Wall Street Tanks, Democrats Surge, Debts Explode

News

|

Posted 12/06/2020

|

29377

Yesterday on talking about the Fed meeting the night before and shares falling we asked: “The Fed’s tone was very dovish on the back of poor forward estimates which ordinarily would see the ‘pure stimulus driven’ sharemarket rally on the promise of more stimulus, but maybe, just maybe when combined with dire warnings from OECD, share traders paused and realised how bad things are… maybe.”

Well last night ‘maybe’ took on a sense of certainty as sharemarkets crashed the most since the rout in mid March, wiping $2 trillion of US sharemarkets. The Dow ended down a whopping 6.9%, S&P500 down 5.9% and even the market darling “tech stocks are different” NASDAQ index fell 5.3%. The USD ended its losing streak with gusto which also saw the AUD pushed back into the mid 68’s. Gold got caught up in the ‘sell everything’ melee, down 0.7% in USD terms but that falling AUD saw gold up 1.4% or $35 here (though silver still down 16c). Bloomberg ran the telling headline “The Stocks-Only-Go-Up Strategy Falls Into a $2 Trillion Ditch” talking to the recent phenomenon of retail mum and dad investors piling into the market the Fed would never let fall.

It wouldn’t be the first time retail investors have been suckered in at ‘the end’ with that being the same case in the GFC with all the sub prime debt being packaged and sold to these unwitting participants. At the same time retail investors have been piling in, the big money has been sounding warnings. In just the last couple of weeks we have seen J P Morgan and Credit Suisse join Bank of America (who a few weeks ago called for $3000 gold within the next 18 months) turning bullish on gold amid growing concerns about the disconnect of the economic reality and sharemarket farce.

Whilst the Fed’s and OECD’s dire outlooks weighed heavily, last night was probably exacerbated by the latest jobs figures which reinforced job losses are still large and putting (even more) substantial doubt about the ‘surprise’ NFP figures that so fuelled the new irrational exuberance theory of a strongly rebounding economy.

Technically too last night was important. Many of the technical commentators believing this to be a bull trap rally were expecting the Dow to bounce off the Fibonacci 61.8% retracement level and yet instead it smashed through it a couple of weeks ago reaching 80%, feeding the bulls that this was indeed a new bull market rally. The trend line too was self reinforcing as each low was a higher low. Both came crashing down last night with the falls both breaking below the 61.8% retracement line (albeit only just), long and short term trend lines, and falling through the 200DMA and breaking below its 100DMA. These are not large technical break outs so tonight will be interesting to watch.

Finally, but we think critically going forward, we have the US election outcome at play. Last night’s losses also coincided with polls showing the Democrats are ahead not only on the Whitehouse but also the Senate. The implications are a whole new news piece but simplistically the Democrats will likely take the opposite tact to Trump’s Republicans and move toward an MMT outcome funded in part by increased taxes on corporates and maybe all out war on the FAAMGs. That is not positive news for a sharemarket dominated by them and fuelled by tax breaks and QE. The other risk is a Democratic Whitehouse and Republican Senate. Yesterday we shared an excerpt from Raoul Pal’s interview with Australia’s Gerard Minack. He outlines these risks perfectly:

“RAOUL PAL: I'm just thinking in a disinflationary environment, we're all going to go, well, they're going to have to stimulate more. What do you think, the outcome is more.

GERARD MINACK: That's right. The one risk, as I said, that I can see on a 6-month view to that is if we do get Biden in the White House, Mitch McConnell in the Senate, you could have a real problem for America with the blocking of fiscal stimulus there [he earlier talks about Republicans blocking every fiscal stimulus plan put forward by the Dems and that leaving the US without any at all]. That risk aside, I think they're heading towards fiscal stimulus. I think Japan probably is heading towards more aggressive fiscal stimulus. I think the UK is and my point of this is, whoever the early adopter is, whoever is the first economy that says, through the expansion, we are going to do whatever it takes fiscally to achieve our policy objectives, that when that happens, there's going to be some people that say, oh, here comes inflation. Well, that may be the case.

My point is, when you start off in a world of excess capacity below target inflation, and just general solid economic conditions, even if you think you head to a world of unacceptably high inflation, there's going to be a bit in the middle where it feels really good. When that first adopter is in that stage where it feels really good, there's going to be a political leader in every other country in the world that says, see, this money printing thing does work. Why don't we do it? I think there's just going to be, the dominoes are going to fall and it's going to be very hard for any country to resist, including Europe, adopting this strategy.

The key test in my view of this change is not what we're seeing right now. We are seeing the largest budget deficits in the post-war era, but we saw the largest budget deficits in the post-war era in the GFC. When the GFC expansion, the post-GFC expansion started, we saw everybody flick the switch to fiscal austerity. The key test is not what people do in the crisis. It's what they do in the aftermath. What we need to see is that as the economies recover in the second half of the year, assuming no second wave of virus, and as we see some expansions in 2021, that if we see signs of weakness, or deceleration, that that stage, when you're still running very large budget deficits, government say, we're going to do more.

We're going to do more because we want to get unemployment back down to where it was by the end of 2021 or 2022. In other words, as I said, be willing to do ‘whatever it takes’ with fiscal tools to hit your macro targets. When we move to that world, we're in an MMT world. That's what MMT is, and so long as the central banks are willing accomplices, backstopping that fiscal action, it's MMT. We'll find out whether it blows up, I don't know, may not but it's going to be a change and it certainly will bring the curtain down on the secular stagnation era.”

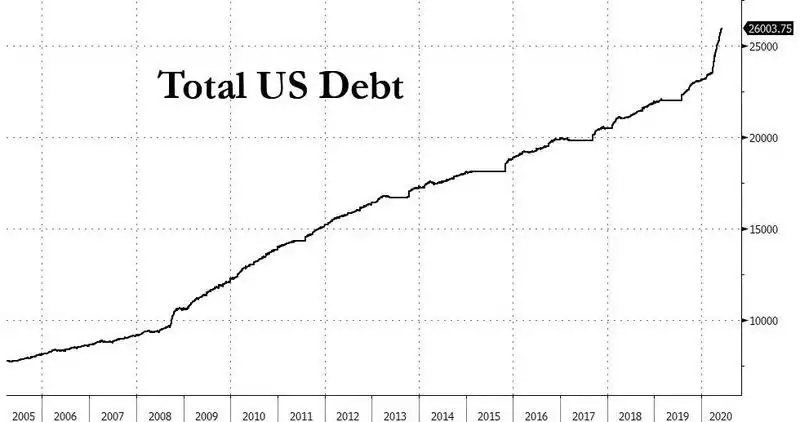

And when Minack talks about ‘very large budget deficits’ just check out the latest debt figures from the US below. Yep, you saw it correctly, over $26 trillion. On 23 March when the Fed announced its unlimited QE response to the crisis, US total debt stood at an already eye watering $23.5 trillion. Since they unleashed the ‘fiscal bazookas’ amid the pandemic crisis they have added $2.5 trillion in just 2.5 months.

For context, it took over 2 centuries for the US to accumulate $1 trillion of public debt in 1981. In just 4 decades that has exploded to $26 trillion, and most of that since the GFC just a decade ago, and a full $1 trillion of it in just the last month. 1 month compared to 2 centuries… seem sustainable to you?

If the response of governments post COVID is to double down with the likes of MMT (Modern Monetary Theory – a quasi socialist infinite money printing program) it will feel very much like the death throes of the economic empire and long term debt cycles that Wall St legend Ray Dalio spoke to recently (respectively in each link above). History tells us one thing always prevails. Gold.