WARNING – Economy ‘Murderer’ at Large

News

|

Posted 09/05/2024

|

2339

Gold is the truly uncorrelated asset that is the world’s go-to when financial and/or geopolitical crises hit. The problem with such crises is you generally don’t get a warning. Call it a ‘Black Swan’ or whatever term you like, fixating on a single or few metrics to tell you when it will happen will more often leave you surprised and unprepared. ‘Better a year too early than a day too late’ is the oft repeated mantra of those who understand. Bianco Research’s Jim Bianco topically just tweeted the following, and it’s a salient reminder.

“There has been much talk about a pending recession ... again!

Keep this in mind.

Economist Rudi Dornbusch is known to have said that economic expansions do not die of old age; they are murdered.

This has been true for the last 50 years:

2020 = COVID

2008 = Financial Crisis, $145 crude oil [we’d argue oil came later, it was simply the ‘bad debt’ of subprime exploding]

2001 = Tech crash/9/11

1991 = Iraq invaded Kuwait (400% rise in crude)

1982 = 200-year high in interest rates

1980 100-year high in inflation

1974 = Arab Oil Embargo

Too many think the economy will either roll over or "pop." It does not work that way. It does not die of old age.

In a capitalist economy, investors, like most of those reading this, give money to good ideas and take it away from bad ideas. This means the economy continuously self-adjusts, so the natural state is to expand and grow 90% of the time.

The other 10% of the time is a recession because something murders it.

So, all the talk about deficits and inflation will not cause a recession. However, these issues can, and probably do, make the economy vulnerable to "murder." But it will still take that murder to cause a recession. Think pandemic, spiking crude oil, political crisis, all of the above simultaneously.

This unexpected event(s) could be later this year, in 10 years, or anywhere between. It really cannot be predicted, like COVID, especially by economists.

This is not a knock on economists. No amount of analysis of payroll numbers or inflation reports can tell you a pandemic, a spike in oil prices, or a political crisis is coming.

How do we know when the murder has happened? Investors lose a lot of money. A recession means that even investors' good ideas act like bad ones.”

Our current world economic order is a flock of ‘black swans’ waiting to emerge from the clouds. Simply, the world’s debt splurge since we left the gold standard is quickly reaching a secular ‘Minsky Moment’ where the debt burden is simply too great and no amount of printing new money to pay the interest on the debt created to print the last lot of money will work, and meaningful growth can’t occur under its weight. The murder weapon could quite simply be interest rates. Gold stands apart from ALL other assets as the asset proven to go up in value with the pre-emptive liquidity injections keeping the Ponzi Scheme alive and also the asset that goes up, or at the very least stays steady as the system collapses. History is littered with the latter occurring time and time again with regularity as human greed and ‘this time is different’ hubris repeats.

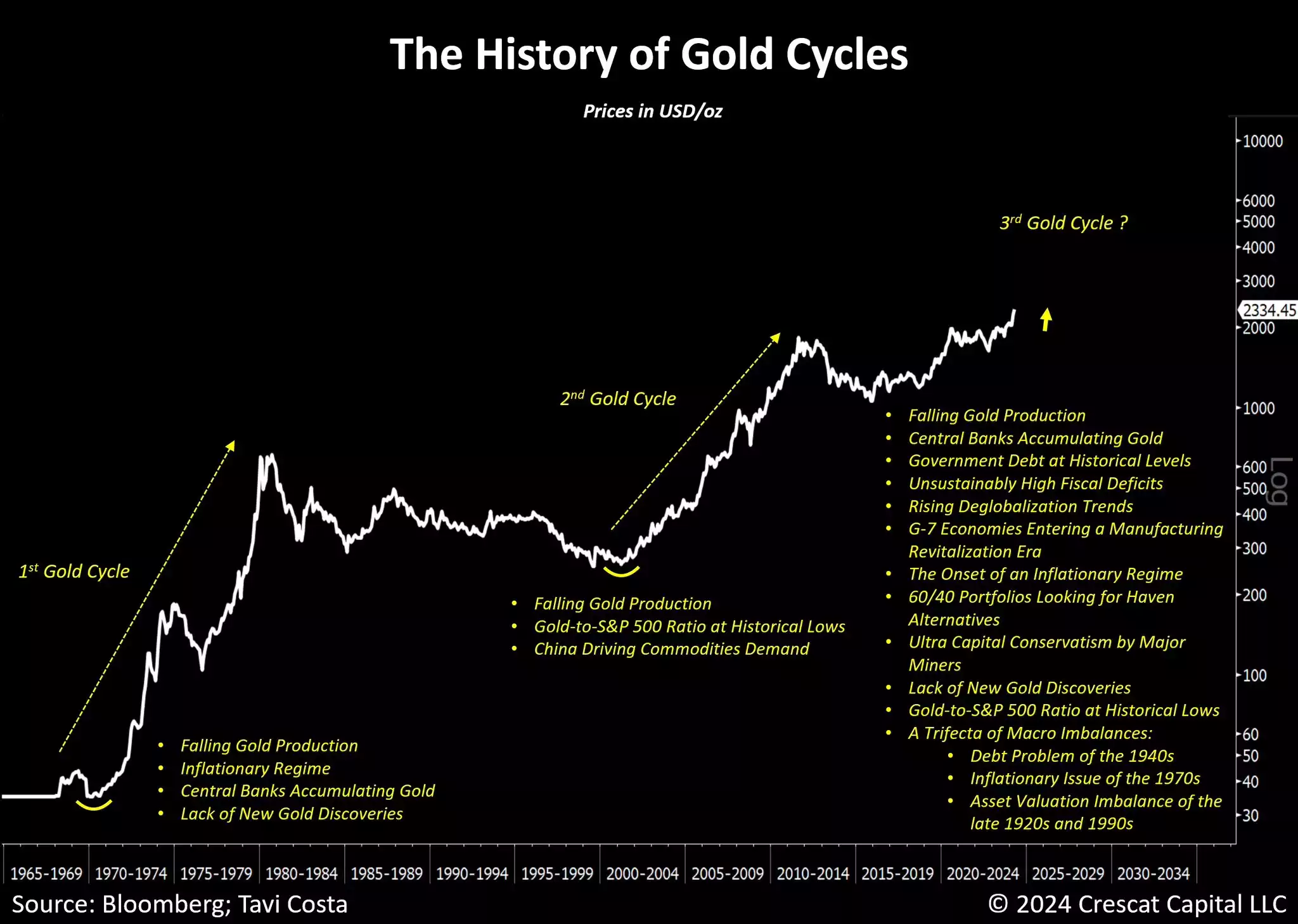

We have shared the chart below courtesy of Crescat Capital putting all of that into further context. Yes, the gold price has been great this year, but it’s likely only just beginning whilst the murderer is at large.