WGC Gold Demand Trends Q3

News

|

Posted 08/11/2019

|

15556

This week saw the World Gold Council release their quarterly demand trends report and yesterday the ETF report for October. As usual we pass on the findings.

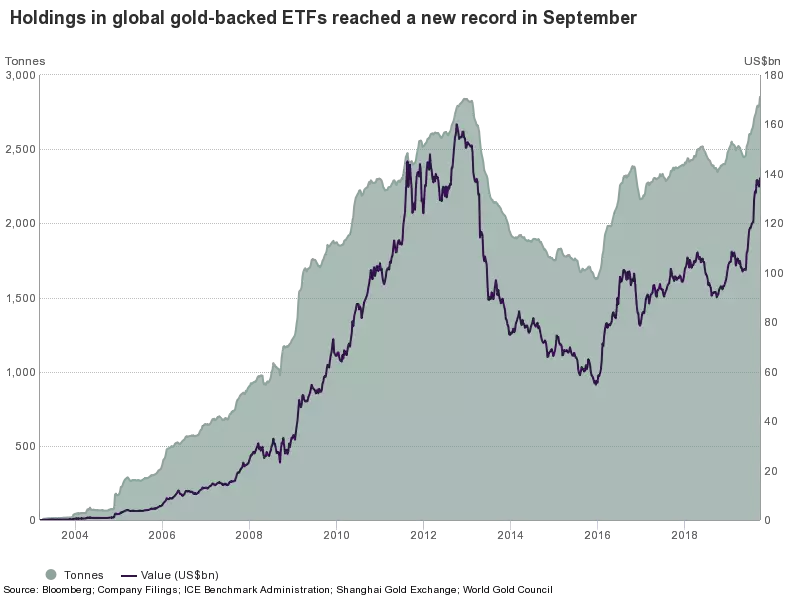

Investment

Holdings in gold-backed ETFs hit a new all-time high of 2,855.3t in Q3. Holdings grew by 258.2t during the quarter, the highest level of quarterly inflows since Q1 2016. Accommodative monetary policies, along with safe-haven and momentum buying, drove demand. Global gold-backed assets under management (AUM) have grown 38% this year, partially driven by the gold price appreciation; this figure is 10% below their historical record in 2012 when the price of gold was above US$1,700/oz.

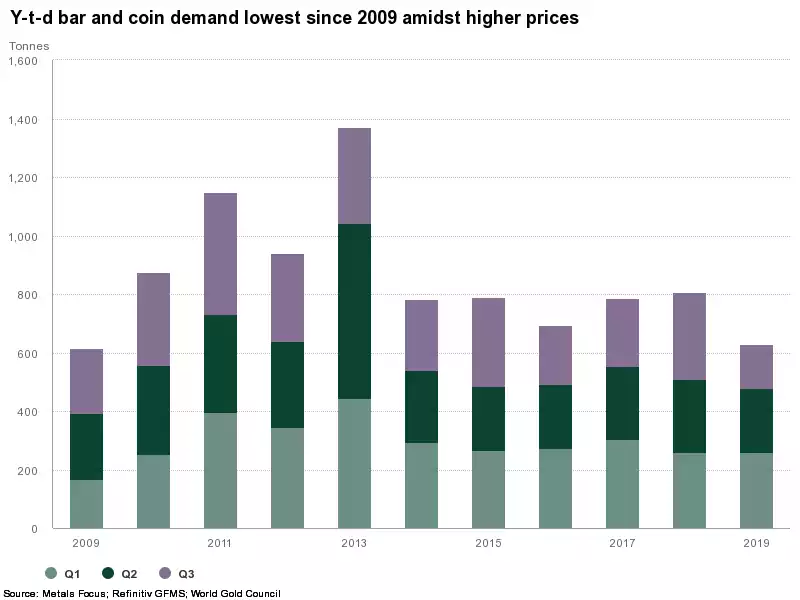

Bar and coin investment halved in Q3 to 150.3t. Higher gold prices across many key currencies were the main cause of the decline to a multi-year low, as retail investors across the globe opted to defer purchases and lock in profits.

