullion stocks quickly dried up around the world. Already we are seeing signs of this again after the demand over the last week. We wrote about this last October, including what is becoming a rather prophetic prediction from Jim Rickards. You can (and should) read that here.

If you’ve missed some good commentary on the current set up, the following from London’s The Telegraph’s Ambrose Evans-Pritchard gives a good account of the gravity of this.

“China has hit back against the Trump administration with a drastic exchange rate devaluation, almost guaranteeing a superpower showdown and a lurch towards full trade war.

The yuan blew through the symbolic line of seven to the dollar for the first time since the global financial crisis, with the offshore rate in Hong Kong spiking to 7.07 in moves that stunned seasoned traders.

The calculated action by the People's Bank (PBoC) threatens to unleash a wave of deflation across the world and risks pushing East Asia and much of Europe into recession. It is certain to provoke a ferocious response from the White House.

Capital Economics said Beijing has taken the fateful step of "weaponising" its exchange rate and is digging in for a long struggle: "The fact that they have now stopped defending 7.00 against the dollar suggests that they have all but abandoned hopes for a trade deal with the U.S."

Commerzbank said China's decision to engineer such a sudden move in its tightly managed currency has far-reaching implications for the whole international system. "It looks like a tsunami is coming."

The shock waves were felt instantly through the nexus of global bond, equity, and commodity prices. It triggered a flight to safe-haven currencies such as the Japanese yen and the Swiss franc, an effect compounded by the thin liquidity conditions of August trading.

Yields on 10-year German Bunds plummeted to minus 0.53 percent, taking much of the eurozone sovereign bond market further into uncharted terrain. The euro Stoxx 50 index of equities has fallen 5 percent since late last week.

While the Chinese government says 7 is an arbitrary level of no macro-economic significance, it has intervened repeatedly in the past to prevent this psychological threshold being threatened.

In case there was any doubt over the motive of today's action, the PBoC issued a statement linking the new rate to "unilateralism and trade protectionism measures and the imposition of tariff increases on China." Despite not naming the U.S., it clearly meant Mr. Trump's latest threat to impose 10 percent tariffs on all remaining Chinese goods in early September.

The PBoC vowed to keep the currency "fundamentally stable" but it is walking a fine line. Capital controls are tighter than they were during the currency scare of 2015-2016 -- when China was losing $100 billion of foreign exchange reserves a month -- but money is still leaking out. Confidence is increasingly fragile.

"The worry is that a break beyond 7 could send the Chinese currency into a vicious circle in which selling leads to more selling," said Ke Baili from Caixin.

Kyle Bass, a long-time China bear at Hayman Capital, said a "mass exodus" of capital is already underway as political protest in Hong Kong reaches crisis point and China's debt-driven growth model reaches the limits. "The collapse has just begun," he tweeted.

Most analysts say the move by the PBoC is a deliberate choice, but that is hardly more reassuring for investors. It means that the Chinese Communist Party is willing to risk a full-blown conflict with Washington on every economic front. Beijing has simultaneously ordered state bodies to halt purchases of all farm products from the U.S.

This escalation comes at a highly sensitive moment. A meeting at the White House in late July actively discussed using the U.S. Treasury's Exchange Stabilization Fund to buy foreign currencies and drive down the dollar as a matter of policy -- an extraordinary moment in the history of the world's paramount reserve currency. It is no surprise that gold has surged to a five-year high of $1,470 [now a 6 year high of $1,500].

The White House discussion was kicked into touch but the issue did not go away. It is now back as a red-hot theme. Mr. Trump's trade guru, Peter Navarro, said over the weekend that currency manipulation by China is one of its "seven deadly sins."

Capital Economics said the Chinese appear intent on neutralising Mr. Trump's tariffs by letting the currency slide pari passu, implying a devaluation of up to 10 percent. This means a parallel yuan devaluation against the rest of the world. It effectively exports trade stress to third countries and risks pushing much of East Asia into a deeper downturn.”

Last night, after a brief reversal Tuesday night, the Yuan fix was lower again.