Utopian Collapse? French and the Far Left

News

|

Posted 10/07/2024

|

2347

Last week, in France, Le Penns RN far right party looked destined to take control of the French Parliament, but in a controversial 2nd round run-off, the leftist New Popular Front (NPF) coalition won over 188 seats, with French President Emmanuel Macron’s centrists and allies landing 161 seats, a new left leaning socialist government will be formed in France. With a likely sovereign debt crisis to follow – is the end of France and the beginning of an Argentinian Europe?

When Winning is not the Popular Vote

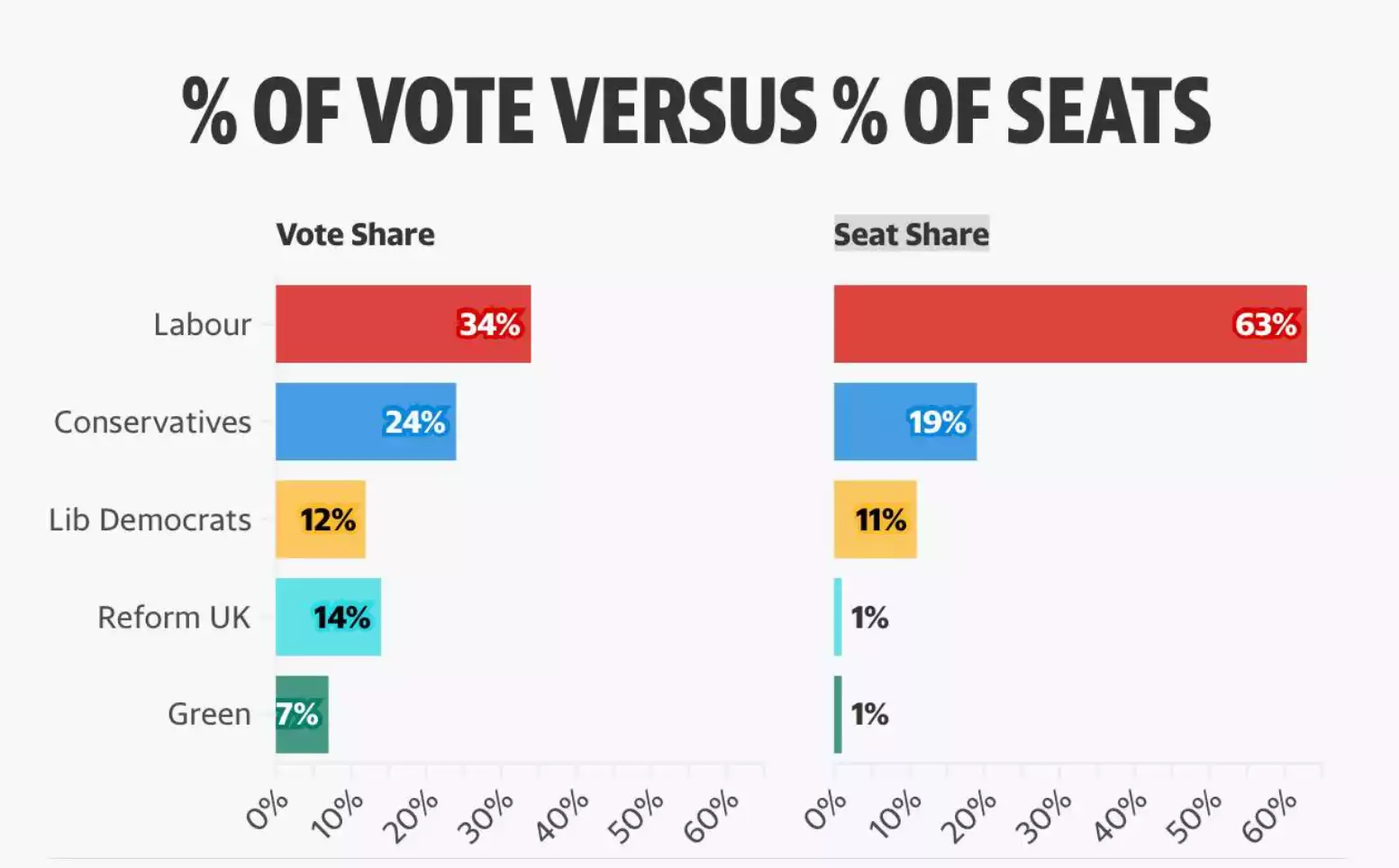

Much like the UK elections – left and far left parties successfully gained a larger share of seats to vote share. In last week’s UK election, labour received 34% of the direct vote and yet secured 63% of the parliamentary seats.

