Wealth inequality, gold and silver – a salient lesson

News

|

Posted 19/11/2019

|

23547

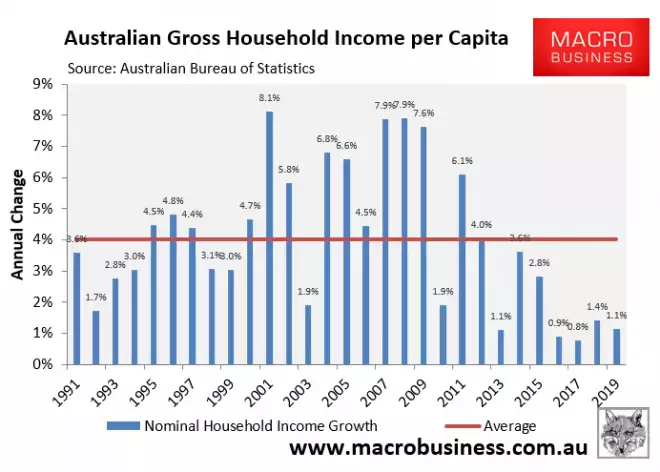

It will come as little surprise to many readers that real income in Australia is going backwards. Recent data from the ABS paints a clear picture. Firstly nominal gross household income per capita rose by just 1.1% in the year to June 2019:

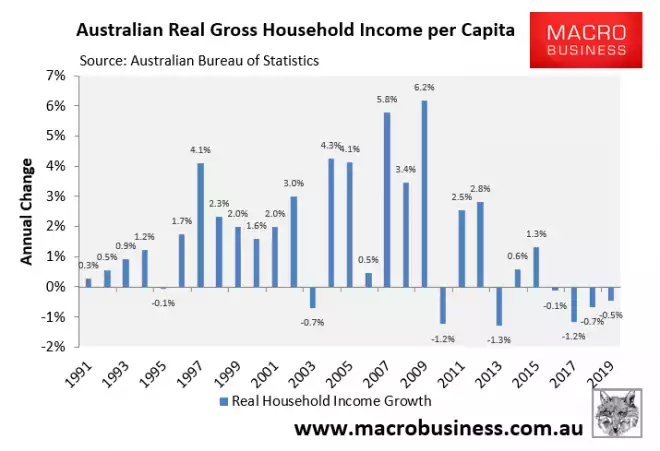

Then real (after official* inflation) is actually down 0.5%:

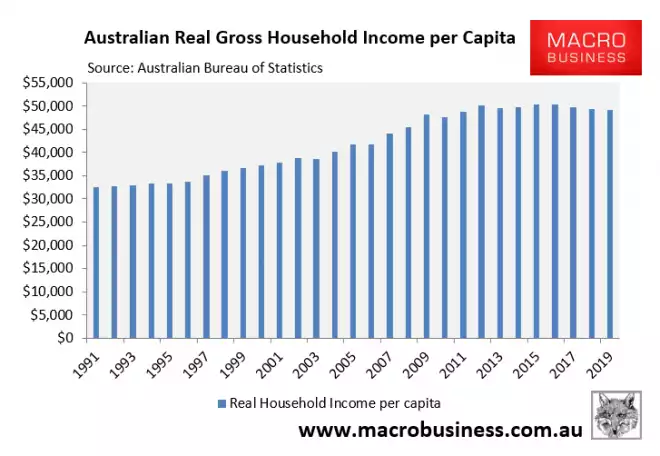

And in actual terms, real gross household income per capita is lower today than it was in June 2012, down 2.0% over the past six years:

We and many others have written ad nauseum about the wealth inequality effects of all the central bank and government monetary stimulus since the GFC. You will note the asterix next to the word official above in describing the applied inflation rate. Many ‘real world’ people would strongly argue inflation is much higher than the government’s official 1.7%. From today’s The Australian:

“The price of consumer goods has stagnated, but asset prices have soared. Had house prices, for instance, been included in the consumer price index, inflation would have been consistently above the Reserve Bank’s 2 per cent to 3 per cent target.

Surveys show people believe inflation to be closer to 4 per cent, whatever the official figures say. And for all the discussion among economists about how to fine tune the inflation target, most of us have no idea what that is. Maintaining public confidence in money might be a better target.

If the Reserve Bank begins creating electronic money (as we discussed last week here) to buy government bonds in the new year, as many economists expect and as central banks have been doing abroad, the public might start wondering how much intrinsic value their deposits have.”

In other words, is unintended higher inflation on its way?

Whilst in the US a lot of that newly created money and stimulus saw their sharemarket rally strongly (and again hitting new all time highs yesterday), in Australia, our sharemarket took until just a couple of months ago to just get back to pre GFC highs, some 10 years later. So where has all the money gone here? You guessed it, property. Again from The Australian:

“We’ve created a lot of new money since the GFC; most of it went into real estate

We all know houses are much more expensive than they used to be, with more suburbs passing the $1m median price mark. That can be good for us, or bad — it depends from where you are viewing it.