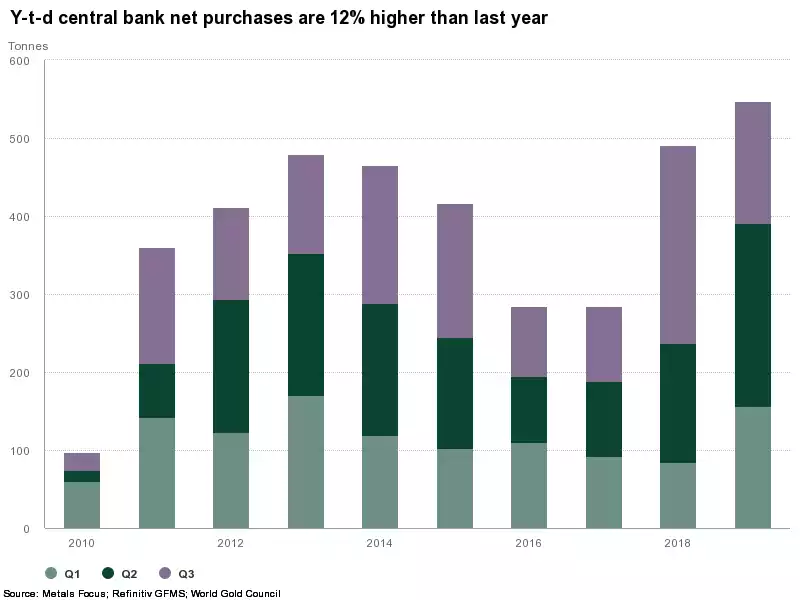

Central Banks

Central banks added 156.2t to reserves in Q3. The -38% y-o-y decline was partly due to Q3 2018 being the highest quarter of net buying in our records. Y-t-d, central banks have purchased 547.5t on a net basis, 12% higher y-o-y.

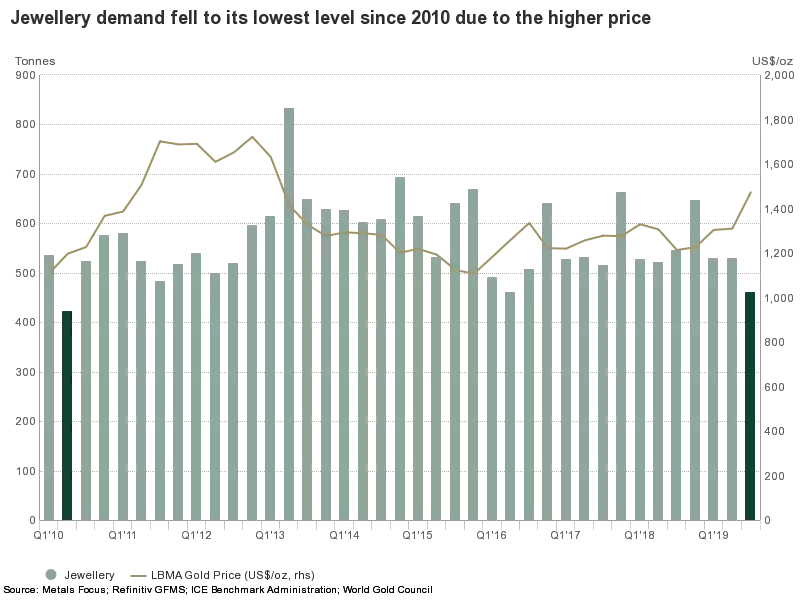

Jewellery

Jewellery demand was down 16% to 460.9t in Q3. Weak consumer sentiment due to continued geopolitical and economic uncertainty, coupled with substantially higher gold prices, dented jewellery purchases in all major markets.

Technology

The third quarter saw a 4% y-o-y drop in the amount of gold used in the technology sector, to 82.2t. Whilst this was the fourth consecutive quarter of falling demand y-o-y, there are indications that some of the key electronics sectors are beginning to recover particularly off the deployment of 5G infrastructure.

Supply

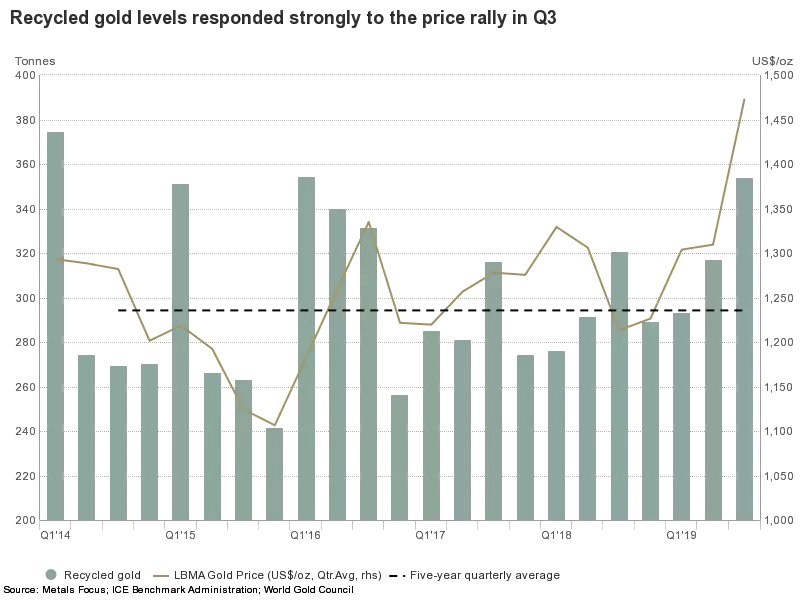

Gold supply rose 4% in Q3 to 1,222.3t. Growth was driven by a 10% increase in recycling – to its highest level since Q1 2016 – as the ongoing price rally continued to encourage selling back by consumers. Mine production of 877.8t was virtually unchanged y-o-y.

Price

The gold price continued to rally, reaching new multi-year highs. The gold price rose by 5% during Q3, finding sustained support around US$1,500/oz. The primary factors behind this price momentum continued to be ongoing geopolitical tensions, concerns of a slowdown in economic growth, lower interest rates and the level of negative yielding debt.