Volatility & Gold in 2022

News

|

Posted 16/02/2022

|

10209

Gold and silver took a bit of a hit last night on news that Putin had withdrawn some troops and the inference that the invasion is no longer on. Despite Biden ‘reassuring’ everyone that the reports were ‘not verified’ and that an attack is “still very much a possibility” the market elected to go with everything is awesome again.

Indeed, despite shares momentarily dumping, it even went on to look past the bigger than expected and record high PPI print out of the US. If you recall from earlier this week, the gap now between CPI and PPI is screaming more trouble ahead, and got worse last night.

The latter is important because the bond market is now firmly pricing in aggressive rate hikes ahead but the sharemarket is arguably not pricing in the full the implications of it. We have shared a number of different analysts warning of the volatility ahead in 2022 markets and that assumptions that gold does not do well in tightening conditions are abjectly false. Goldman Sachs again this week gave the following insights:

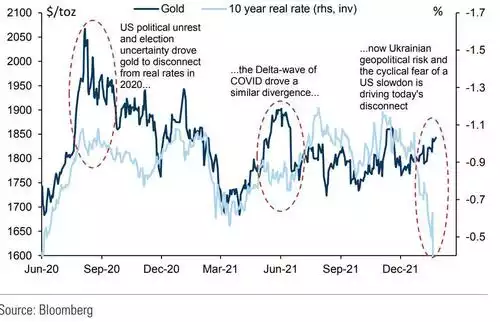

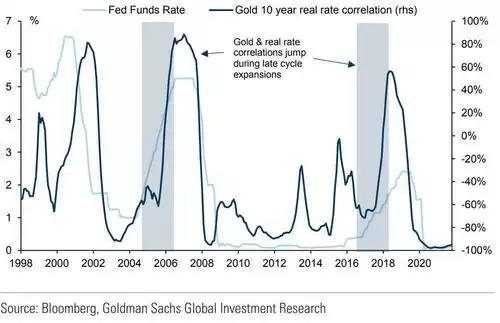

“A common concern for gold in 2022 is looming Fed hikes and the potential for higher long term real rates. However, we find that historically, gold tends to increase during rate hike periods when gold’s negative correlation with long term real rates also tends to break down. This is already happening with gold displaying resilience to the most recent increase in US 10 year real rates. In our previous research, we argued that this has to do with the fact that the rate hikes themselves can lead to fears of a growth slowdown and recession and therefore boost demand for safe haven assets, such as gold. This means if inflation fails to slow down in the second half of 2022 and the Fed is forced to hike more than currently expected, gold should be resilient as this would increase fears of a potential recession.

Gold is beginning to disconnect from real rates...”

“2022 looks to be closer to the 2004-06 hiking cycle vs 2017-18 as our economists expect a material slowdown in US growth and our EM dollar GDP growth forecast, while not as strong as in 2004-06, is still positive unlike in 2018.

The negative correlation between gold and real rates breaks during every hiking cycle...”

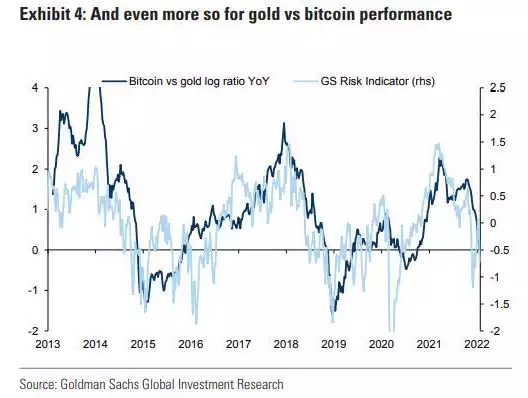

Whilst we often talk to the similarities between gold and bitcoin in terms of a monetary asset, the two have performed very differently over the last couple of year. Bitcoin, whilst it establishes its fair value and market cap, is a 13 year old asset early in this journey. Whilst the prospects ahead are indeed heady, it comes with much volatility. Gold, whilst more ‘boring’ has reached maturity and a level of market trust born of a 5000 year old history. Goldman talk to this as well:

