WGC Q3 Gold Demand & Supply – Investment surges, Jewellery slumps

News

|

Posted 30/10/2020

|

9703

Another quarter, another World Gold Council Gold Demand Trends report and as with all things 2020, what a quarter it was… The combination of a high gold price and the effects of the pandemic saw a massive bifurcation in the 2 biggest users with gold jewellery demand plummeting whilst investment surged and whilst almost negligible in quantum, we saw the first net sales, not purchases of gold from central banks in a decade. From the report:

Demand for gold dropped to 892.3t in Q3 – its lowest quarterly total since Q3 2009 – as consumers and investors continued to battle the effects of the global pandemic. At 2,972.1t year-to-date (y-t-d) demand is 10% below the same period of 2019.

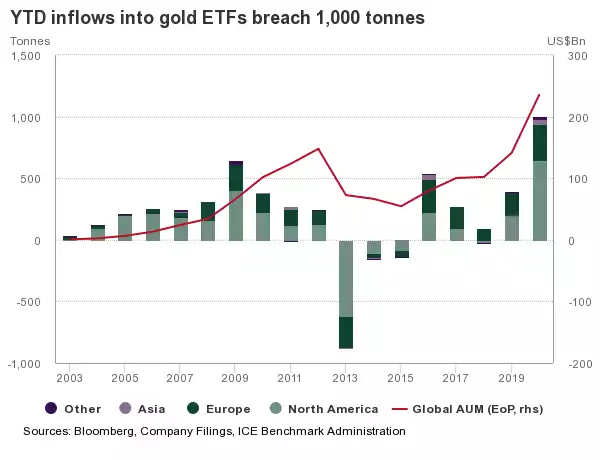

ETF Investment

Quarterly inflows of 272.5t took global holdings of gold-backed ETFs to a new record of 3,880t. While the pace slowed a little from H1, sustained inflows throughout Q3 demonstrate the continued motivation of ETF investors to add to their holdings.

Bullion investment

Bar and coin investment jumped to 222.1t in Q3 – up 49% y-o-y. Most major retail investment markets saw strong growth though the largest volume increases were seen in Western markets, China and Turkey. This contrasted with continued strong sales in Thailand.

The US dollar gold price rose to a record high of US$2,067.15/oz in early August. This was followed by a correction with the price closing the quarter around US$1,900/oz. Record high prices for gold were also seen in various other currencies, among them the rupee, the yuan, the euro and sterling.

Jewellery

The pandemic further impacted the jewellery sector. Weakness caused by COVID-19 was compounded by record gold prices: Q3 demand fell 29% y-o-y to 333t. While China and India accounted for the largest volume declines, weakness was global.

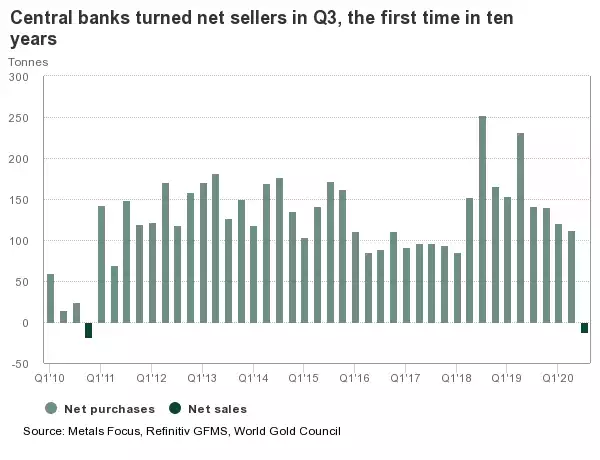

Central Banks

Central banks generated modest net sales of 12t of gold in Q3. This was the first quarter of net sales since Q4 2010, primarily due to concentrated sales by two banks, Uzbekistan and Turkey. Buying continues at a moderate pace, driven by the need for diversification and protection amid the negative rate environment.

Turkey sold 22.3 tonne in the quarter as it battles to manage its currency and facilitates trades to support its commercial banks in times of high gold demand. Uzbekistan reduced its gold reserves by 34.9t during Q3, bringing y-t-d net sales to 28.6t. Despite the sizable sale in Q3, gold reserves of 307t still account for 56% of total reserves. The country has seen a rise in gold exports this year as it looks to utilise its gold reserves, capitalising on higher prices to combat the economic impact of the pandemic.

Technology

Demand for gold used in technology remained weak in Q3, down 6% y-o-y at 76.7t. But the sector saw a decent quarterly improvement as some key markets emerged from lockdown.

Supply

Total supply fell 3% y-o-y in Q3 to 1,223.6t. Mine production was 3% lower y-o-y as the industry continued to feel the effects of the H1 COVID-19 restrictions. That said the biggest declines in the quarter had nothing to do with COVID. The stalemate between Barrick and PNG saw the suspension of the giant Porgera mine and the world’s biggest producer, China, posted another 3% decline due to implementation of stricter environmental policies. Russia, hot on the heels of Australia for the #2 position saw a massive 13% decline due to lower grades yielding less as the easy stuff has already been mined and the record year they had last year.

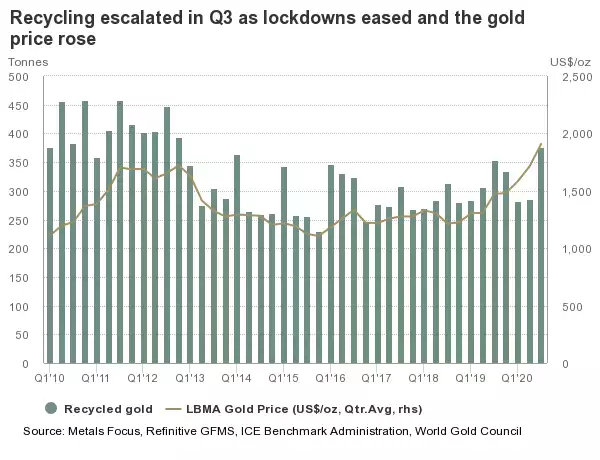

Recycled gold supply increased 6% y-o-y, with recycling channels reopening as consumers and retailers emerged from lockdown and its predictable correlation with a higher gold price as can be seen in the chart below. On a y-t-d basis, total supply remained 5% lower than the same period last year due to the disruption caused by the pandemic.