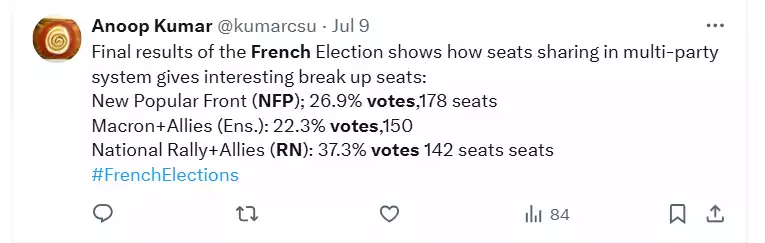

Much like in France, after the 1st election Le Penns Party, RN looked likely to secure the majority of the votes, with 33% of the vote – and looked assured of a parliamentary majority. But in the 2nd round run offs, where candidates are withdrawn the left leaning parties banded together to put forward fewer candidates ensuring more votes where needed. This led to the RFP (far left) receiving the majority of seats with 176 (6.7million votes), Macrons EN 150 seats (6.3 million votes) and Le Penns Rn with 143 seats (10.1 million votes).

Despite the largest number of votes going to Le Penn, the gaming of the electorate system saw the RFP with 23% less votes winning the parliament (but not majority).

The NFP

The French NFP has introduced a new economic plan that includes significant changes such as increased spending of €150 billion, a 14% increase in the minimum wage, price freezes on some goods, a 90% tax rate on incomes above €400,000, and lowering the retirement age to 60. While these measures aim to provide immediate benefits, they raise concerns about long-term economic sustainability.

For example, the 90% tax rate on high incomes may lead to a significant outflow of wealth, as many wealthy French citizens seek to move their assets and businesses to more tax-friendly countries. Additionally, lowering the retirement age to 60, while popular among certain groups, could place a substantial financial burden on future generations who may not see the same benefits due to the need to manage increased national debt.

These proposed changes reflect a shift in economic policy that could have far-reaching implications for the French economy and society

Sovereign Debt Crisis

There’s a lot of comparisons that can be made between 2024 and the Financial Crisis, but the one consistent difference is that everything in 2024 is like 2007 on steroids. It’s hard to forget the Greek sovereign debt crisis that occurred during the GFC – as the Greek economy was such a small part of the European economy. This time the 2024 bigger equivalent is France. Unlike Greece, France is too big to fail but too big to save. Under the rules of the European Union – budget deficits of members are not meant to exceed 3%, with a budget deficit of 5.5% already and the proposed increased spending (accompanied with decreased tax receipts, due to avoidance - changes in taxation jurisdictions and reduced retirement age), this year the International Monetary Fund has predicted it to likely to rise to 112%.

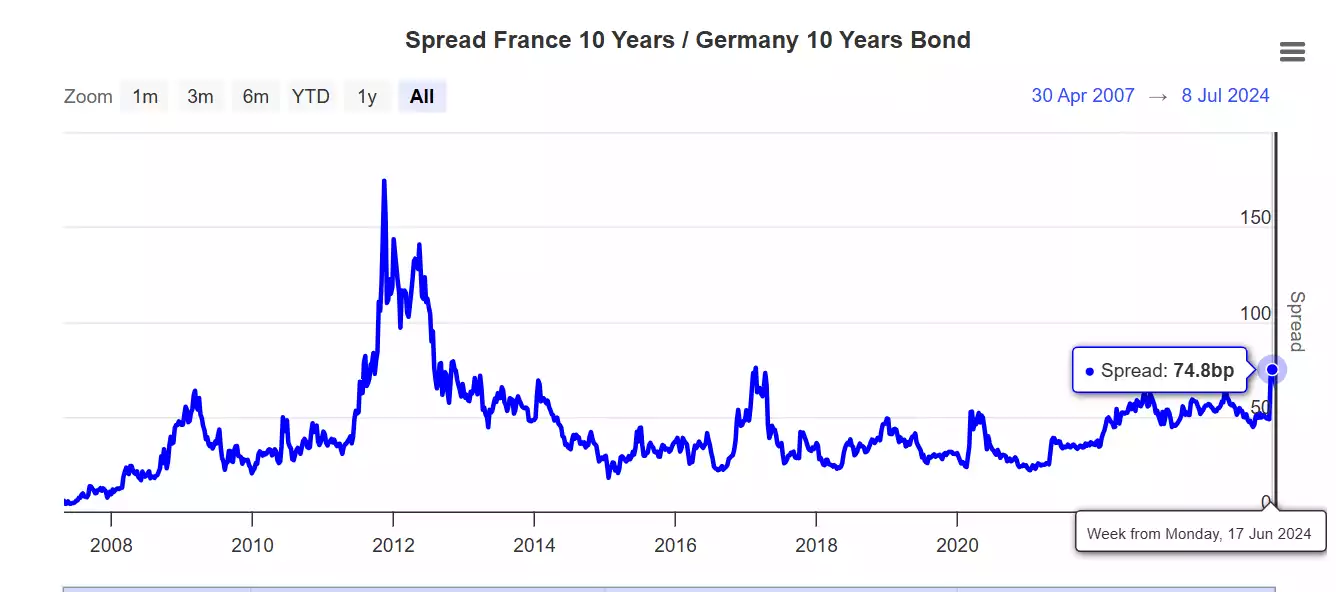

With the political shock in France, bond holders have now lifted their bond spread between German (the most stable European Bond) and French to 75 BP, this is the highest in 12 years, with previous peaks going back to the GFC.

Bonds and Gold

So as Sovereign Bonds become riskier, once again, look at the only other ‘safe’ asset gold and get ready to keep it secure.