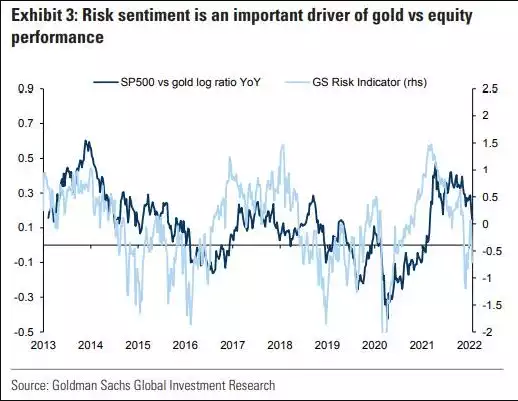

“Today, the global growth-inflation mix is markedly different. While there is not yet talk of recession, our economists forecast a material deceleration in US growth, while the imminent prospect of a new hiking cycle is leading to a risk-off environment across long duration asset classes.

Indeed, risk sentiment has begun to deteriorate, while our Portfolio strategists see a challenging growth inflation mix keeping volatility elevated near term. It is important to remember that risk-aversion is a major driver of investment interest in gold vs assets such as equities and, to an even larger extent vs Bitcoin.”

“In our view, gold is a risk-off inflation hedge while Bitcoin is a risk-on inflation hedge. For investors looking for a way to hedge their portfolios from risks of a growth-slowdown and falling valuations, we believe a long gold position would be more effective in the current macro environment.

As we have often said, we believe this is driven by crypto’s lack of use beyond a digital store of value, indicating to us that it is still too early for crypto to compete with gold or the dollar for defensive asset investment flows.”

Goldman conclude and forecast as follows:

“In our framework, two of the most important drivers of gold are ‘Fear‘ (a driver of investment demand) and ‘Wealth’ (a driver of EM purchasing power). While US real rates are often a good barometer of Fear, during periods of monetary stimulus, their signalling power breaks in a late cycle environment. Instead, we find that in that environment the market’s assessment of recession risk becomes a better barometer of Fear. Based on the expected slowdown in the US economy and the increase in recession concerns, the build in gold ETFs should increase to an annual pace of 300 tonnes by end of 2022. This, combined with a 10% forecasted increase in EM dollar nominal GDP, points to a gold price of $2,150/toz in 12 months’ time, which is now our new target. We lower our 3m forecast to $1950 from $2000/toz and raise our 6m forecast to $2050/toz.”

Earlier this month we shared Macro Insiders’ Julian Brigden’s great insights into the economic setup for 2022. In his latest piece he is now recommending buying precious metals:

“The reasons to be short Gold have caught traders’ attention. Rising nominal yields, rising real yields down the track, the relative strength of USD etc., etc. And yet, Gold has not gone down. Speculative net long interest in the CFTC Commitment of Traders’ statistics on futures trading has dropped this year and is now near the bottom half of an historically unchallenging range.

The Gold chart tells you it could go either way, but it ain’t staying here. Both the bull and the bear case have been frustrated so far. We have tried this before with tight stops. I potentially want to try this again. Targets are big. Wave parity suggests ~$2600 by this time next year if we get lift-off.”

Readers will recall our presentation bigger picture of the cup & handle formation this represents here.

You will struggle to find any analyst not predicting a turbulent time ahead in financial markets for 2022. As Lance Roberts said in our recent article, “There have been absolutely ZERO times in history the Federal Reserve began an interest-rate hiking campaign that did not eventually lead to a negative outcome.”

Volatility has its own index, the VIX. As The Market Ear noted this morning:

“Remember the "old school" fear hedge substitute?

It just sits there, and has been sitting there for a long time, but the safe haven feature of gold has made a strong comeback in 2022. VIX vs gold YTD...and gold can actually trend, which VIX "can't". “

So whilst gold and silver got even more affordable last on easing Ukraine fears, sabre rattling is not the big theme for metals this year, the bigger battle is within the US Fed. Tighten and crash the easy-money-addicted market and its financialised economy. Don’t tighten and inflation rips, consumers stop spending, earnings are squeezed, and recession ensues. It’s rare one asset can profit off either scenario but that is the prospect before gold and silver right now.