WGC 2020 World Gold Demand Trends

News

|

Posted 02/02/2021

|

11138

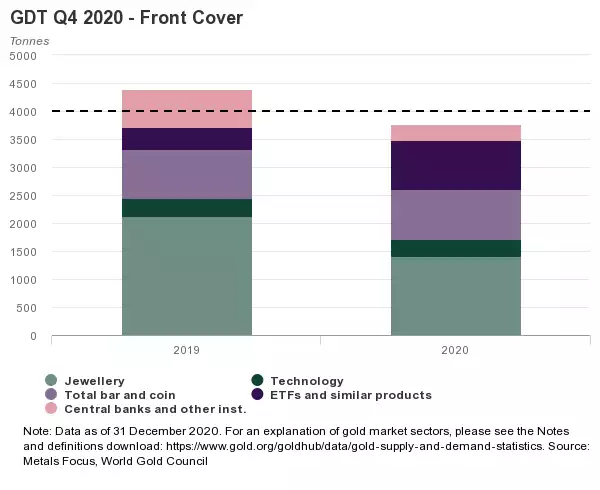

It’s that time of year when we get the World Gold Council release their Full Year Gold Demand Trends report, this time for that year we will never forget, 2020. As it was in so many ways, the year was one of contradictions in the gold market as well. In the year we saw a new all time high price, we also saw weaker than average demand despite record demand in ETF’s over the full year. Lets look at their key takeaways:

Price

The US dollar gold price returned 25% in 2020 supported by investor demand. After reaching a record high in August across most currencies, the LBMA Gold Price PM dropped back to US$1,762.55/oz at the end of November, before recovering to close the year at US$1,887.6/oz.

Investment

Inflows into global gold ETFs reached an annual record of 877.1t (US$47.9bn). Increased uncertainty and the policy response to the pandemic likely fuelled consistent inflows through October, before a recovery in sentiment and a drop in the gold price likely led to 130t of outflows in Q4.

Demand for gold bars and coins grew 10% in Q4. A recovery in China and India in the second half of 2020 added to continued strength in Western markets to lift annual demand to 896.1t (+3%).

Jewellery

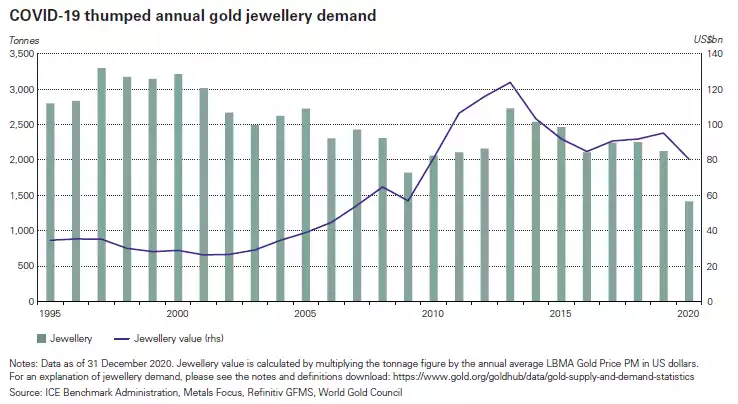

2020 marked a record low for gold jewellery demand. Despite a quarterly recovery in Q4, demand was unable to overcome the continued challenges presented by COVID-19.

Central Banks

Gold buying by central banks slowed sharply in 2020, almost 60% lower at 273t. Q4 saw a return to net buying: global official reserves grew by 44.8t during the quarter, more than reversing the 6.5t of net sales from Q3.

Supply

Total supply fell in 2020 by 4% y-o-y to 4,633.1t, the largest annual decline since 2013. The drop was primarily due to disruptions caused by the pandemic. Mine production declined 4% y-o-y, while the global hedge book fell by 65.1t in 2020, more than reversing the small increase in hedging seen in 2019. Lockdown restrictions also impeded consumers’ ability to sell back: the supply of recycled gold grew by only 1% despite record gold prices in every market. That said, at 1,297.4t 2020 marks the highest level of recycling since 2012 (1,645.1t).