But when priced in terms of gold — for hundreds of years the international measure of value — it’s another story. The median Sydney dwelling price is $818,000. That’s 378 ounces of gold, about 10kg. A decade ago Sydney’s median dwelling price was $470,000, according to Corelogic data. That’s 373 ounces of gold based on the price back then. So the price of a Sydney houses has appreciated 75 per cent, but only 1.3 per cent in terms of gold.

It’s a worry; perhaps wealth hasn’t increased much and our wages, in term of gold, have plummeted. But don’t panic. Gold lost its formal role as the anchor of the global financial system in 1971. It’s no longer money but instead a speculative metal whose price tracks sentiment about the outlook for economic growth — and confidence in our money system.

Nevertheless, its rise in price should give central banks cause for thought. It’s naive to think the relentless march of so-called unconventional monetary policy isn’t eroding public confidence in the financial system. Central bankers have been fretting about the prospect of deflation, but might the gold price spike suggest the opposite?”

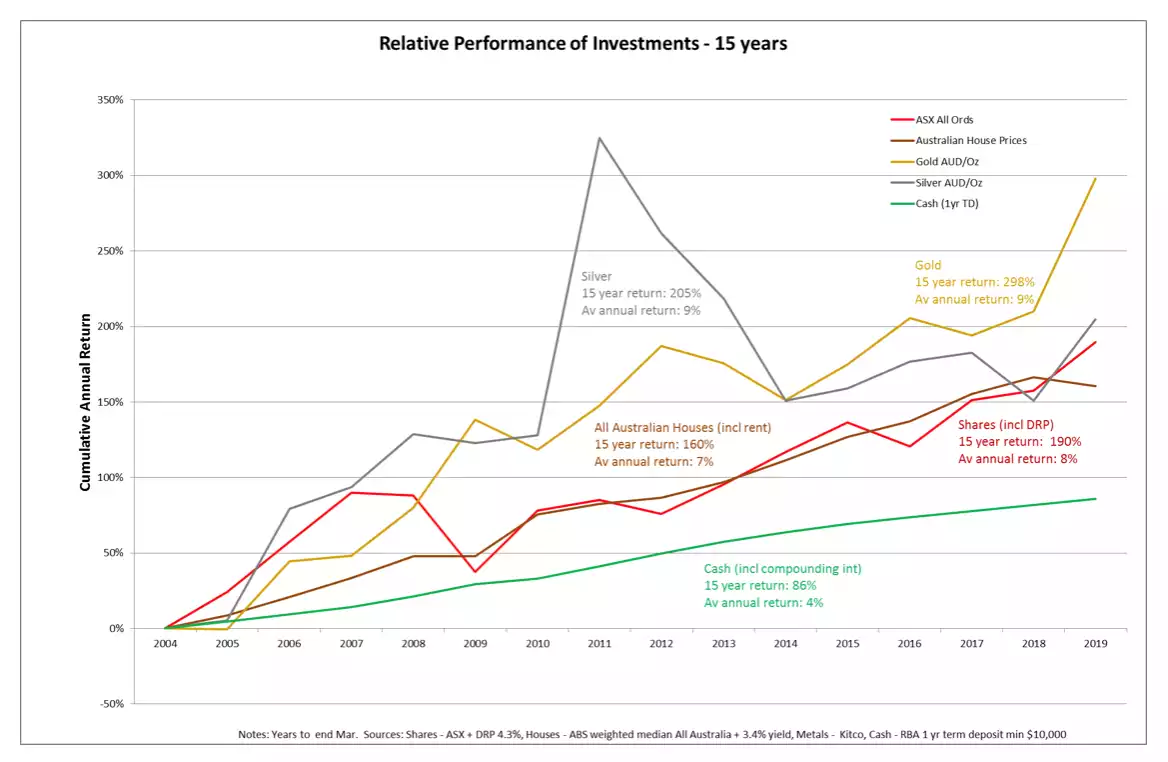

Gold’s rise has hardly been a ‘spike’. You may recall our chart of prices of each Aussie asset over the last 15 years (including rent, dividends and interest on term deposits to level the playing field) shows gold and silver have outperformed both shares and property:

Note closely how gold and (the more volatile) silver have increased in each year shares and property dipped.

Regardless, yet again, as seen over thousands of years, gold has protected people’s wealth from the erosion effects of fiat currencies and the irresistible urge of human greed to game the system through it.

Absolutely anyone can own gold and silver in as little or as great a value as suits their budget. Particularly now with the introduction of Gold and Silver Standard tokens (https://www.goldsilverstandard.com/) buying small amounts is very easy and cost effective. We were featured on the front page of the business section of Saturday’s Courier Mail in Brisbane last weekend. In that article they reported we did over 5,000 trades of these tokens on CoinSpot in 2 months. Those trades totalled $2.1m or just $400 per trade on average. There are many many trades of less than $20, and all at the same rates those buying $100’s of thousand pay. Such is the beauty of the blockchain and the accessibility of gold and silver in our modern age.

Whilst the realm of the property market and sharemarket is often only for those on higher incomes, gold and silver, which has outperformed both and protected your wealth from the effects of this debasement of your hard earned, is readily available to all in whatever quantity suits any budget.