WGC – Gold Market in 2018

News

|

Posted 22/01/2018

|

8038

The World Gold Council recently published their outlook for 2018 and identified 4 Major Trends for the year ahead.

You can access the full report here or below is our summary:

1. A year of synchronised global economic growth

The world appears to be returning to economic normality with global growth increasing in 2017 and expected to continue into 2018. (On Friday we shared a chart with you showing this growth has been ‘bought’ with far more debt than growth achieved, but it is growth nonetheless so let’s continue with their view….). Critically too, China and India, the very dominant two major gold buyers, are enjoying particularly strong growth. From WGC:

“Our research shows that continued economic growth underpins gold demand. As incomes rise, demand for gold jewellery and gold-containing technology, such as smartphones and tablets, rises. Income growth also spurs savings, helping increase demand for gold bars and coins.”

“Increased consumer demand supports the investment case for gold and highlights its dual nature. Investors often focus on gold’s effectiveness as a hedge against financial shocks. But rising wealth underpins gold consumer demand, which, in turn, supports gold prices over the longrun. The interaction between investment and consumption also results in gold’s lower correlation to other mainstream financial assets, making it an effective diversifier.”

2. Shrinking balance sheets, rising rates

We discussed this last week and they continue the discussion around the big central banks reigning in their stimulus and reducing their balance sheets. Simplistically this means higher rates and higher rates are not normally good for gold due to opportunity cost. However the WGC point out that apart from the obvious risks to stimulus dependent markets we have discussed at length, there are nuances like “Government bonds – the chief beneficiaries of quantitative easing – may come under pressure and their multi-decade high returns decrease.” Their view is that real interest rates (headline less inflation) will remain well within the range where gold historically does well, 0%-4%.

3. Frothy asset prices

This is no new news for regular readers and is the elephant in the room. Valuations in all forms of measure and comparison are at or near all-time highs, not just in shares but in property and higher risk debt like corporate and junk bonds. From WGC:

“In addition, investors have been forced to take on additional risk to generate additional returns. In the credit markets, they have increased their exposure to lower quality companies. According to the St Louis Fed, the spread between BAA rated corporate bonds and 10-year US treasuries is the lowest since 2007, while the Chicago Fed has noted that credit conditions are at their loosest levels since 1994. Investors’ hunt for yield has fuelled rampant asset price growth elsewhere: in China, for example, property prices almost doubled in the period January 2015 to October 2017.” And let’s not get started on Australian property prices….

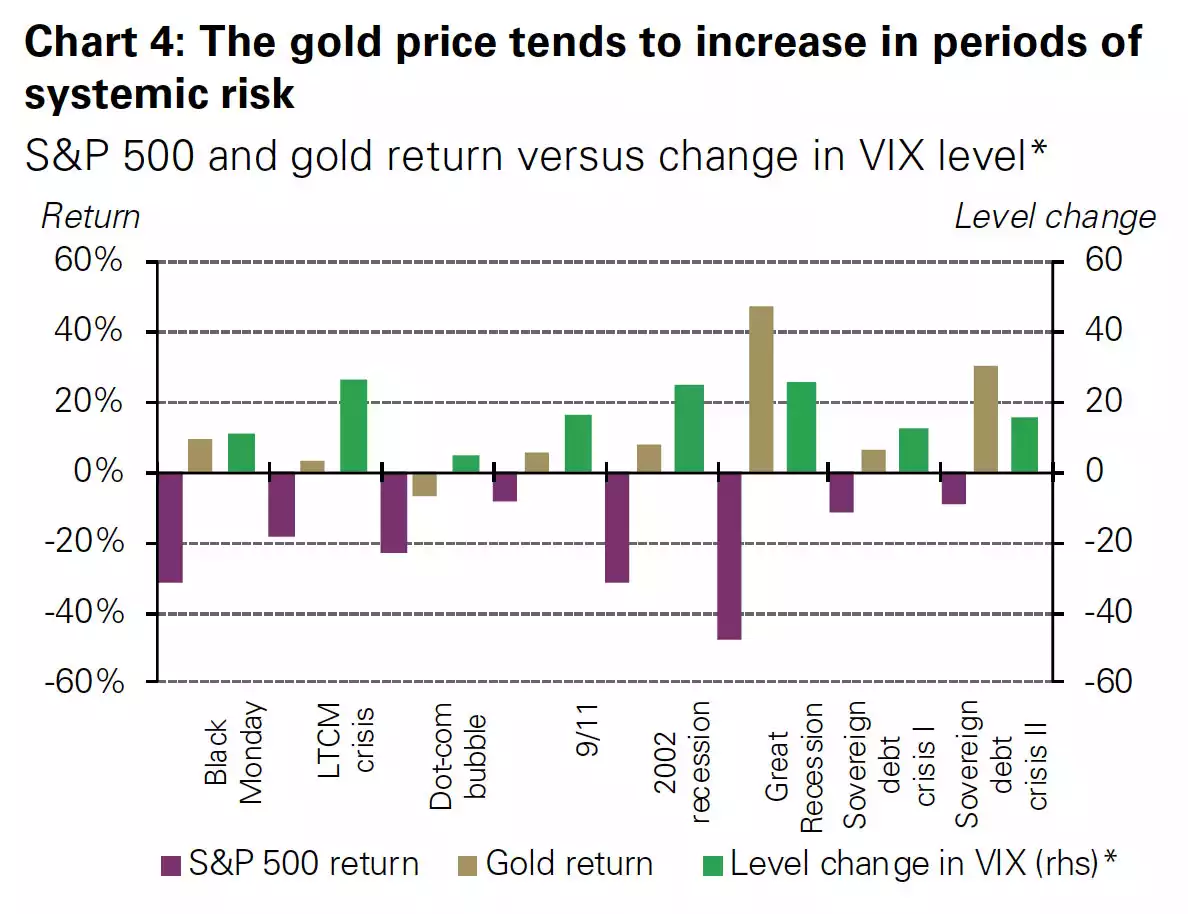

“Should global financial markets correct, investors could benefit from having an exposure to gold as it has historically reduced losses during periods of financial distress (Chart 4)”

The VIX is available only after January 1990. For events occurring prior to that date, annualised 30-day S&P 500 volatility is used as a proxy. Dates used: Black Monday: 9/1987-11/1987; LTCM: 8/1998; Dot-com: 3/2000-3/2001; September 11: 9/2001; 2002 recession: 3/2002-7/2002; Great Recession: 10/2007-2/2009; Sovereign debt crisis I: 1/2010-6/2010; Sovereign debt crisis II: 2/2011-10/2011. Source: Bloomberg, World Gold Council

4. Market transparency, efficiency, and access

In this section they talk largely to new products entering the market making it easy for more people to get into gold. As we discussed last week most of these are a derivative or ‘paper play’ of some sort, which begs the question “Why?” when owning the real thing directly is so easy. However as holders of gold, any new demand through whatever vehicle people use is a good thing for the price. For us however it is the news of Russia that really excites us:

“Currently, Russia’s tax rules virtually prohibit gold investment. Individual and institutional purchases of gold bars are subject to value added tax (VAT) of 18% – the highest rate in the world. This may change in 2018. A draft amendment to the tax code proposing an exemption for gold has been submitted for consideration by the Russian government. If approved, it may herald the development of a new gold investment market.” There is a mountain of money in Russia and they may well be taking their cue from their central bank who bought a record amount last year. This is definitely a space to watch.