War With Iran? (& happy All-Time-High AUD Gold price day!)

News

|

Posted 19/10/2023

|

2915

Last night the gold price in Aussie dollar terms hit an all time high of $3081/oz. In USD spot price terms its current $1950/oz is still over $100 from its 2020 high of $2063. That gold surges in unison with the US Dollar speaks volumes for the fear in financial markets and of course turbo charges AUD gold in lockstep. This is as much about the frightening US bond market as it is about the war, but lets look more closely at the war side of things:

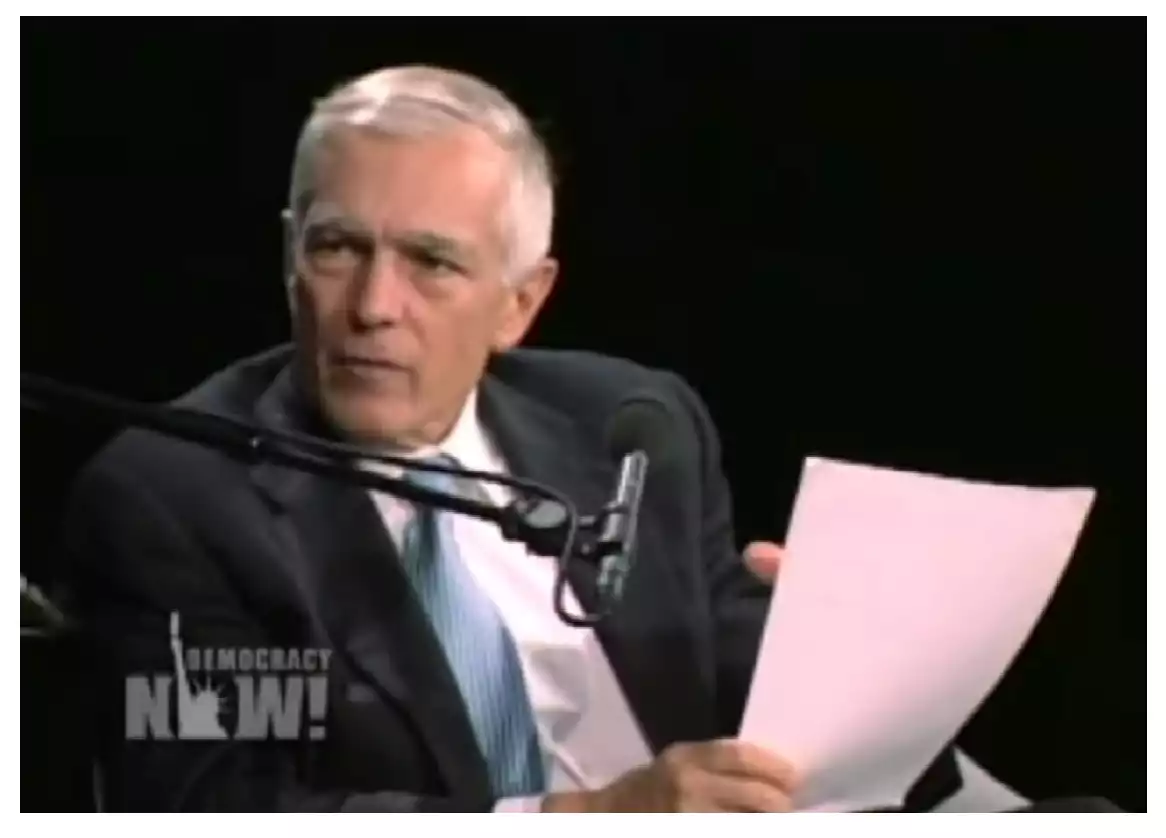

"This is a memo that describes how we're going to take out 7 countries in 5 years, starting with Iraq and then Syria, Lebanon, Libya, Somalia, Sudan, and finishing off, Iran. I said is it classified? He said 'Yes, sir'."

-Gen Wesley Clark, Democracy Now! interview, 2007

This interview from 2007 is beginning to resonate with the current situation in the Middle-East. A quick search for news on the conflict is starting to show news heavily weighted towards Iran and their involvement:

“Iran, if you escalate this war, we’re coming for you,”

"If Hezbollah Enters War, Iran Will Be "In The Crosshairs" Of U.S. And Israel"

-Senator Lindsey Graham, on NBC

Donald Trump Warns Iran Is Building 'Large Scale' Nuclear Arsenal

-Newsweek

Will the US-Gaza war expand to Iran's proxies?

-Australian Broadcasting Corporation

Iran's Middle East allies primed as Israel-Hamas war rages

-Reuters

Iran's Role in the Geopolitical Landscape

Iran, a major player in the Middle East, has been at the centre of international attention due to its regional influence and nuclear ambitions. Tensions between Iran and other nations, especially the United States and its allies, have created a heated geopolitical situation. Any escalation in these tensions, including the possibility of military conflict, could have profound implications for global financial markets, including the price of gold.

Compared to Iraq, Iran’s population is more than three times the size. Iran also has nearly double the military personnel compared with Iraq at the time leading up to the war. One of its main advantages may be the geography around the country. It’s well protected by the Caspian Sea to the North and the Persian Gulf and Gulf of Oman in the South. The Strait of Hormuz which connects the two gulfs is so narrow, it would not take much to defend. Iran also benefits from being surrounded by countries that have shaky ties to the US, to say the least.

-Gold from 1 October until today

How War Can Bolster Gold's Price

- Safe-Haven Demand: In times of uncertainty, investors seek safe-haven assets like gold, leading to increased demand and higher prices. The simplicity of this safe-haven means it cannot “go out of business” like a company can if a missile lands nearby, or if money is simply redirected towards the war effort and away from consumer luxuries.

- Dollar Devaluation: Geopolitical tensions often lead to a weakening of the US dollar as investors seek refuge in other currencies or assets, boosting gold prices. This can especially happen if the country is actively funding multiple wars at the same time and needs to create vast sums of new money.

- Supply Chain Disruptions: Conflicts can disrupt the supply chains of various commodities, such as gold, leading to supply shortages and price hikes. We saw this recently when China attempted to control gold imports and inadvertently caused a $100 USD premium on the price of gold per ounce.

- Central Bank Policies: Central banks globally might increase their gold reserves as a safeguard against economic instability. We have already seen that happening this year, but how much could this accelerate if all global powers are dragged into a proxy war?

Joe Biden has just landed in Israel to meet with Netanyahu in the shadow of a US Navy fleet just off the coast. Let's see what happens if the current conflict expands to include more allies, and potentially, Iran itself.