Was that the ‘backtest’? Trade War ‘Fixed’?

News

|

Posted 06/09/2019

|

15107

Last night was possibly the night a few of the technical guys have been waiting for with silver smashed 4.5%, gold 2.3% and wiping out all the gains of the night before.

Some technical analysts have for a while now have been calling for such a pull back after such a strong uninterrupted rally. One of the best in the closed group of Nuggets Crypto Community (you can pay to subscribe here) noted yesterday (before the hit last night) about the following chart “The implications are enormous. Silver has broken a mighty resistance. Expect backtest as per textbooks then off to races.”

Whether 4.5% is enough of a ‘backtest’ is anyone’s guess, but the ‘races’ do still appear to be ahead of us still.

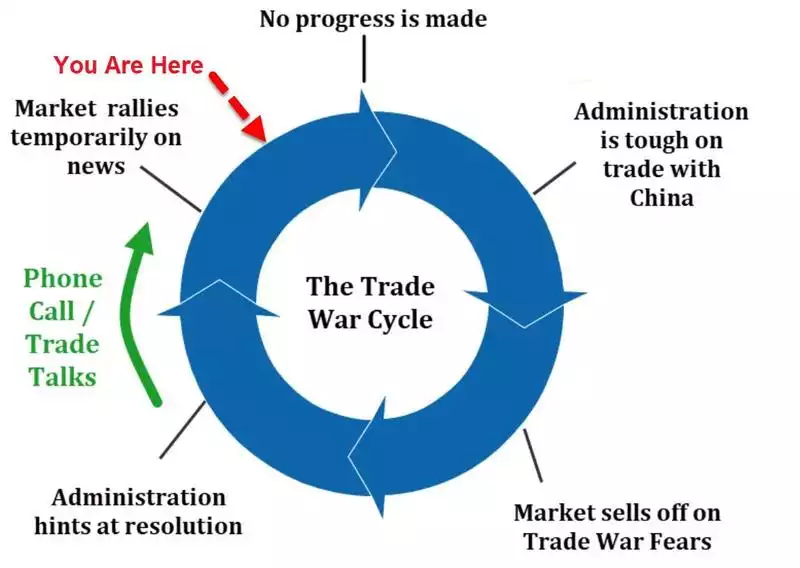

The catalyst for the pullback in precious metals and the surge in shares was on news of Trump and Xi agreeing to meet in October. Meet. This is a market gagging for good news on the trade war and they pounced on it. We came across the following which puts that ‘good news’ into perspective…

The latest trade war ‘progress’ fundamentally changes little given the level of distrust on both sides. From Bloomberg:

““No one is holding their breath” with regard to the talks, said Chua Hak Bin, an economist at Maybank Kim Eng Research Pte. in Singapore. “ Investors are slowly coming to terms that a trade deal is increasingly remote, with both sides talking tough and preparing for a long battle.””

Also, for context, the US imposed tariffs relate to $250b of Chinese goods, compared to a $12.2 trillion GDP and the China imposed tariffs of $185 billion against the USD GDP of $19.5 trillion. That is in no way to say the trade war is not a big deal, but there are far bigger structural issues in the global economy at present that don’t simply get fixed with what is still an unlikely ‘good’ outcome.

As we touched on in our Crypto Koala interview yesterday, there is a bigger ‘game’ at play here between the US and China and one shouldn’t expect an easy solution to this trade war.

This all comes as last month saw another 122 tonne of gold added to gold backed ETF’s around the world, up another 5% of AUM. Per the WGC press release yesterday:

“In August, global gold-backed ETFs and similar products had US$6.0bn of net inflows across all regions, increasing their collective gold holdings by 122t to 2,733t. Total holdings are 59t tonnes or 2% away from all-time highs of 2,791t, which occurred in late 2012 when the price of gold was 9% higher (US$~1,665/oz).”

Those inflows are just shy of the epic inflows of June this year: